Speculative-Project-or-WIP

advertisement

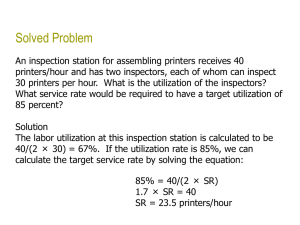

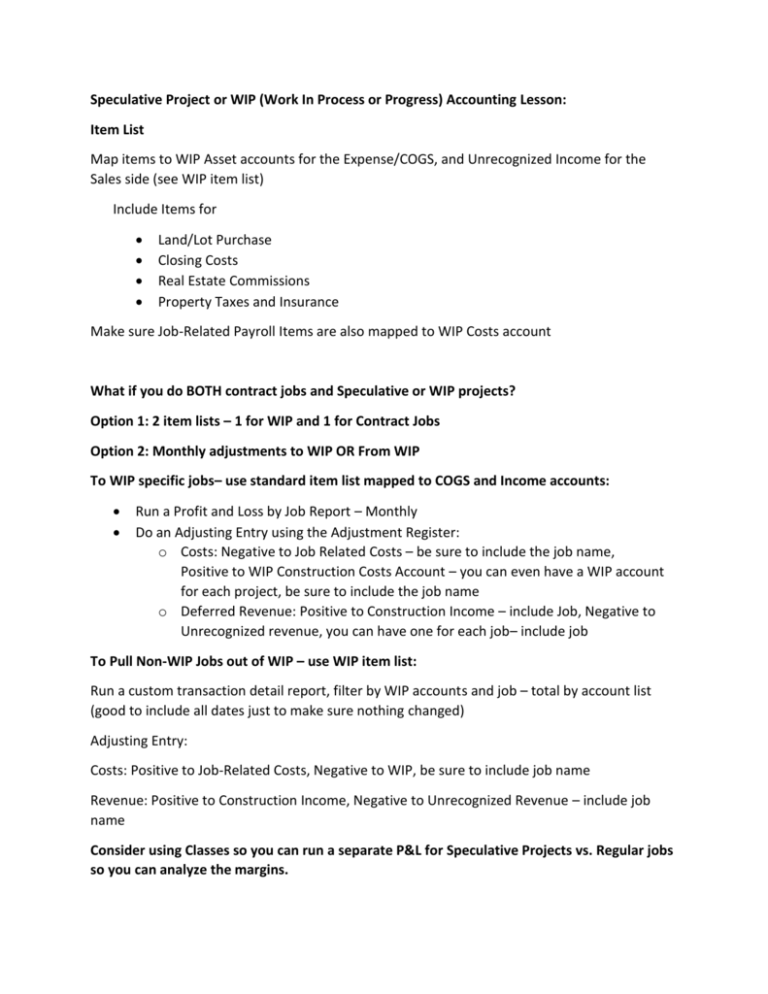

Speculative Project or WIP (Work In Process or Progress) Accounting Lesson: Item List Map items to WIP Asset accounts for the Expense/COGS, and Unrecognized Income for the Sales side (see WIP item list) Include Items for Land/Lot Purchase Closing Costs Real Estate Commissions Property Taxes and Insurance Make sure Job-Related Payroll Items are also mapped to WIP Costs account What if you do BOTH contract jobs and Speculative or WIP projects? Option 1: 2 item lists – 1 for WIP and 1 for Contract Jobs Option 2: Monthly adjustments to WIP OR From WIP To WIP specific jobs– use standard item list mapped to COGS and Income accounts: Run a Profit and Loss by Job Report – Monthly Do an Adjusting Entry using the Adjustment Register: o Costs: Negative to Job Related Costs – be sure to include the job name, Positive to WIP Construction Costs Account – you can even have a WIP account for each project, be sure to include the job name o Deferred Revenue: Positive to Construction Income – include Job, Negative to Unrecognized revenue, you can have one for each job– include job To Pull Non-WIP Jobs out of WIP – use WIP item list: Run a custom transaction detail report, filter by WIP accounts and job – total by account list (good to include all dates just to make sure nothing changed) Adjusting Entry: Costs: Positive to Job-Related Costs, Negative to WIP, be sure to include job name Revenue: Positive to Construction Income, Negative to Unrecognized Revenue – include job name Consider using Classes so you can run a separate P&L for Speculative Projects vs. Regular jobs so you can analyze the margins. Special Reports: Job Profitability Detail is automatically filtered to show income and expense accounts ONLY, change filter to show All accounts, eliminate “actual income” column and memorize for each job. Create 2 custom transaction detail reports: o Filter for WIP Construction Costs account, Total by Customer, filter by “not cleared” o Filter for Unrecognized Income account, Total by Customer, filter by “not cleared” Deposits/Draws/Loans: Post Loans as deposits on deposit form to individual Loan accounts – note job in Memo or on “from” line of the deposit To get Estimated Revenue vs. Actual Revenue: Create invoices for WIP Jobs using WIP items to post to Unrecognized Revenue, or Post deposits to Unrecognized revenue with customer as “from” on line item. Owner Investment – Post to Owner Contribution or Shareholder Loan account as deposit or transfer Closing Speculative Development Jobs: Run Custom Transaction Detail on both WIP Costs and Unrecognized Revenue (if applicable) Identify and reconcile loans (add accrued interest if applicable) associated with the project, or Unrecognized Revenue Obtain final closing statement for Sale of property and create adjusting entry to clear: Liabilities: Loan Balances or Unrecognized Revenue Assets: o Lot Purchase o Land Development o WIP Construction Costs o Any other assets/liabilities Record final closing statement as an adjustment entry (customer job on each line): o Use items to record costs as a positive for: closing costs, real estate commissions, insurance and taxes as stated on closing statement, Use a negative to record Sale of property, and other credits (property taxes), Use a positive to clear out the loan and deposit proceeds into checking account (or a negative if a loss) o To clear current asset values, use items as a positive to record Lot/land Purchase, Land Development costs, WIP Construction Costs, accrued interest on loans if not accrued as cost already, any other assets associated with the project o Use Expenses side to clear the Loan Balance as a negative amount o Use expenses side to assign proceeds to the bank account – either positive or negative o Net amount of adjusting entry should be 0, all Balance Sheet Accounts associated with the project should be 0 Closing WIP, non-speculative jobs: Run Custom Transaction Detail on both WIP Costs and Unrecognized Revenue accounts Create an adjusting entry: Post on expenses side: Unrecognized Revenue as a Positive amount, same amount to Construction Income as a negative amount, WIP Construction Costs as a negative amount, offset by Job Related Costs as a Positive, use job name on all line items If you want to post more detailed Cost of Goods Sold to the P&L: Consider using classes on all cost transactions as: Subcontractor, Materials, and Labor, then filter Custom transaction detail by Customer and total by class, create separate entries on adjusting entry for the type of cost