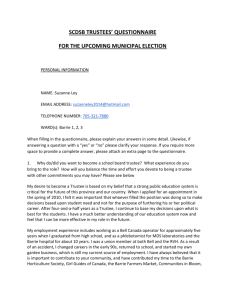

Alaska Descendants Trust

advertisement