PowerPoint

advertisement

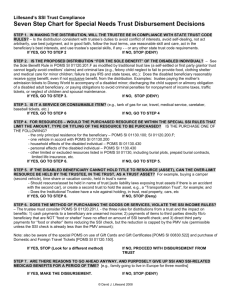

Special Needs Trusts: How to Write Them and How to Use Them Presented By: Martha C. Brown, Esq. Russell A. Fracassa, Esq. What is a Special Needs Trust? Also known as a supplemental needs trust To “supplement,” not replace, public benefits for disabled person What is a Special Needs Trust? this context – any type of disability as defined by Social Security at 42 USC 1382c(a)(3) In What is a Special Needs Trust? Different forms of SNTs codified in Omnibus Budget Reconciliation Act in 1993 (OBRA ’93) Self-Settled or 3rd Party Inter vivos or Testamentary Facts and Circumstances will determine type of trust What is a Special Needs Trust? Three types of SNTs (d)(4)(A) (d)(4)(C) Third Party SNT What is a Special Needs Trust? Trust Type (d)(4)(A), SelfSettled (d)(4)(C), Pooled Third-party SNT Established by Parent, Grandparent.. Individual, Parent… Other than disabled Assets Funding Disabled person Disabled person Third person Beneficiary Disabled person only Disabled person Anyone Grantor Trustee No No Yes Distributions To third parties To third parties To third parties Payback Yes Yes No Disability SSA Definition SSA Definition SSA Definition GiftTax Exclusion Cannot use Cannot use Can use Testamentary No No Yes Age Limit Funded by 65 No (check state) None Frequent used for PI or Inheritance Same but lesser Any use Drafting Considerations Not just a form Risks Loss of client benefits Attorney malpractice Drafting Considerations Grantor trust provisions for income tax See I.R.C. §§671-679 Net income taxed to beneficiary Not on the IRS Form 1041 Typically lower tax rates Know the Public Benefits Supplemental Security Income (SSI) Social Security Disability Insurance (SSDI) Know the Public Benefits Supplemental Security Income (SSI) Needs Based • Limited income and assets Know the Public Benefits Supplemental Security Income (SSI) Medicaid Qualification • Some states is automatic qualification • MO, not – still have Medicaid qualification • Less than $1,000 • Non-countable resources • Home • One car • Pre-need burial agreements….. Know the Public Benefits Social Security Disability Insurance (SSDI) Not means-tested No financial eligibility requirements Medicare Qualification • 24 months after receiving SSDI • Some exceptions to the waiting period Distribution Standards Discretionary vs. Support Discretionary Support No standards for trustee discretion Support requirements UTC – Distinction eliminated Support trusts are discretionary trusts with support standards Distribution Standards Should only contain pure discretionary distribution standards Not give a beneficiary any right to compel a distribution Trustee to have “sole,” “uncontrolled,” “absolute” discretion Distribution Standards Avoid toxic language as “support and maintenance” Avoid “Health, education, maintenance and support” language Highly recommended to spell out grantor’s intent to supplement and not to supplant public benefits Choice of Trustee Family members often have little fiduciary experience Family members often do have superior knowledge of the disabled person Educate family member trustee Utilize co-trustees include a family member Courts may desire or require professional trustees Distributions from the Trust Concept of “in-kind support and maintenance” (ISM) Payments for necessities of life such as food or shelter Treated as income to beneficiary Dollar-for-Dollar reduction in benefits Limited to one-third POMS Social Security Administration’s Program Operations Manual System (POMS) Many changes and clarifications in 2009 POMS Changes affecting drafting Spendthrift clause – required Revocation & termination – available Child support & maintenance – not income Payback – cannot be limited to time Sole benefit – no other persons to benefit Legal authority to establish the trust required Seed trust POMS Changes affecting administration Distributions that are income Distributions that are not income Distributions not for the benefit of beneficiary Distributions for credit cards Distributions for Gift Cards/Certificates Pooled Trusts Transfers As of today, no penalty for transfers occurring at any age Sole benefit Account may be established by beneficiary Payback provision