Repeal of the Carbon Tax - How the Repeal will Work

advertisement

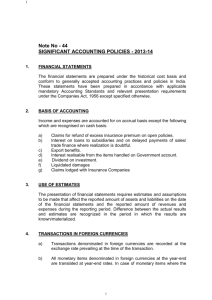

REPEAL OF THE CARBON TAX – HOW THE REPEAL WILL WORK The carbon tax repeal legislation received the Royal Assent on 17 July 2014 and the bills as part of this package are now law, with effect from 1 July 2014. As a result, no new carbon tax liabilities will be incurred from 1 July 2014. This approach gives certainty to business and households by making it very clear when the carbon tax will end. What is the legal basis of the carbon tax? The carbon tax was established in law through a package of Acts of Parliament. Removing the carbon tax required repealing these Acts through the carbon tax repeal legislation. Now that the repeal bills have passed both Houses of Parliament and received the Royal Assent, the carbon tax is no longer in place and savings should be passed onto households and businesses. What is the rationale for repealing the carbon tax? Abolishing the carbon tax will reduce costs for business and households. Modelling by the Australian Treasury suggests that removing the carbon tax in 2014-15 will leave average costs of living across all households around $550 lower than they would otherwise be in 2014-15. It is also estimated that in 2014-15 retail electricity prices should on average be around 9 per cent lower (or around $200 per household) and retail gas prices around 7 per cent lower (or around $70 per household) than they would otherwise be. When did the carbon tax finish? The carbon tax repeal legislation received the Royal Assent 17 July 2014 No new carbon tax liabilities will be incurred from 1 July 2014. Ending the carbon tax at the end of the financial year provides certainty for business and simplifies the transition to the Direct Action Plan. Will the Government remove carbon tax liabilities incurred before 30 June 2014? The Government will not remove carbon tax liabilities incurred before 30 June 2014. Backdating the repeal of the carbon tax to a date prior to 1 July 2014 would have introduced major complexities for business, and would have been costly and administratively complex for Government. It would also have been impossible to ensure that the full carbon tax impact was refunded to consumers, without extremely complex and intrusive legislation. How will ongoing carbon tax obligations for 2013-2014 be managed? Carbon tax liabilities and equivalent carbon price liabilities incurred up to 30 June 2014 must be met in full. Collecting all outstanding tax liabilities is a key principle that underpins the integrity of Australia’s taxation system. Carbon tax liability reporting for 2013-14 will need to follow the process and timeframes set out in the carbon tax legislation. Emissions reporting and related administrative arrangements under the National Greenhouse and Energy Reporting Scheme will continue and will, in the future, support the Emissions Reduction Fund. More information Repealing the carbon tax www.environment.gov.au/climate-change/repealing-carbon-tax Clean Energy Regulator – carbon pricing mechanism www.cleanenergyregulator.gov.au/Carbon-Pricing-Mechanism/Pages/default.aspx Disclaimer While reasonable efforts have been made to ensure that the contents of this publication are factually correct, the Commonwealth does not accept responsibility for the accuracy or completeness of the contents, and shall not be liable for any loss or damage that may be occasioned directly or indirectly through the use of, or reliance on, the contents of this publication. 2