Capital Budgeting: Cash Flow & Discounting - Finance

advertisement

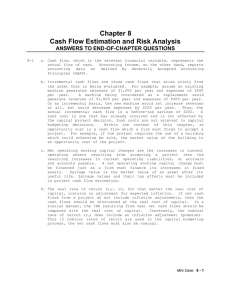

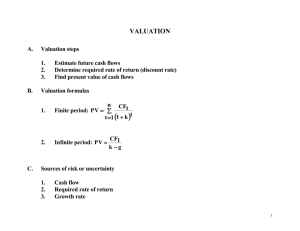

Ch.6 Topics Covered What To Discount IM&C Project Project Interaction Timing Equivalent Annual Cost Replacement Cost of Excess Capacity Fluctuating Load Factors What To Discount Only Cash Flow is Relevant Always estimate cash flows on an after-tax basis and record cash flows only when they occur (not when the work is undertaken or the liability is incurred) What To Discount Do not confuse average with incremental payoff. In calculating the NPV, only cash flows that are incremental to the project should be used. These cash flows are the changes in the firm’s cash flows that occur as a direct consequence of accepting the project The easiest way to determine whether a cash flow item is incremental is by asking two questions: What will this cash flow be with the project? What will this cash flow be without the project? If the answers differ then this cash flow item is incremental, otherwise, it is irrelevant Include all incidental effects. (may be difficult to figure all incidental effects) Do not forget working capital requirements. Most projects require an additional investment in working capital. This investment should, therefore, be recognized in the cash flow forecasts, because firms must commit cash to short term assets to produce the finished goods. Forget sunk costs: money that a firm has already spent or committed to spend regardless of whether a project is taken . Just as we “let bygones be bygones”, we should ignore sunk costs, since they are not incremental cash outflows. Include opportunity costs. By taking the project, the firm forgoes other opportunities for using the assets in alternatives. Market price does matter. Interest rates and inflation 1+ R nominal = (1+R real)(1+ inflation rate) R real is approximately R nominal – inflation rate The real rate of interest is 3 % and the inflation is 4%. What is the nominal rate of interest? 7.12% Inflation INFLATION RULE Burrows Publishing has just purchased the rights to to next book of famed romantic novelist Babara Musk. Still unwritten, the book should be available to the public in four years. Currently, romantic novels sell for $10 in softcover. The publishers believe that inflation will be 6 percent a year over the next four years. Publishers anticipate that the prices of romantic novels will rise about 2 percent per year more than the inflation rate over the next four years. Not wanting to overprice, Burrows plans to sell the novel at 13.60 (=1.084 *10) four years from now. The firm anticipates selling 100,000 copies. What is a nominal cash flow of the firm in the fourth year? A real cash flow? Inflation Example You own a lease that will cost you $8,000 next year, increasing at 3% a year (the forecasted inflation rate) for 3 additional years (4 years total). If discount rates are 10% what is the present value cost of the lease? IM&C’s Guano Project Revised projections ($1000s) reflecting inflation A capital equipment costing $100,000 today has no (zero) salvage value at the end of 5 years. If straight-line depreciation is used, what is the book value of the equipment at the end of three years? 40,000 Working capital rises over the early years of the project as expansion occurs. However, all working capital is assumed to be recovered at the end (that is, all inventories sold by the end, the cash is liquidated, and all A/R are collected). Increases in working capital in early years must be funded by cash generated elsewhere in the firm (viewed as cash outflows). Conversely, decreases in working capital in the later years are cash inflows. EX) For project X, year 5 inventories decrease by $5,000, accounts receivables by $3,000 and accounts payables by $2,000. Calculate the increase or decrease in working capital for year 5. Details of cash flow forecast in year 3 ($1000s) A further note on depreciation Depreciation is important only because it reduces taxable income; Tax shield = depreciation * tax rate If the firm could just get those tax shields sooner, they would be worth more. However, tax law allows accelerated depreciation- the modified accelerated cost recovery system (MACRS) Tax Payments ($1000s) Taxes are different when MACRS is used for depreciation PV of the tax shields based on the straight-line is $1,842,000, while PV of these tax shields is $2,174,000. Revised cash flow analysis ($1000s) The NPV is higher than the one in T.6.2, since T6.2 ignored the additional PV of accelerated depreciation. Even projects with positive NPV may be more valuable if deferred Any project has two mutually exclusive alternatives: Do it now, or wait and invest later Under conditions of certainty, find the date that maximizes the NPV of the project Timing Example You may harvest a set of trees at anytime over the next 5 years. Given the FV of delaying the harvest, which harvest date maximizes current NPV? The longer you defer cutting the timber, the more you will make. But you need to find the date that maximizes the NPV of you investment The optimal point to harvest the timber is year 4, because this is the point that maximizes NPV Equivalent Annual Cost Equivalent Annual Cost - The cost per period with the same present value as the cost of buying and operating a machine. Equivalent Annual Cost - The cost per period with the same present value as the cost of buying and operating a machine. Example Given the following costs of operating two machines and a 6% cost of capital, select the lower cost machine using equivalent annual cost method. Example Given the following costs of operating two machines and a 6% cost of capital, select the lower cost machine using equivalent annual cost method. Machine A B Year 1 15 10 2 5 6 3 5 6 4 5 PV@6% 28.37 21.00 EAC Example Given the following costs of operating two machines and a 6% cost of capital, select the lower cost machine using equivalent annual cost method. Machine A B Year 1 15 10 2 5 6 3 5 6 4 5 PV@6% 28.37 21.00 EAC 10.61 11.45