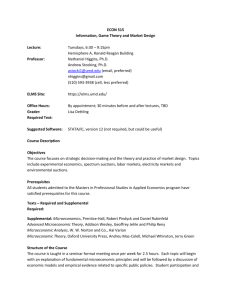

Market Design - Lawrence M Ausubel

advertisement