To view this press release as a file

advertisement

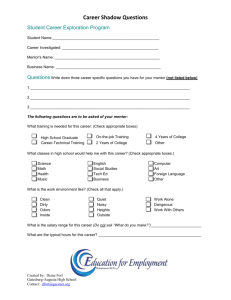

BANK OF ISRAEL Office of the Spokesperson and Economic Information January 13, 2016 Press release Characteristics and risks of shadow banking worldwide and in Israel Shadow banking—nonbank credit intermediation activity—is steadily developing around the world. Notable examples of shadow banking are guaranteed-yield money market funds, securitization, hedge funds, broker-dealers who supply credit to their customers along with executing their transactions, and non-institutional credit intermediation companies. The growth of shadow banking worldwide in 2011–14 was greater than growth of banks. In 2014 alone, shadow banking assets increased by $2 trillion, to $80 trillion. Shadow banking, and particularly non-institutional credit intermediation, incorporates numerous advantages, chief among them increasing the supply and broadening the range of sources of credit in the economy. However, alongside these advantages, such activity incorporates risks, which are liable to impact on financial stability, and financing from the public via tradable bonds heightens these risks. Supervision of credit intermediaries needs to be not only consumer oriented but also stability oriented. Prudential supervision has to reduce the risk of a specific noninstitutional credit intermediary finding itself in distress, as well as reduce the impact of that distress on the overall economy (macroprudential risks). Regulation should be in line with the level of risk created by such entities to the financial system and to the economy in general. It is very important that prudential regulation of entities that provide credit (particularly in large sums) is aligned with their level of risk—the risk in entities that take deposits from the public is greater, while supervision of entities that finance the credit through bonds alone would likely be more lenient. Non-institutional credit intermediation in Israel is part of the shadow banking system, which is consistently developing worldwide. These are companies whose main activity is providing credit, and that are not banks, insurance companies, pension funds or provident funds. In view of evolving regulatory changes, which relate to regulation of the industry, and in view of the development of this industry in Israel, this box will review the characteristics of shadow banking, and of non-institutional credit intermediation in particular. Shadow banking is nonbank credit intermediation. Similar to banks, shadow banking deals with providing credit and liquidity, but shadow banking, as opposed to banking, generally does not include taking deposits and is not under the same tight supervision as deposit-taking banks. Notable examples of shadow banking are guaranteed-yield money market funds1, securitization2, hedge funds, broker-dealers who supply credit to their customers as part of executing transactions for them, and non-institutional credit intermediation companies. The growth of shadow banking worldwide in 2011–14 was greater than that of banks. In 2014 alone, shadow banking assets increased by $2 trillion, to $80 trillion. Shadow banking is not developed in Israel. Its riskier sectors do not exist here in large scope, and therefore, currently, the risk to financial stability inherent in them is not great. However, in Israel there is a developing market of non-institutional credit intermediation—an examination of public non-institutional credit intermediation companies indicates that they focus on providing low-duration loans to small and medium sized businesses that find it difficult to receive bank funding. Shadow banking, and particularly non-institutional credit intermediation, incorporates many advantages, chief among them increasing the supply and broadening the range of sources of credit in the economy, and making it more accessible to a wide range of borrowers. Shadow banking even contributes to increased competition within the financial system. However, alongside those advantages, there are risks inherent in such activity that are liable to impact on financial stability and on the economy, and to increase its vulnerability to crises. In a case of several shadow banking financial institutions, or a single entity, getting into distress, there is concern that the negative impact would grow stronger and spread to other sectors through the mutual relationships between shadow 1 The risk inherent in guaranteed yield money market funds is significant, as these entities hold liquid assets, and are thus exposed to economic distress and bankruptcies. In a case of mass withdrawals from the funds, the value of the assets declines, but the financial commitment requires the entities to pay the full deposit. As there is a gap between the value of the assets and the value of the liabilities, these entities are considerably exposed to “runs” and prudential risk. The risk was actualized due to the global financial crisis: many guaranteed-yield money market funds around the world went bankrupt. 2 In a securitization transaction, securities are issued whose maturity value is ensured by pre-defined cash flows, which are expected to derive from a defined asset or group of assets. For a deeper discussion, see the report by the Committee to Promote Securitization in Israel, November 2015. banking and the rest of the financial system. Furthermore, the failure of a shadow banking entity or entities is liable to call into question the public’s trust in other financial intermediaries, a situation that may be reflected in herd behavior such as selling/withdrawing assets that were invested/deposited at other financial institutions (for example, mass withdrawals from provident funds and mutual funds, even those that are not significantly invested in the failed entity). Thus, financial distress among financial intermediaries may be created, which leads to a shortage of credit, which negatively impacts on real economic activity. Examples of the effect of financial crises in the noninstitutional credit intermediation industry on activity in the overall economy can be found in the crises that developed in South Korea and New Zealand. Raising financing from the public through tradable bonds increases the risks inherent in shadow banking activity. First, the information asymmetry between borrower and lender reduces the public’s ability to supervise the investment and increases the ability of the financial entity to take excess risks. Thus, the risk of overreaction and contagion also increases. Second, as this is financing through money that the financial institution is to return to the investing public3, it is contingent on the state of the markets and the ability to roll over the debt through the markets. Therefore, an external shock that leads to a standstill in the markets or to a loss of confidence in financial institutions would make it difficult for such institutions to raise new funds in order to roll over the debt, and thus, together with the standstill in granting credit, would make it difficult for the institutions to meet their obligations. The shorter the duration of the liabilities, and the larger the gap between that and the duration of assets, the more intense the problem is. The tradability of the bonds could lead to a fire sale, negatively impacting on the bonds’ value, which will make future financing, meeting obligations, and providing credit even more difficult. Third, financing by issuing tradable bonds increases the scope of the entity’s potential activity and leverage, as well as all the risks inherent in it. Thus, in Europe, as a direct result of these risks, regulation that is similar to banks—even if more lenient—is imposed on an intermediary issuing bonds in order to provide credit. These risks are not exclusive to the shadow banking system; they are characteristic of the overall credit intermediation system, at the center of which are banks and financial institutions, but the supervision of banks and financial institutions acts to minimize and monitor these prudential risks. In the absence of extensive supervision mechanisms, shadow banking, and particularly the activities of non-institutional credit intermediaries, is fragile and less stable than traditional banking activities. This box emphasizes the importance of balanced prudential supervision of shadow banking institutions in addition to consumer-related supervision, particularly of entities 3 With regard to sources of financing from the public that have to be repaid, we make a distinction between financing through current-account deposits and financing through bonds and term deposits. The prudential risk inherent in the former method is greater. financing themselves by issuing bonds to the public. Appropriate prudential supervision is capable of reducing the risks inherent in shadow banking, and of allowing this market to continue to exist and develop. In this way, the public will be able to benefit, with confidence, from the advantages inherent in this activity. Shadow banking worldwide a , according to the broad definition, by institutionb, 2014 Money market funds Trust companies Other Noninstitutional credit intermediaries 5% Securitization 7% Hedge funds Real estate funds Brokerdealers Investment funds a The countries are: Argentina, Australia, Brazil, Canada, Sw itzerland, Chile, China, Germany, Spain, France, UK, Hong Kong, India, Indonesia, Ireland, Italy, Japan, South Korea, Mexico, Netherlands, Russia, Saudi Arabia, Singapore, Turkey, US, South Africa. b Distribution of shadow banking by institutions w as based on a sample of 26 jurisdictions; based on that, shadow banking assets total $68.1 trillion. In contrast, the assessment of shadow banking assets presented in this box w as based on a w ider sample of 20 jurisdictions and the eurozone. Based on that, shadow banking assets total $80 trillion. SOURCE: FSB’s “Global Shadow Banking Monitoring Report 2015”.