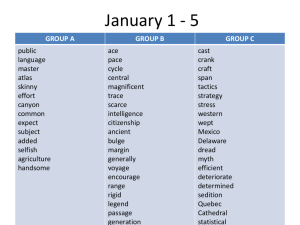

Table 1b: Summary of key regulatory savings

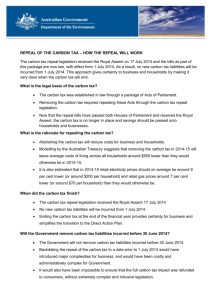

advertisement