Commercial Bank - IMSciences.net

advertisement

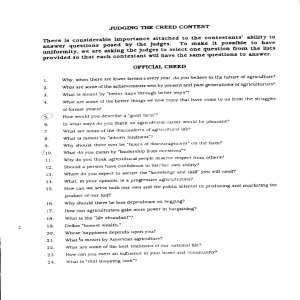

TYPES OF BANK BANKING ORGANIZATIONS BANKING • Banking means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, ad withdraw able by cheques, drafts, order or otherwise. TYPES OF BANK • Classification on the Basis of Function • Classification on the Basis of Ownership • Classification on the Basis of Domicile Classification on the Basis of Function 1. 2. 3. 4. 5. 6. Central Bank Commercial Bank Exchange Bank Saving Bank Agricultural Bank Industrial Bank 1. Central Bank The function of the central bank is to regulate the flow of money and credit in order to promote efficiency, stability & growth in the country. 2. Commercial Bank The commercial banks have been the most effective mobilizes of savings & have been providing working capital to trade, commerce & industry. 3. Exchange Bank The exchange banks mainly deal with international trade. 4. Saving Bank The saving banks collects ad keep the small savings of public. 5. Agricultural Bank The agricultural banks are set up to provide financial assistance to the agriculturists 6. Industrial Bank The industrial bank provide short, medium, and long term credit to the industries. Classification on the Basis of Ownership • Public Sector Bank – The are owed & controlled y the Govt. e.g. National Bank • Private Sector Bank – These are owed y private corporations such as HBL, ABL, MCB etc… • Cooperative Bank – Cooperative are a integral part of the cooperative movement which aims at the promotion of thrift, selfhelp & mutual aid amongst agriculturists & others with common economic needs so as to bring about better living, better business & better methods of production etc. Classification on the Basis of Domicile • Domestic Bank – Registered ad incorporated within the country – E.g. • Foreign Bank – Which have their origin & head offices in the foreign country – E.g.