Full Time Employees

advertisement

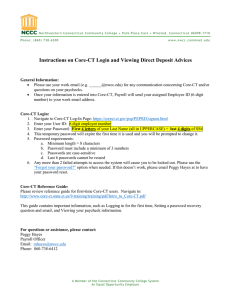

Full Time Employees W2 Wage and Tax Statement The 2015 W2 Wage and Tax Statement contains information related to income earned from 12/12/2014 through 12/10/2015, and is used to file your 2015 federal and state income tax returns. The State is delivering the 2015 Statement electronically. If you worked during this timeframe, an electronic W2 Statement will load on your Core-CT Reporting System employment record, however, how you receive your Statement will be set according to a default status - based on set of criteria. If you have questions or need a Core-CT password reset, please contact the Human Resources department. Lisa Lengel, - lengell@wcsu.edu, telephone 203-837-8666 Michele Cazorla – cazorlam@wcsu.edu, 203-837-8497 Active Employee Default Criteria Electronic W2 – Employees who receive their paycheck through direct deposit will default to an electronic W2. These employees must log onto Core-CT to print their W2 Statement. It’s anticipated that the 2015 electronic W2 will be available on their Core-CT record by the last week of December. Paper W2 - Employees who receive a hardcopy paycheck will default to a paper W2 Statement. Paper W2s will be mailed to the employee’s home address in mid-January. These employees can also print an electronic W2 through Core-CT. Employees can change how they receive their W2 by logging onto Core-CT and changing their default status. Changes to the default status must be completed by December 16, 2015 or the default will remain for the 2015-W2. Directions to log onto the Core-CT Log onto the State of CT Core-CT System website: http://www.core-ct.state.ct.us/ & enter your User ID and Password. If you need your User ID and/or password, please contact the Human Resources department. Directions to change the default status this must be done by December 16, 2015. Log onto Core-CT, under the Payroll section select >W-2/W-2c Consent Status and change the default Directions to print your Electronic W2 Log onto Core-CT, under the Payroll section select >View W-2/W-2c Forms, then select >tax year 2015 Year End Form. Information found on the back of W2 is located under the section > Filing Instructions. Terminating Employees Employees who are terminated on or prior to 12/10/2015, will automatically default to a paper W2 mailed to their home address in mid-January. Employees who terminate between 12/11/2015 and 12/24/2015 will need assistance from the Payroll department with printing their W2. Employees who terminate after 12/25/2015 will have to print their electronic W2 before termination. Re-Printed W2s Employees must receive their W2 Statement according to the default criteria. Please direct W2 questions to Payroll. In exceptional situations, employees can seek assistance from the Payroll department for a re-printed W2. Employees will have to pick-up their W2 in the Payroll Office (University Hall Room 224) or request to have it mailed. W2s cannot be faxed or emailed. Payroll Contact Information Sarah Baywood, tele: 203-837-8366 Patricia Bartolo, tele: 203-837-8364 Resa Sawyers, tele: 203-837-8365 *New* CO-1095c Statement – late in January, the Office of State Comptroller will mail employees who have WCSU health insurance, a 1095c Statement. The 1095c Statement will be mailed to the employee’s home address, and will be needed to file your 2015 federal income tax return.