WIP - Yale Entrepreneurial Institute

advertisement

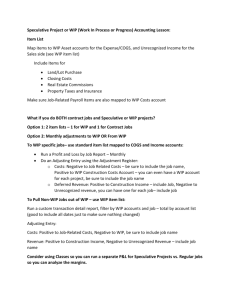

WIP Yale Yale Entrepreneurial Institute (YEI) Early Stage Capital WIP Creating the Most Possibilities to Excel Start Something Tech Boot Camp Venture Creation Program Summer Fellowship Program (Accelerator) YEI Innovation Fund YEI is equipped to help students start scalable ventures by providing: 1. 2. 3. 4. Funding Resources Mentors Space 2 WIP Growing the Pool of Funds Time Academic Year Funnel of Start-ups Student ventures are eligible for ~$120K in funding Promising start-ups have more opportunities to secure funding ~$2K Fellowship ~$15K YEI Innovation Fund ~$100K 3 YEI Funding Success Started in 2007 More than 70 companies accelerated 3 companies acquired $70M raised in outside funding 305+ jobs created YEI grads have gone onto MassChallenge, Ycombinator, TechStars, etc. WIP Successful YEI Teams WIP Panorama Education Aaron Feuer, Xan Tanner and David Carel $4M Funding – Google Ventures, Zuckerburg, Yale School systems engaged with students, parents and teachers participating in highly-focused, digital opinion surveys. 2012 YEI Summer Fellows 5 Successful YEI Teams WIP Dr. Daniel Abadi, Computer Science Justin Borgman, SOM ’11, YEI ‘10 • Complex analytics for cloud computing • Founded in 2010 by Faculty Member and SOMer • 35 Employees • Raised $17+ Million 6 Funding Technology Innovation WIP Resources Available ($) Industry Investors Valley of Death Small Business Academia Development Discovery Commercialization Level of Technology Maturity NSF, NIH Academic SBIR Senior Debt Angel Venture Capital From Angus Kingon WIP What is your Enterprise Risk Profile? Friends, Family (and Fools) Threshold Technology Risk NSF SBIR/STTR Threshold Venture Capital Threshold Finance Risk People Risk Economic Development Funds Threshold Senior Debt Threshold Angel Capital Threshold Market Risk Bootstrap Techniques What you have in your pocket! Pros + Protection of Entrepreneur’s Equity + No Outside Oversight + Low Cycle Time and Transaction Costs + Certain Consulting Activities May Augment Technology Development Cons - Self-Funding Brings High Level of Personal Exposure - Consulting May Dilute Core Development Activities - Licensing May Erode Downstream Revenue Potential - Equity-for-Service Trades Dilute Entrepreneur Ownership WIP WIP Federal and State Funding SBIR, STTR ($3B available annually) and other grants Pros + Non-Dilutive + May Offer Federal Customer Entrée + Potential Adjunct to Development Roadmap and Business Direction + Clear Milestone Expectations + Validating of Technology Direction Cons - Government Funding Sources May Bring Less Business Expertise Than Equity Investors - If Grants Define and Drive Development Roadmap and Business Direction, Cancellation of Requirement Could Leave Business Without a Customer - Generally Insufficient to Bridge “Valley of Death” - May Not Be Anchored to End-User Requirements - Not All States Offer Incentives Yale Support for SBIR/STTR WIP BioHaven Event (November) Office Hours – – Dec. 4, 11 – Merrie London from CT Innovations SBIR “How To” – February 11-12 *** Additional Resources Available 11 WIP Angel Investment >2M individuals w/ Net Worth > $1M “Qualified Investors” May have investment motivations beyond Rate of Return (ROR) Various structures – Angel funds, Individuals, Super Angels Pros + May be Active Advisors + May Assist in Business-Building Activities + Less Structured Monitoring and Control than Venture Capital + Shorter Due Diligence Cycle than Venture Capital + Relatively Loose Terms and Conditions + Option Pool Likely not Required + May be Widely Accessible Cons - May be Active Advisors - Valuation Sensitive - High Expected Rate of Return (ROR) - Limited Ability to Support Follow-On - Availability / Access Subject to Macroeconomic Climate ** TERMS VERY IMPORTANT TO POSITION COMPANY FOR DOWNSTREAM CAPITAL** WIP Venture Capital Private Equity Class Focused on Funding and Building Early Stage, High-Growth Enterprises Pros + Investment Validates Business Plan + Adds Significant Value to Business + Ability to Significantly Assist in Business-Building Activities + Well-Structured Terms and Conditions Designed to Balance Management and Investor Objectives + Assistive in Finding Follow-On Financing Cons - Extensive Due Diligence Cycle - Heavy Company Monitoring and Control - High ROR Expected - Moderately – Highly Dilutive - Expectation of Preferred Stock - Option Pool Required WIP Strategic Partners Any alliance between commercial entities that furthers business interests (Formal to informal) – Financing – R&D – Marketing / Sales / Distribution Pros + Able to Add Meaningful Business Value + Able to Assist in Business Building Activities + Source for Technology, Market, or Business Model Validation + Numerous Industry contacts + Investment from Partner May Be Relatively Valuation Insensitive + Expect Lower ROI + courtship by Prospective Acquirer Cons - Restrictive Terms and Conditions - May Require Certain Preferences to the Business Partner - Can Sometimes Limit Attractiveness of Company for Future Investment Panelists “Advice for Accessing Early Capital” WIP Kyp Sirinakis – Managing Partner, Rock Spring Ventures kyp@rockspringventures.com Adrian Horotan – Principal, Elm Street Capital adrian@elmvc.com 15 WIP Resources National Venture Capital Association. Provides listings of venture capital firms and entrepreneur education. http://www.nvca.org. Kauffman Foundation Entrepreneurship Resource Center. Education on the A to Zs of business, including venture capital. http://www.entrepreneurship.org. National Associate of Seed and Venture Funds. Provides lists of state venture capital funds and other resources. http://www.nasvf.org. Angel Capital Association. Provides lists of angel groups. http://www.angelcapitalassociation.org. Small Business Administration (SBA). http://www.sba.gov • Connecticut Innovations http://www.ctinnovations.com/ • CVG http://www.cvg.org/