“The new paradigm for financial markets”

advertisement

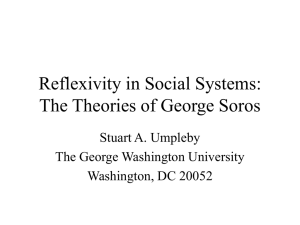

George Soros “The new paradigm for financial markets” published by PublicAffairs USA 2008 a member by the Perseus Books Group ISBN 978-1-58648-683-9 Summary The book is divided in two parts. The first part is more philosophical, formulates George Soros “Theory of reflexivity” and shows its applicability at the financial markets. The second part of the book is devoted to the financial crisis (the book is finished in April 2008). Part 1 Central idea of George Soros is that social events have a different structure from natural phenomena. In natural phenomena there is a causal chain that links one set of facts directly with the next. In human affairs the course of events is more complicated. Not only the facts are involved but also the participant’s views and the interplay between them enter into the causal chain. There is a two-way connection between the facts and opinions prevailing at any moment: the participants try to understand the situation and also seek to influence it. Participant’s views introduce an element of uncertainty into the course of events. This twoway interference is the core idea of George Soros Theory of Reflexivity. People’s understanding is inherently imperfect because they are part of the reality and as such they can not comprehend the whole. The understanding is incomplete and distorted. The misconceptions or the misinterpretations by the participants introduce an element of genuine indeterminacy into the course of events. The ultimate truth is beyond the reach of the human intellect, the more the people acquire some insight into reality, the more is to be understood. The classical economic theory and the “Concept of equilibrium” imitate Newtonian physics, but in the financial markets, where expectations play an important role, the contention that markets tend towards equilibrium does not correspond to reality. The participants on the financial market are often influenced by its developments, the events on the financial market affect the shape of the demand and supply in contradiction to the Equilibrium theory. The theory of “Rational expectations” is also wrong because the market participants do not act on the basis of their best interests but on their perception of their best interest, thus on a basis of imperfect understanding. Because financial markets do not tend toward equilibrium they can not be left to their own devices. Previous periodic crises brought forth regulatory reforms. This is how central banking and regulation of financial markets are evolving. While boom-bust sequences occur only intermittently, the reflexivity between financial markets and the financial authorities is an ongoing process. Both of them are acting on imperfect understanding and that makes this interaction reflexive. Market fundamentalists blame market failures on the fallibility of the 1 regulators but they are half wrong: both markets and regulators are fallible. While the prevailing paradigm acknowledges only the known risks and fails to allow for the consequences of its own deficiencies and misconceptions, the Theory of reflexivity recognizes the uncertainties associated with the fallibility of both regulators and market participants. The Equilibrium theory leaves out of the account the possibility that deviations may be self reinforcing in the sense that they may alter the theoretical equilibrium and when this happens, risk calculations and trading techniques based on these models are liable to break down. The Theory of reflexivity provides a better explanation of how financial markets function, but it is also less conducive to the manipulation of reality than the currently prevailing scientific theories because it avoids making excessive claims about its ability to predict and explain social phenomena. We can not expect reflexive events to be determined according to timelessly valid generalizations when reflexivity brings an element of uncertainty and indeterminacy. Part 2 George Soros acknowledges that the financial crisis is the worst since the Great Depression, it is not compatible to the other previous crises because it is not confined to a particular undertaking or segment of the financial system. The crisis has brought the entire system to the brink of a breakdown. The author’s concept is that this is not just one boom-bust process or bubble but two: the housing bubble and the long term super-bubble, both bubbles did not develop in isolation and are part of the history of the last period. The housing bubble developed following the course of a regular boom-bust model ever more aggressive relaxation of lending standards, expansion of loan to value ratios, rising of house prices, declining of savings, decline in credit quality, growing share of subprime mortgages, and growth of synthetic financial products. The cross-over point was reached in August 2007. The market recovery from August until October 2007 was followed by a collapse in January 2008. The super-bubble is founded on the misconception of excessive reliance on the market mechanism - “Market fundamentalism”. It became a dominant doctrine in the 1980s and combines 3 trends: ever increasing credit expansion, globalization of financial markets and progressive removal of financial regulations and accelerating the pace of financial innovations. The international financial system is under the control of a consortium of financial authorities representing the developed countries, which seek to impose strict market discipline on individual countries, but are willing to bend the rules when the financial system is endangered. The way the system works, the US is “more equal” than others – it enjoys veto power both in IMF and World Bank. This allowed the US to be able to pursue countercyclical politics. The liberalization sucked up the savings of the world from the periphery to the center and allowed the US to develop a chronic current account deficit. Since 1980s the US also developed a large budget deficit. The current crisis is a cross-over point not just in the housing bubble but also in the long term bubble, where the subprime crisis was the trigger. It’s an end of an era. This time the crisis is not confined to a particular segment of financial markets but has endangered the whole system. The markets have defied the efforts of the financial authorities to bring them under control. The central banks were slow, may be because they have believed that the subprime crisis was an isolated phenomenon. Later, their ability to stimulate the economy was constrained by the unwillingness of the rest of the world to hold dollars, the financial 2 innovation, which has run amok during the last years and the impaired capital base of the banks. The Theory of Reflexivity can explain the events better then the prevailing paradigm, but it can not offer any generalizations. According to the new paradigm events on the financial market are best interpreted as a history. The past is uniquely determined and the future is uncertain. One of the book’s chapters is a history of the financial markets from the period since World War II until 2007 – the period is characterized by less and less restrictive regulations, the emerge of Bretton Woods system with fixed but adjustable rates, growth of the banks, new and sophisticated kinds of financial instruments and start I US (in the 1980s) of a self reinforcing process in which a strong economy, a strong dollar and large budget and trade deficits reinforced each other to produce noninflationary growth. The international banking crisis in the 1980s was contained by the active intervention of the authorities. The IMF and creditor countries (including central and commercial banks) were used for rescue packages for debtor countries. In the 1980s under the influence of market fundamentalism, banks in the USA were granted great freedom to make money and the separation of investment and commercial banking disappeared (The Glass-Steagall Act, provided for the separation of bank types according to their business (commercial and investment banking), was introduced in 1933 and revoked by the Gramm-Leach-Bliley Act of 1999). The few crises after the 1980s did not lead to regulatory reforms; the ability of the system to withstand reaffirmed the market fundamentalists and led to a further relaxation of the regulatory environment. After 11.09.2001 the lowering of the federal funds rated to 1% (the US central bank's most important official interest rate) for a period of almost 3 years engendered the housing bubble. With the newly invented methods and instruments the regulatory authorities lost their ability to calculate the risks involved. The Basel 2 agreements allowed the largest banks to rely on their own risk management systems, which the author considers as a most shocking abdication of responsibility on the parts of the regulators, because the risk models of the banks were based on the assumption that the system is stable. The credit expansion became unchecked, higher standard deviations occurred more frequently. The various synthetic mortgage securities were based on the assumption that the value of houses in the US would never decline and the market is stable. The interventions of the regulatory authorities created moral hazard. The Federal Reserve failed to exercise it’s authority to regulate the mortgage market and became active when the crisis was already advanced and complicated. The book ends with an experiment, where George Soros documented his decision making and made some predictions for 2008. The predictions include harder obtaining credit, insolvency of financial institutions, changes in banking and investment banking, reversing the trend of ever looser regulations, no prediction of a prolonged period of credit contraction and economic decline, because of the economic expansion in India, China and some of the oilproducing countries, the decline of the dollar as a generally accepted reserve currency with far reaching political consequences. George Soros is certain that in 2008 the US will slip into recession, despite the fact that in January most of the economists forecast the chances of that as less than 50%. One of the predictions is about the financial institutions where unpleasant surprises are expected. The predictions for Europe and especially for the UK and Spain are also negative, because of the housing bubble in Spain and because of the importance of London as a financial center. 3 The prediction for China is that there also forms a bubble, but it is an early-stage one still. The recession in the developed world will affect Chinese export and the rate of growth will slow down, but the bubble will continue to grow. China is expected to challenge the supremacy of the US much sooner then expected. Source of strength for the world economy are also India and the oil-producing countries of the Middle East. The policy recommendations by George Soros are that major new initiatives are to be expected by the new Democratic US President. Credit creation needs to be regulated in order to prevent excesses, but should not be put into a straitjacket. Some of the newly introduced financial instruments should be abandoned, because they have shown themselves as unsustainable. Risk management should not be left to the participants and the regulators should not allow practices that they do not fully understand. The financial authorities must exercise more vigilance and control, they must be concerned not just with the inflation but also with avoiding assets bubbles, they must take into account not just the money supply but also the credit conditions. One of the specific measures that must be taken is the establishment of a clearing house or exchange for credit default swaps (CDS) with a sound capital structure. Additional measures should be taken to contain the collapse in house prices and the systemic approach should be accompanied by an individual one, including guarantees that will help refinance subprime borrowers, amendment of bankruptcy law and loans modifications. 18.02.2009 Plamen S. Slavov Paralegal to Prof. Dr. René Smits 4