Economics Exam: Cost-Benefit Analysis & Opportunity Cost

advertisement

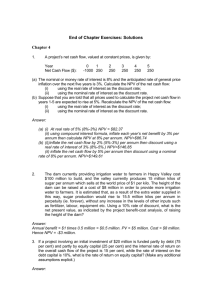

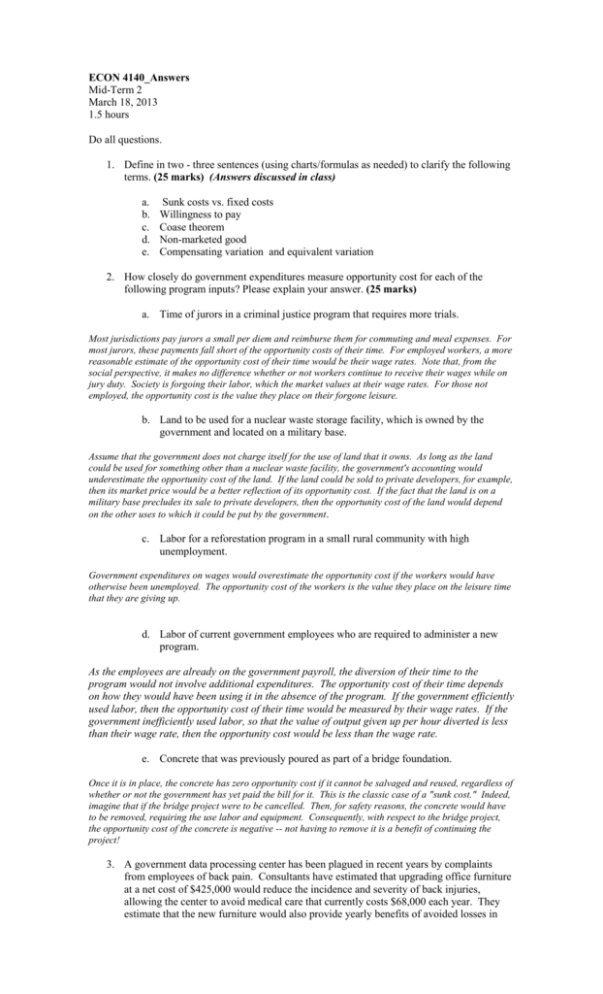

ECON 4140_Answers Mid-Term 2 March 18, 2013 1.5 hours Do all questions. 1. Define in two - three sentences (using charts/formulas as needed) to clarify the following terms. (25 marks) (Answers discussed in class) a. b. c. d. e. Sunk costs vs. fixed costs Willingness to pay Coase theorem Non-marketed good Compensating variation and equivalent variation 2. How closely do government expenditures measure opportunity cost for each of the following program inputs? Please explain your answer. (25 marks) a. Time of jurors in a criminal justice program that requires more trials. Most jurisdictions pay jurors a small per diem and reimburse them for commuting and meal expenses. For most jurors, these payments fall short of the opportunity costs of their time. For employed workers, a more reasonable estimate of the opportunity cost of their time would be their wage rates. Note that, from the social perspective, it makes no difference whether or not workers continue to receive their wages while on jury duty. Society is forgoing their labor, which the market values at their wage rates. For those not employed, the opportunity cost is the value they place on their forgone leisure. b. Land to be used for a nuclear waste storage facility, which is owned by the government and located on a military base. Assume that the government does not charge itself for the use of land that it owns. As long as the land could be used for something other than a nuclear waste facility, the government's accounting would underestimate the opportunity cost of the land. If the land could be sold to private developers, for example, then its market price would be a better reflection of its opportunity cost. If the fact that the land is on a military base precludes its sale to private developers, then the opportunity cost of the land would depend on the other uses to which it could be put by the government. c. Labor for a reforestation program in a small rural community with high unemployment. Government expenditures on wages would overestimate the opportunity cost if the workers would have otherwise been unemployed. The opportunity cost of the workers is the value they place on the leisure time that they are giving up. d. Labor of current government employees who are required to administer a new program. As the employees are already on the government payroll, the diversion of their time to the program would not involve additional expenditures. The opportunity cost of their time depends on how they would have been using it in the absence of the program. If the government efficiently used labor, then the opportunity cost of their time would be measured by their wage rates. If the government inefficiently used labor, so that the value of output given up per hour diverted is less than their wage rate, then the opportunity cost would be less than the wage rate. e. Concrete that was previously poured as part of a bridge foundation. Once it is in place, the concrete has zero opportunity cost if it cannot be salvaged and reused, regardless of whether or not the government has yet paid the bill for it. This is the classic case of a "sunk cost." Indeed, imagine that if the bridge project were to be cancelled. Then, for safety reasons, the concrete would have to be removed, requiring the use labor and equipment. Consequently, with respect to the bridge project, the opportunity cost of the concrete is negative -- not having to remove it is a benefit of continuing the project! 3. A government data processing center has been plagued in recent years by complaints from employees of back pain. Consultants have estimated that upgrading office furniture at a net cost of $425,000 would reduce the incidence and severity of back injuries, allowing the center to avoid medical care that currently costs $68,000 each year. They estimate that the new furniture would also provide yearly benefits of avoided losses in work time and employee comfort worth $18,000. The furniture would have a useful life of five years, after which it would have a positive salvage value equal to 10 percent of its initial net cost. The consultants made their estimates of avoided costs assuming that they would be treated as occurring at the beginning of each year. In its investment decisions, the center uses a nominal discount rate of 9.5 percent and an assumed general inflation rate of 3 percent. It expects the inflation rate for medical care will run between 3 percent and 5 percent but is uncertain as to the exact rate. In other words, it is uncertain as to whether the cost of medical care will inflate at the same rate as other prices or rise 2 percent faster. Should the center purchase the new furniture? (Hint – you will need to incorporate the inflation projection into the model) (25 marks) Working in real dollars, the first task is to convert the nominal discount rate to a real discount rate: d = (.095-.03)/(1+.03) = .063 A major benefit is avoided medical care costs. If it is assumed that the price of medical care inflates at the same rate as the general price level, then all the costs and benefits are in real dollars and the present value can be calculated as: NPV = (-$425,000 + $68,000 + $18,000) + ($68,000 + $18,000)/(1+.063)1 + ($68,000 + $18,000)/(1+.063)2 + ($68,000 + $18,000)/(1+.063)3 + ($68,000 + $18,000)/(1+.063)4 + ($42,500)/(1+.063)5 = -$339,000 + $80,903 + $76,108 + $71,598 + $67,354 + $31,313 = -$11,724. If, instead, it is assumed that the price of medical care inflates 2 percent faster than the general price level, then the net benefits are calculated as follows: NPV = (-$425,000 + $68,000 + $18,000) + ($69,360 + $18,000)/(1+.063)1 + ($70,747 + $18,000)/(1+.063)2 + ($72,162 + $18,000)/(1+.063)3 + ($73,605 + $18,000)/(1+.063)4 + ($42,500)/(1+.063)5 = -$339,000 + $82,183 + $78,539 + $75,063 + $71,744 + $31,313 = -$158 In this case, the purchase would not pass the net benefits test if it were assumed that medical care prices will rise at the general rate of inflation, or if it were assumed medical care prices will rise 2 percent faster than the general rate of inflation. Though medical care prices have appeared to rise substantially faster than other prices in recent years in the United States, some of the faster increase may result because medical care price indexes do not take full account of improvements in the quality of care. If the consultants assumed instead that the avoided costs will occur at the end of each year instead of at the beginning of each*/ year, the NPV would be lower. In fact, with medical care prices rising 2 percent faster than general inflation, the NPV would be: NPV = -$425,000 + ($69,360 + $18,000)/(1+.063)1 + ($70,747 + $18,000)/(1+.063)2 + ($72,162 + $18,000)/(1+.063)3 + ($73,605 + $18,000)/(1+.063)4 + ($75,077 + $18,000 + $42,500)/(1+.063)5 = -$425,000 + $82,183 + $78,539 + $75,063 + $71,744 + $99,889 = -$17,582. 4. A highway department is considering building a temporary bridge to cut travel time during the three years it will take to build a permanent bridge. The temporary bridge can be put up in a few weeks at a cost of $740,000. At the end of three years, it would be removed and the steel would be sold for scrap. The real net cost of this would be $81,000. Based on estimated time savings and wage rates, fuel savings, and reductions in risks of accidents, department analysts predict that the benefits in real dollars would be $275,000 during the first year, $295,000 during the second year, and $315,000 during the third year. Departmental regulations require use of a real discount rate of 5 percent. a. Calculate the present value of net benefits assuming that the benefits are realized at the end of each of the three years. b. Calculate the present value of net benefits assuming that the benefits are realized at the beginning of each of the three years. c. Calculate the present value of net benefits assuming that the benefits are realized in the middle of each of the three years. d. Calculate the present value of net benefits assuming that half of each year’s benefits are realized at the beginning of the year and the other half at the end of the year. e. Does the temporary bridge pass the net benefits test? (25 marks) Begin by calculating the present value of the costs, which are realized at the beginning of year 1 and at the end of year 3: PV(cost) = $740,000+$81,000/(1+.05)3 = $740,000+$69,971 = $809,971 1.a. Benefits accrue at the end of year: PV(ben) = $275,000/(1+.05)1+$295,000/(1+.05)2+$315,000/(1+.05)3 = $261,905 + $267,574 + $272,109 = $801,588 NPV = $801,588-$809,971 = -$8,383 1.b. Benefits accrue at the beginning of year: PV(ben) = $275,000+$295,000/(1+.05)1+$315,000/(1+.05)2 = $275,000 + $280,952 + $285,714 =$841,666 NPV = $841,666-$809,971 = $31,695 1.c. Benefits accrue at mid-year: PV(ben) = $275,000/(1+.05).5+$295,000/(1+.05)1.5+$315,000/(1+.05)2.5 = $268,373 + $274,181 + $278,829 = $821,383 NPV = $821,383-$809,971 = $11,412 1.d. Benefits split equally between beginning and end of year: PV(ben) = ($801,588 + $841,666)/2 = $821,627 NPV = $821,627-$809,971 = $11,656. Alternatively, average the answers to parts a and b: ($-8,383 + $31,695)/2 = $11,656. 1.e. The sign of the present value of net benefits depends on when the benefits are assumed to accrue. In this case, they accrue as various savings throughout the year, so either method (c) or (d) is most appropriate, and the temporary bridge passes the net benefits test. Note that even more accurate methods of discounting would involve estimating the benefits on a monthly, weekly, or even daily basis. Such refinement in the specification of the timing of benefits, however, would usually amount to false precision, given uncertainties in their measurement and the appropriate social discount rate.