Trend Analysis and Isolating the Cyclical

advertisement

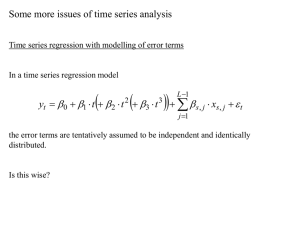

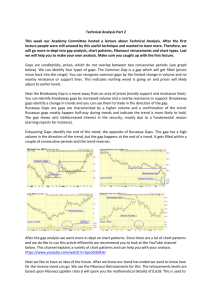

Trend Analysis and Isolating the Cyclical Component of Intel Stock, January 2005 – December 2009 Andrew Brown Stats 350 Managerial Report #7 Due: 4/28/10 I am comparing a linear model and a polynomial model to find which one best fits Intel’s stock prices as a modeling trend. I will then use the best fitting trend line to determine whether or not a cyclical component exists in my time series. Equation 1 shows the proposed linear model used for estimation. Yt = β0 + β1t + εt (1) Equation 2 shows the proposed polynomial model used for estimation. Yt = β0 + β1t + β2t2 + εt (2) Table 1 shows the results I obtained when I ran both the linear and polynomial model for trend. Table 1. Regression Results for Modeling Trends Dependent Variable: Adjusted Close Stock Price ($) Constant Time Time2 R2 F Standard Error Observations Linear Model 21.72* (0.000) -0.072* (0.001) Polynomial Model 21.33* (0.000) -0.034 (0.702) n/a n/a -0.001 (0.658) 0.161 11.161 2.872 60 0.164 5.603 2.892 60 * denotes significance at the 5% significance level (p-value) For the linear model, time is significant in explaining Intel’s stock price at the 5% significance level. For the polynomial model, neither time nor time squared is significant in explaining Intel’s stock price at the 5% significance level. The coefficient of determination in both models is roughly equal as only 16% of the variability in stock price is explained by time. However, the linear model is the best fit because it has a lower standard error, meaning there is less variance in its residuals, and also for the reason that time is significant in explaining stock prices at the 5% significance level in this model. Using the trend line from the linear model, I calculated the percentage of trend over time. For this series, I obtained Graph 1 from the data. Graph 1. Percentage of Trend 140 120 100 Percentage of Trend 80 60 40 20 0 0 10 20 30 40 50 60 70 Time (January 2005 - December 2009) From the data obtained from the linear model and the percentage of trend shown in Graph 1, there does not seem to be any evidence of a cycle in my series. I concluded from the lack of equal clusters of data points alternating above and below the percentage of trend line that no discernable cycle exists.