outline

advertisement

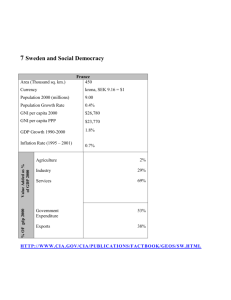

Sweden: Whither the Welfare State? I. The Environment A. Geography Relatively isolated; allowed Swedes to avoid major war since 1813. Rich endowment of timber, and iron ore and other natural resources. B. Sociological Isolation contributes to cultural homogeneity. Supports equalitarianism. Welfare programs are not seen distributing income from one group to another. C. Political Dominant since 1932, the Social Democratic Party lost control during 1936, 1976-1982, and 1991-1995. Since 1995, led by centrist social democrat Göran Persson, a renewer. SDP lost 20% of its parliamentary seats in 1998 elections, mainly to the Left party, which opposed austerity programs and Swedish entry into Euro. II. Industrial Organization A. Nationalization - SDP philosophy did not call for the nationalization of industry. Some were nationalized to prevent them from facing bankruptcy, but some of those have been returned to private hands. B. Monopolies and Industrial Concentration Small domestic market contributes to high industrial concentration ratios. Dominance of small number of large multinational companies. Still, a high level of foreign competition and extensive system of consumer cooperatives. III. The Labor Market and Labor Relations A. Collective Bargaining 1. Basic Agreement Swedish Confederation of Trade Unions (LO) formed in 1898, and Swedish Employers Association (SAF) formed in 1902. In 1938, employers and labor accepted the Basic Agreement of Saltsjobaden, under which management recognized the labor unions and established general rules about layoffs and dismissals. Both sides agreed to hold direct negotiations before resorting to strikes or lockouts. 2. Centralized bargaining Developed after World War II. Employers wanted more orderly bargaining. Unions wanted wage solidarity (largest wage increases to the lowest-paid workers). Wage negotiations take place at the national level and result in a binding framework. Local negotiations are held between employers' groups and union affiliates. 3. Evaluation - 1945-1970, central bargaining worked well. In 1970 departures from the central agreement became common and inflation rose above the average of other industrial countries. Disagreements over wage solidarity have weakened the system. B. Active Labor Market Policy Includes programs to increase the demand for labor, programs to tailor labor supply to new job openings, and to match supply and demand through job information and placement services. National and 24 regional Labor Market Boards. UPDATE: The Economist, July 7, 2001. According to the OECD annual Employment Outlook, governments should target policy towards more "active" programmes that focus on getting people into jobs (such as job-search assistance and training) and away from "passive" programmes that take care of them and give them income while they are out of work (unemployment insurance, for instance). . . Between 1986 and 1998, two years with similar unemployment rates, average OECD spending on active labourmarket policies rose only slightly, from 35% to 37% of total spending. . . Spending on active policies varies widely by country. In 1998 such spending accounted for 0.2% of GDP in the United States, 1.3% in Germany, and 2% in Sweden. Do active labour- market programmes actually reduce unemployment? . . Simple programmes, such as intensive help with searching for jobs, are very successful--and also cheap. C. Codetermination and Employee Ownership Workers participate in management through advisory works councils, and through representation on boards of directors. Controversial wage earner funds were designed to increase employee ownership. Failed to gain public support, and were discontinued in 1991. IV. The Governmental Sector A. Fiscal and Monetary Policy Even before the Depression, policies designed to reduce unemployment were proposed in Sweden. 1. Investment reserve funds allowed the government to control rough one eighth of private investment by awarding tax credits to companies that save during boom periods and invest during downturns. According to Taylor, successfully stabilized investment. Abolished in 1991. 2. Monetary policy - the Riksbank once exercised direct control over bank lending. In recent years, focus on inflation reduction. B. Social Welfare and Income Redistribution - An extensive welfare state with services including free public education through graduate school, family allowances for children, a national health program, and generous retirement and disability pensions. The most even distribution of after-tax income in the West. Has a high cost; social spending represents 39% of national income (in 1995, compared to 24% OECD average), and total taxation is about 60 percent. Critics maintain that the high tax rates have damaged incentives. The average Swedish work week is one of the shortest in the world. High taxes have driven a significant part of income and production underground in the form of do-ityourself home improvements and barter activities. Outflow of Swedish wealth due to emigration. 70.0 65.0 Sweden 60.0 55.0 50.0 Euro Area 45.0 40.0 United Kingdom 35.0 United States 30.0 25.0 General Government Revenues as % of GDP 20.0 1986 1988 1990 1992 1994 1996 1998 2000 2002