Technical Analysis Part 2

advertisement

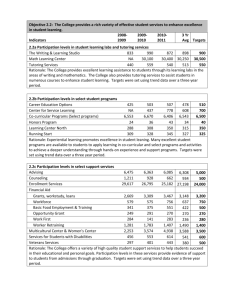

Technical Analysis Part 2 This week our Academy Committee hosted a lecture about Technical Analysis. After the first lecture people were still amazed by this useful technique and wanted to learn more. Therefore, we will go more in-dept into gap analysis, chart patterns, Fibonacci retracements and chart types. Last we will help you to make your own analysis. Make sure you caught up with the first lecture. Gaps are candlesticks, prices, which do not overlap between two consecutive periods (see graph below). We can identify four types of gaps. The Common Gap is a gap which will get filled (prices move back into the range). You can recognize common gaps by the limited change in volume and no nearby resistance or support lines. This indicates nothing weird is going on and prices will likely adjust to earlier levels. Next the Breakaway Gap is a move away from an area of prices (mostly support and resistance lines). You can identify breakaway gaps by increased volume and a nearby resistance or support. Breakaway gaps identify a change in trends and you can use them to trade in the direction of the gap. Runaway Gaps are gaps are characterized by a higher volume and a confirmation of the trend. Runaway gaps mostly happen half-way during trends and indicate the trend is more likely to hold. The gap shows a(n) in(de)creased interest in the security, mostly due to a fundamental reason (earning reports for instance). Exhausting Gaps identify the end of the trend; the opposite of Runaway Gaps. This gap has a high volume in the direction of the trend, but the gap happens at the end of a trend. It gets filled within a couple of consecutive periods and the trend reverses. After the gap analysis we went more in-dept on chart patterns. Since there are a lot of chart patterns and we do like to use this article efficiently we recommend you to look at the YouTube channel below. This channel explains a variety of chart patterns and can help you with your analysis. https://www.youtube.com/watch?v=5pcoOdoRJeI Next we like to have an idea of the future. After we know our trend has ended we want to know how far the reverse trend can go. We use the Fibonacci Retracements for this. The retracements levels are based upon Fibonacci golden ratio (I will spare you the mathematical details) of 0,618. This is used to create an alert zone. The reversed trend can move back between 38.2 and 62.8% of your initial trend (from bottom to top). This alert zone helps you determine where future support and resistance lines can form. Now we have seen the Candlestick Chart we like to have some more variation in charting types and see if we can get more information from the prices. Although it is true that Candlestick charts are the mostly used charts for technical analysis there are variations on it. First we have the Arms CandleVolume. This basically is a Candlestick Chart, but now the width of the bar indicates the volume. This helps you to see which bars are more important than others, but it can become messy. You can use this chart just like a candlestick chart. The Heikin-Ashi Chart helps us to identify trends. It uses prices of the last three days to determine its bar for today. If it is filled the trend is downwards, if not then the trend upwards. Keep in mind that the bars you see are not the real prices and that the chart cannot be used for chart or candle patterns. An interesting new graph type is based on momentum of a security. The Relative Rotation Graph (RRG) is based on price trends and the momentum (unfortunately the calculation is still patented, so this will have to do for now). Normally the momentum changes before the trend changes, but not all momentum changes result in trend changes. Now we make a graph showing the momentum and the trend. The point indicates the momentum and trend right now and the line shows the past momentums and trends, therefore the cycle the security makes in time. Since we are currently running out of space to do a new technical analysis here, we refer you to a YouTube channel making an analysis. They have a clear understanding of the subject and explain their view fairly well. https://www.youtube.com/user/LiveForexTradingTV/videos If you want additional help with your technical analysis you can subscribe for the workgroup on the 4th of February. Due to your enthusiasm last time we will make sure to book two different occasions if the number of attendances exceeds 20 members. Therefore, we will assure that we can help you! Feel free to send an E-mail to president@bnrbeurs.com to subscribe for the workgroup. Written by Paul Hendriks