Committed Procurement in Privately Negotiated Markets: Evidence

advertisement

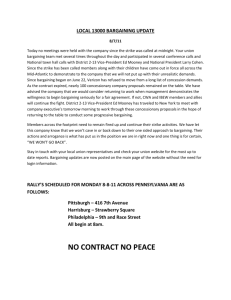

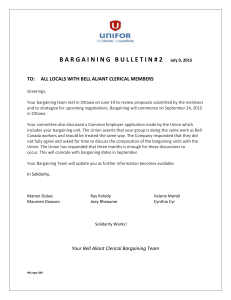

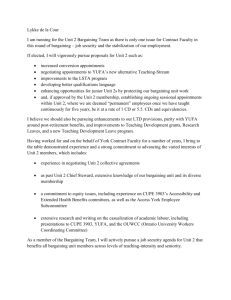

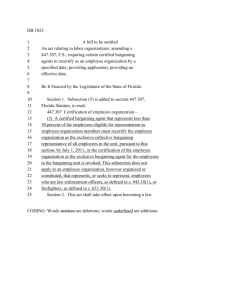

Committed Procurement in Privately Negotiated Markets: Evidence from Laboratory Markets By Darlington M. Sabasi* Christopher T. Bastian Dale J. Menkhaus Owen R. Phillips * Authors are former graduate assistant, associate professor, professor, Department of Agricultural and Applied Economics, and professor, Department of Economics and Finance, University of Wyoming. Contact Author: Christopher T. Bastian Associate Professor Department of Agricultural and Applied Economics University of Wyoming 1000 E. University Avenue, Dept. 3354 Laramie, WY 82071 Ph. (307)766-4377 Fax (307)766-5544 e-mail: bastian@uwyo.edu Acknowledgements: This work was supported, in part, by the Lowham Research Fund. Opinions expressed herein are those of the authors and do not necessarily reflect that of the granting agency. JEL codes: D1, L4 1 Abstract Previous research suggests that an increase in committed procurement can result in lower cash market prices for livestock, but the magnitude of the price effect is often small. There is a paucity of research ascertaining prices received by those market agents allowed to trade in a prior bargaining session via alternative marketing arrangements versus those who have not. The objective of this study is to analyze the potential market impacts of committed inventory on privately negotiated transactions when some traders have two windows of negotiation and others have one. We use laboratory market experiments to achieve our research objective. Experimental treatments increase the percentage of buyer and seller pairs, from 25, to 50, and to 75 percent, that are allowed to trade units produced in a prior bargaining period (BP1) resulting in committed procurement. All market participants are then allowed to trade in a subsequent bargaining period (BP2). Results suggest that inventory loss risk increases for sellers in BP2 who are not allowed to trade in BP1. Sellers unmatched in BP1generally negotiate for lower prices in BP2. Prices are statistically lower in the 75 percent treatment for those sellers not matched in BP1. Buyers who do not have the opportunity to trade in BP1 tend to negotiate for higher prices in BP2. Statistically significant higher prices for unmatched buyers occur in two of the three committed procurement treatments. Interestingly, average prices tend to converge to the predicted competitive equilibrium in BP2 even with differences in outcomes for unmatched traders. Overall, results suggest increased regulatory pressure from those who are unable to participate in alternative marketing arrangements is likely as committed procurement increases. 2 It is well documented that there has been a trend toward fewer and larger firms in both the beef and pork packing industries (Ward 2010a). Ward (2010b) further states that this trend has been driven by enhanced economic efficiency and cost management associated with operating larger plants. In order to realize this cost advantage, larger plants must operate at high levels of utilization (Ward 1990; Barkley and Schroeder 1996). This, in turn, has affected procurement practices and pricing behavior in these industries, which likely can be extended to other industries in the food and commodity supply chains. Specifically, concomitant with the structural changes is increased procurement of cattle and hogs by packers on a non-cash basis, i.e., a trend away from spot or cash purchases to committed procurement methods1 (Ward et al. 2001). This trend is particularly evident for hogs – negotiated cash purchases in 2002 and 2008, respectively, were 15.5% and 10.3% indicating spot market transactions declined to an even smaller proportion of total purchases over that period (Ward 2008). Swine market formula contracts as a single category made up more than 55% of hog purchases during this period. The shift away from spot procurement toward alternative marketing arrangements by beef packers has been more gradual than in the pork industry. Marketing agreements, a type of committed procurement method, accounted for 28.8% of head purchased for the period October 2002 through March 2005 (Muth et al. 2008) and negotiated cash trades went from 43.8% in 2001-02 to 34.1% in 2009-10 (Ward 2010b). It is thought by some that committed procurement methods, if widely used, could have the effect of reducing competition in markets for livestock and depress not only cash market prices but prices under all procurement methods (U. S. Department of Agriculture 3 2011, p.59). With changes in procurement methods, privately negotiated pricing for both cattle and hogs has become common, whether directly or price based on negotiated cash prices as in formula-priced contracts (Lawrence 2010; Ward 2010b). As a result, producers having inventory on hand that has not been committed could find their bargaining advantage with processors in negotiations for cash price reduced (Ward et al. 2001). The objective of this study is to analyze the potential market impacts of committed inventory on privately negotiated transactions when some traders have two windows of negotiation and others have one. Naturally occurring data from individual privately negotiated transactions are difficult to obtain and, when available, are fraught with empirical challenges such as confounding influences among alternative explanatory variables. We therefore analyze data from laboratory market experiments designed to control for these potential issues which may occur in naturally occurring data. Experimental treatments increase the percentage of buyer and seller pairs, from 25, to 50, to 75 percent, that are allowed to bargain in a prior bargaining period resulting in committed procurement. All market participants are then allowed to trade in a subsequent bargaining period. This experimental design is intended to reflect practices in which some market actors may not have the opportunity to make prior agreements and may face trading windows with inventory to sell or purchase that has not been previously committed (Menkhaus et al. 2007). Market outcomes from these experimental treatments are then compared to a base treatment in which no buyer-seller pairs are allowed to bargain prior 4 to a trading cycle exactly like the second bargaining period. We also analyze trades and prices across the two bargaining periods for the committed procurement treatments, and analyze prices received by those participants allowed to trade in the first bargaining period versus those who do not have the opportunity to trade in the first bargaining period. Previous Research Previous studies focusing on pricing and committed procurement in the livestock industry are summarized by Ward (2010a). Selected studies of the effect of forward contracting or captive supplies on cash price generally find an inverse relationship, but the magnitude is small when they exist (Elam 1992; Schroeder et al. 1993; Ward, Koontz, and Schroeder 1998; Schroeder and Azzam 1999 and 2003; Muth et al. 2008; Vukina, Shin, and Zheng 2009). Generally, the majority of the studies in the literature compare alternative marketing arrangement prices to cash prices. Given the nature of data in many of these studies, however, there is a paucity of research ascertaining prices received by those market agents allowed to trade in a prior bargaining session via alternative marketing arrangements versus those who have not had that opportunity. Nevertheless, concerns remain among producers who do not have the opportunity to pre-commit supplies regarding cash prices they receive. Policy makers continue to find this to be an issue that merits debate for legislative or regulatory reform, and is the focus of this research. Approach While changes in procurement practices and pricing behavior in the beef and pork packing industries motivate this paper, we study the price effects of committed 5 procurement and privately negotiated transactions in a general sense without specific reference to these industries. The use of a controlled laboratory market allows us to extend much of the previous research to include the effects of alternative levels of committed procurement as compared to a base treatment absent of such practices and assess how agents not participating in alternative marketing arrangements are affected. This approach also allows for a comparison to the predicted competitive market outcomes. Trading Behavior with Committed Procurement and Private Negotiation Assume a simple market where some participants can be matched in a first bargaining period (bargaining period one) prior to the rest of the market participants being able to trade in a second bargaining period (bargaining period two) – where transactions are privately negotiated in each bargaining period. Also assume that the production decision is in advance of negotiating for price. Those matched in the first bargaining period represent an opportunity to commit procurement or forward price for some or all of the supply produced for sale in the overall market. Buyers and sellers each face price risk in the second bargaining period associated with not being matched in bargaining period one - matching risk. For sellers, there also is inventory loss risk due to advance production – losing all or part of the cost of production. That is, sellers face the risk of holding unsold units, or trading units produced in advance at a loss, at the end of bargaining period two. We investigate the implications of these two important risks – inventory loss risk due to advance production and matching risk, in a market setting with two bargaining periods 6 (where bargaining period one is not open to all traders) and production in advance of privately negotiated trading as just described.2 Menkhaus et al. (2007) model this bargaining setting as follows. Each unit produced by a seller has a probability represented by f(N) that the nth unit sells at a loss, where N is the total production. Loss is represented by αnCn and generally is a function of N, where αn is the loss as some proportion of the unit’s cost Cn. When αn=1, the full unit cost of production is lost due to the unit being unsold. For the purpose of illustration Menkhaus et al. (2007) set f(N) = (N-1)/N and derive the first order condition as Pn = Cn(1-(αn+N(N-1)αn')). The risk of inventory loss is -(αn+N(N-1)αn´ ), where αn' is ∂αn/∂N and Pn is the negotiated price of the nth unit. This risk causes the risk averse seller to produce less. That is, the producer will not produce up to the point where Pn = Cn. Matching risk represents a situation in which a buyer or seller in private negotiation is matched with a trading partner in two bargaining rounds to trade one unit. In round one, the matched buyer and seller can trade or wait until round two. In the case of a “no trade” in round one, the matched agents move to bargaining round two and each is matched with the same or a different trading partner. If matched with a different partner, that agent could have already traded the one unit and negotiation ceases. Three additional scenarios are possible in bargaining round two: (1) another “no trade” in which case there are no earnings in the second round for either the buyer or seller and the seller loses the unit cost; (2) earnings for the buyer and seller can be better or worse than the trade deal in the prior bargaining round; (3) either the buyer or seller are matched with 7 someone who has traded in the previous round causing sellers to accept a lower bid or buyers to accept a higher offer than they would have in the previous round. The probabilities are such that expected payoffs in round two are sufficiently low to cause both the buyer and seller to trade in round one to avoid matching risk and inventory loss risk for the seller. In multiple bargaining rounds, the highest percentage of trades is expected to occur in the first round, as compared to latter rounds. Note there is added incentive for the seller to trade in round one, because of inventory loss risk. In the current research with two bargaining periods and four bargaining rounds (one bargaining round in bargaining period one and three bargaining rounds in bargaining period two), we expect active trading between matched buyers and sellers in the first bargaining period. This is because each trading partner has incentive to reduce respective inventory loss risk and/or matching risk as discussed. The desire for active trading in bargaining period one by both the buyer and seller should result in a price near the competitive level in order to equitably share the total available surplus – an empirical issue we test in the experiments. We can explore price between the two bargaining periods, as in this study, in more detail. Inventory loss risk and the risk associated with being matched in bargaining period two with someone who traded in bargaining period one have potential impacts on trade prices. Further, these two risks are interrelated from the perspective of a seller. A seller matched in bargaining period two with a buyer who traded in bargaining period one negatively affects his/her negotiation advantage for price relative to the buyer, resulting in lower prices as compared to prices in bargaining period one. The opposite effect on 8 negotiations for price is expected for buyers – i.e., those not matched in bargaining period one might find themselves in a position to negotiate for higher prices in bargaining period two than those matched in the prior period. The following propositions are tested through experiments. Proposition one: Inventory loss risk due to advance production causes the risk averse seller to produce less than the competitive level. Proposition two: Proportionately more units are expected to be traded in bargaining period one than in bargaining period two to reduce inventory loss risk and/or matching risk. Proposition three: Active trading in bargaining period one (the committed procurement period) for some agents, coupled with reduced inventory and matching risks in bargaining period two, leads to more competitive prices in both bargaining periods than if all traders only met in bargaining period two. Proposition four: Price received in bargaining period two by sellers (buyers) not matched in bargaining period one decreases (increases). Experimental Design The experiment was designed to address fundamental market impacts of committed procurements in private negotiation trading by including two bargaining periods. In bargaining period one some buyers and sellers were randomly matched, while some were not, for a single one-minute round of bargaining. In bargaining period two, all buyers and sellers were randomly matched in each of three, one-minute bargaining rounds. This design allowed for the analysis of the impact of a trading environment with two 9 bargaining periods – the first bargaining period results in committed procurements and the second bargaining period represents a negotiated cash market in which all market participants are given the opportunity to trade. There were four treatments. The base or control treatment consisted of all buyers and sellers being randomly matched for three one-minute bargaining rounds. Thus, all buyers and sellers in the base treatment have the opportunity to trade in a market environment like that of bargaining period two without opportunities for committed procurement. The second treatment allowed 25% of buyers and sellers to be matched in bargaining period one, in the third treatment 50% of buyers and sellers were matched in the first bargaining period, and the fourth treatment allowed 75% of buyers and sellers to be matched in bargaining period one (table 1).3 Three replications were conducted for each treatment. Each replication had 20 trading periods. After trading period 20 a random stop was in place so participants did not know for sure when the experimental session would end to mitigate strategic behavior in the last trading period. Figure 1 illustrates the organization of each experimental session. There were four sellers and four buyers for each session.4 At the beginning of each trading period, consisting of three or four bargaining rounds, sellers would make a production decision while buyers would wait. Once sellers made their production decision, the units they produced were available for sale in bargaining period one, consisting of one bargaining round, and/or bargaining period two, consisting of three bargaining rounds. Sellers produced a homogenous good. Further, each seller could 10 produce, and buyers could purchase, a maximum of eight units. No production was carried over to the next trading period, i.e., the units were considered to be perishable. Once the production decision was made, participants negotiated for prices during the bargaining rounds to complete the trading period. In each of the three or four bargaining rounds (one in bargaining period one and three in bargaining period two), buyers and sellers were randomly matched anonymously and no information was provided to either buyers or sellers regarding partner identity. In treatments with two bargaining periods market participants did not know during the production decision whether they would have the opportunity to trade in bargaining period one, because the computer randomly chose those that were allowed to trade during bargaining period one. This generally captures relevant features of alternative marketing arrangements for this research where not all sellers are able to enter into committed procurement with buyers prior to a marketing window where all participants may trade. Both buyers and sellers gained knowledge and experience as the experiment progressed. This experience allowed them to adjust accordingly regarding production decisions and negotiations for prices. Laboratory Procedures Subjects were recruited mainly from students majoring in business and/or economics. After arriving at the study site, participants were given instructions regarding the experiment via a PowerPoint presentation. The presentation gave an overview of the experiment as presented in figure 1, and how profits were determined for both buyers and sellers. The specific design for the committed procurement treatments – i.e., whether 11 25%, 50%, or 75% of the buyers and sellers would be matched in the first bargaining round, was not common knowledge. For those treatments, the instructions indicated there would be two bargaining periods during which randomly paired buyers and sellers would negotiate for trade prices for those treatments allowing committed procurement. There was no mention of this for the control or base treatment. The presentation went on to explain that some buyers and sellers would be randomly paired for one minute during bargaining period one while others would remain idle. Similarly, for bargaining period two the instructions noted that all buyers and sellers would be randomly matched for one minute in each of three bargaining rounds. The instructions for the base treatment did not indicate an opportunity for some participants to trade in bargaining period one, but rather indicated that all participants would have the opportunity to trade for three one-minute bargaining rounds. Participants were informed that their payoff at the end of the experiment would be determined by their performance during the experiment. Also highlighted was that their participation as a buyer or seller would be assigned randomly and once assigned they would remain a buyer/seller throughout the experiment. Participants were informed that each participant’s actions during the experiment would be kept private and only aggregate data would be reported. After the presentation, questions were invited and answered. Following the question and answer session participants were asked to sit at a computer station. At login it was randomly determined whether the participant was a buyer or seller for the experiment. At that point a practice session was conducted, which allowed the participants to become familiar with how to make bids and offers and make decisions 12 during a trading period. The practice session continued until all participants indicated they were ready to move into the actual experiment. The production costs and redemption values displayed for the practice session were different from the ones for the actual experiment. Participants were instructed that the values would change in the experiment that followed the practice session and not to form any preconceived expectations regarding trade prices. Production costs and redemption values for the actual experiment are presented in table 2. These represent individual supply and demand curves. When summed across participants a predicted competitive equilibrium of 80 tokens and 20-24 units is determined. This provides a competitive benchmark with which to compare results. The currency used was referred to as tokens with one hundred tokens equal to a dollar. The production cost and redemption value schedules were the same for all sellers and buyers, respectively, but participants did not know this. At the beginning of the experiment each buyer and seller was given 1,000 tokens or $10. This was to ensure that sellers would not go bankrupt early in the experiment as they incurred costs to produce units. Buyers also were given the same amount for consistency. For each bargaining round, each randomly paired buyer and seller would make bids and offers until they reached an agreeable price. Once price was agreed upon a trade occurred. Buyers’ bids had to become progressively higher while sellers’ offers had to become lower. The matched pair could trade as many units as possible, one at a time, for each one-minute round after which buyers and sellers were again randomly matched. At the end of each trading period, there was a period recap on the computer screen privately 13 showing each buyer and seller how much they made or lost on each transaction. The average payoff per participant for a typical session lasting between 1½ to 2 hours was about $36, including the $10 show-up fee. Results and Discussion We focus on quantities produced/traded and prices from the laboratory market treatments described above. Data from the base treatment are compared to bargaining period two results of the committed procurement treatments using a convergence model which allows comparisons across treatment asymptotes for price and trades variables5 (Menkhaus, Phillips and Bastian 2003; Menkhaus et al. 2007). Statistical tests compare sample price data from the experiments for each committed procurement treatment to the competitive prediction for price, price differences between bargaining periods, and price differences in bargaining period two between agents matched and unmatched in bargaining period one. The one-sample t-test is used in all cases for comparison across the committed procurement treatments, i.e., treatments with two bargaining periods.6 To assure independence for the statistical test, average prices for the last five trading periods (to allow for convergence in latter periods) for each replication are used (Phillips, Menkhaus, and Krogmeier 2001). Quantities Produced/Traded Table 3 indicates that the average units traded in the base treatment is higher than the number of trades conducted in bargaining period two of the committed procurement treatments. This is to be expected given the opportunity for at least some of the participants to trade an additional bargaining round in bargaining period one. Overall, 14 however, more units are traded in the committed procurement treatments as compared to the base (table 4). Table 4 provides a summary of the average units produced across the last five trading periods and three replications for each committed procurement treatment. Also reported are the percentages of units traded in bargaining period one, units traded in bargaining period two, and units not sold. Consistent with proposition one, except for the 75% treatment, total units produced are below the predicted competitive level of 20-24 units due to inventory loss risk. Additional matches in bargaining period one (increased committed procurement), which was unknown to the seller but would have been recognized after a few trading periods, contributed to increased units produced in the 75% treatment equal to the lower range of the predicted competitive level (20 units). Inventory loss risk would have been perceived to be lower because of a high expected probability of trading in bargaining period one. As expected, more units are traded in bargaining period one as the number of matches increases from 25% to 75% - there simply are more active traders in the market. The proportion of trades across the last five trading periods and three replications in bargaining period one (one of four bargaining rounds) is 14.38% for the 25% treatment. Comparing this to that which would be expected, assuming an equal proportion of trades across bargaining rounds and buyer-seller pairs and with a quarter of the buyer-seller pairs matched in the 25% treatment (1/4 x 1/4 = 1/16 → 6.25%), a disproportionate number of trades occurs during the first bargaining period. Similarly, for the 50% and 75% treatments, in which there were on average 20.85% and 32.75% of 15 units traded in bargaining period one, the expected percentages, respectively, are (1/4 x 1/2 = 1/8 → 12.50%) and (1/4 x 3/4 = 3/16 → 18.75%). Each reflects active trading in bargaining period one to reduce matching risk and/or inventory loss risk (proposition two). It follows that with more units traded in bargaining period one, fewer units remain to be traded in bargaining period two. This is illustrated by the decrease in the percentage of units traded in bargaining period two as the number of matches in bargaining period one increases (table 4). Notable is the increase in the average percentage of units not sold moving from the 25% treatment to the 75% treatment (table 4). Agents not matched in bargaining period one in the 25% and 50% treatments were responsible for all units not sold. That is, those matched in bargaining period one sold all units in these two treatments during the last five periods of the three replications. In the 75% treatment, those not matched in bargaining period one contributed to 44% of the unsold units (rather than all units as in the other two treatments). The latter is somewhat contrary to the other committed procurement treatments. In the scenario of increased matches in the first bargaining period, there is a higher risk that sellers get matched in bargaining period two with buyers who would have procured units in bargaining period one. This was expected to result in an increase in surplus units for sellers not matched in bargaining period one and a loss of production costs for those units. The higher frequency of being matched in bargaining period one in the 75% treatment, as discussed, provided incentive to produce additional units, which contributed to more unsold units in bargaining period two, even by those matched in 16 bargaining period one. This result suggests that the number of unsold units in the committed procurement treatments might be expected to decrease if the buyer-seller pairings had not been random in bargaining period one. In the absence of random pairings in bargaining period one, sellers would be assured of being matched likely resulting in an increase in the probability of trading additional units of production. Trade Prices Convergence model results indicate that trade prices in the base treatment are consistently lower as compared to bargaining period two of the committed procurement treatments. However, this difference in price is only statistically significant for the 25% and 75% treatments. The opportunity created from an additional bargaining round may somewhat increase trade prices as inventory loss and matching risks are reduced for at least some of the market participants. Price in bargaining period one is significantly higher than 80 for the 25% treatment, but price is not significantly different from the competitive level for each of the other two treatments, as per the one-sample t-test (table 5). This supports our proposition three, which is prompted by active trading in bargaining period one (table 4). Further, and also in line with proposition three, price in each of the treatments for bargaining period two (table 5) is not significantly different from 80. Following the above results, the difference in prices between the two bargaining periods (table 5) are significantly higher for bargaining period one for the 25% treatment and not significantly different in the other two treatments. 17 Trade Prices in Bargaining Period Two for Sellers (Buyers) Matched and Not Matched in Bargaining Period One An important issue related to committed procurement is if bargaining period two prices received (paid) by sellers (buyers) who were not matched in bargaining period one differ from bargaining period two prices received (paid) by those who were matched in bargaining period one. Generally the seller(s) not matched in bargaining period one in all the three treatments tend to negotiate for a lower price in bargaining period two, and significantly lower in the 75% treatment (table 6), as per proposition 4. In the second bargaining period, sellers not matched in the first bargaining period are faced with the prospect of losing all or part of the cost of production if they do not trade. This inventory loss risk due to advance production, coupled with the risk of being matched with a buyer who has purchased units in bargaining period one, contributes to sellers negotiating for and accepting lower prices in bargaining period two. Conversely, sellers matched in bargaining period one generally receive a higher price in bargaining period two as compared to unmatched sellers. From the perspective of buyers and consistent with proposition four, buyer(s) not matched in bargaining period one are willing to negotiate for higher prices when they trade in bargaining period two, as compared to buyers who were matched in bargaining period one (table 7). The price difference is significant in both the 25% and 75% treatments. A price difference is anticipated more for the 75% treatment, in which the probability of being matched with a seller who already traded in bargaining period one is higher, than for the 25% treatment. This reflects the fact that if buyers do not trade, they 18 do not make any profit. Thus, buyers are willing to pay a higher price to trade. Moreover, given the risk of being matched with a seller in bargaining period two that has sold most or all of his/her inventory, a buyer will likely be more aggressive in negotiating price to make trades when matched with a seller with inventory and the willingness to trade. Buyers matched in bargaining period one have already traded and captured some units before entering into bargaining period two, and they would not be demanding as much in bargaining period two. They have already earned some revenue in bargaining period one, and this likely contributes to them bidding lower prices in bargaining period two. Consequently, buyers matched in bargaining period one earn more than buyers not matched in bargaining period one. Summary and Implications The objective of this research was to investigate the market outcomes from privately negotiated trading associated with increased participation of market actors in a prior bargaining period in which some of the production by sellers in the market is committed, as compared to outcomes in a second bargaining period in which all market actors participate. Such knowledge should provide useful insights for policy makers as they face growing public concerns about the use of alternative marketing arrangements in private negotiation trading by industries in the food and commodity supply chains. Laboratory market experiments were designed to identify potential impacts of committed procurement on negotiated transactions. In committed procurement treatments some market actors were allowed to trade in a bargaining period prior to when everyone 19 could trade in a second bargaining period. This design allowed us to identify the impacts associated with those market actors not participating in committed procurement, along with comparing laboratory market outcomes to the predicted competitive equilibria as well as to results from a base treatment in which there were not opportunities for committed procurement. Generally, the potential for at least some participants to trade in a prior bargaining period (committed procurement) increased the number of trades and price levels as compared to if all agents only met in bargaining period two. This suggests that, overall, more surplus may be extracted from the market, i.e., the market outcome is more efficient because of the addition of a bargaining opportunity for participants. This result supports arguments made that alternative marketing arrangements may increase efficiency in the beef and pork sectors. Results reveal that inventory loss risk (unsold units) for sellers increases in bargaining period two for agents not participating in the first bargaining period in the 25% and 50% treatments. Increased production, coupled with not being matched in bargaining period one, resulted in inventory loss for sellers matched and not matched in bargaining period one in the 75% treatment. Further, the results show that a seller who did not get matched and trade in bargaining period one negotiates for a lower price in bargaining period two, and significantly so as the percentage of matches in bargaining period one increases to 75%. On the other hand, buyers not participating in the first bargaining period tend to negotiate for higher prices. 20 Based on the results obtained in this study, those producers not able to participate in earlier trading (committed procurement) may receive lower prices in negotiated cash market sales. The results suggest, however, this may not always be to a degree that would be found to be statistically significant. Experiment results indicate that firms purchasing units prior to trading in the negotiated cash market have a bargaining advantage, and they can use their previously obtained inventory as leverage to offer lower prices on the cash market. The decrease in negotiated cash price for producers not participating in committed procurement, as more buyers and sellers are matched in bargaining period one, provides evidence of how the market may be impacted when there are more buyers and sellers engaged in alternative marketing arrangements. Prices in the second bargaining period, however, are generally approaching the competitive benchmark, regardless of the level of committed procurement. An additional bargaining round contributes to reducing matching and inventory loss risks and generally moves price to the predicted competitive level in bargaining period two. Sellers produce more units in the 75% treatment (near the predicted competitive level) compared to the 25% and 50% treatments. Thus, more production is expected as committed procurement increases. Sellers in the 25% and 50% treatments seemingly produce less quantity as they discover that they have a lower chance of being matched in bargaining period one. As the likelihood of being matched in bargaining period one increases, perceived risk of loss is reduced and sellers produce more units. Increased production tends to lead to more unsold units, whether or not the seller is matched in 21 bargaining period one. A history of committed procurement between buyers and sellers could mitigate the occurrence of unsold units. The results from this research are consistent with the findings of others (e.g., Muth et al. 2008 and Key 2011) in that committed procurement overall does not greatly impact the competitive nature of markets. Moreover, our results are also consistent with past research in that buyers not engaged in committed procurement may pay higher prices than those that do for those units available on the market at a later time (Vukina, Shin and Zheng 2009). The results reported here extend the existing literature in that specific market outcomes for participants allowed to engage in committed procurement activities versus those who do not can be explicitly compared. Generally our results suggest a potential disadvantage and less desirable outcome for market participants shut of committed procurement activities. Thus, our findings provide support for concerns expressed by sellers that committed procurement may result in lower prices for sellers not engaged in alternative marketing arrangements, but price differences are not statistically significant in two of the three treatments. Overall, these results point to increased controversy and desire for policy and or regulatory intervention as the use of committed procurement increases. 22 Footnotes 1 References to the general term committed procurement (alternatives to the cash or spot market) in the literature include alternative marketing arrangements (AMAs), captive supplies, pre-committed supplies, and non-cash transactions. These refer to livestock that is owned, procured or otherwise committed to a packer more than 14 days prior to slaughter. Committed procurement practices or AMAs include forward contracts, swine market formula contracts, marketing agreements, procurement or marketing contracts, packer ownership, custom feeding, and custom slaughter. Cash or spot market transactions include auction barn sales; sales through order buyers, dealers, and brokers; and direct sales. In addition to assuring high levels of plant utilization, both pork and beef packers also can use committed procurement methods to improve coordination of the supply chain – to secure more consistent and higher quality hogs/cattle (Ward et al. 2001). 2 We recognize that we conceivably have provided buyers with a bargaining advantage because of inventory loss risk. Buyers of inputs, for example, can face risk associated with meeting a plant capacity. As mentioned, the practice of utilizing plant capacity provides incentive for the committed procurement practice. While this buyer-related practice would have the potential to dampen the buyer bargaining advantage in our model and experiments, we believe the seller (producer) is generally impacted more than the buyer in our industry setting. We also avoid the confounding influences of risks faced by both buyers and sellers by considering only the seller risk. Nevertheless, buyers in the 23 experiments must trade to make a profit, which can reflect a need to meet a plant capacity constraint. 3A treatment with 100% of the buyers and sellers matched in the first bargaining period essentially involves four bargaining rounds, the results of which would closely replicate previous research (Menkhaus et al. 2007). Because both matching and inventory loss risks are reduced, price converges to a level near the predicted equilibrium. We therefore use the predicted competitive price (presented later) as the comparator. 4 Previous laboratory market research has shown four sellers and/or buyers to be adequate for convergence with regularity to the competitive equilibrium under alternative trading institutions (Davis and Holt 1993; Menkhaus, Phillips, and Bastian 2003; Plott 1982; Smith and Williams 2000). 5 The form of the convergence model is i 1 i 1 j 1 j 1 Zit B0 (t 1) / t B1 (1 / t ) j D j (t 1) / t j D j (1 / t ) uit ' where Zit is the average sale price or units traded across three replications or sessions and all trades for each of t periods (1, ... , 20) in cross section (treatment) i; B0 and B1 are the predicted asymptote and starting level of the dependent variable for the control/base treatment; α and β are adjustments to the asymptote and starting level for each treatment’s relation to the base; Dj is a dummy variable separating j treatments as identified in table 1; and uit is an error term. The Parks method was used to estimate the model as it accounts for unique statistical problems resulting from the panel data sets. Further, the residuals from the estimated convergence model for each equation were 24 tested for normality – normality was not rejected. Analyses were conducted in SAS using the PANEL Procedure. The estimated asymptote values are of most interest in this study. Accordingly, these estimates are reported in table 3. 6 The t distribution is not sensitive to moderate departures from normality (Neter, Wasserman, and Kutner 1985, p.49), the seriousness of which is measured by the severity of skewness (Brown 1997). We tested for the severity of skewness and in each case skewness was not severe. 25 References Barkley, A.P. and T.C. Schroeder. “Long-Run Impacts of Captive Supplies.” in Role of Captive Supplies in Beef Packing. Washington, D. C.: U.S. Department of Agriculture, GIPSA-RR-96-3, 1996. Brown, J.D. “Questions and Answers about Language Testing Statistics: Skewness and Kurtosis.” Shiken: JALT Testing & Evaluation SIG Newsletter 1(1997):20-23. Davis, D.D. and C.A. Holt. Experimental Economics. Princeton, N.J.: Princeton University Press, 1993. Elam, E. “Cash Forward Contracting versus Hedging of Fed Cattle, and the Impacts of Cash Contracting on Cash Prices.” Journal of Agricultural and Resource Economics 17(1992):205-217. U. S. Department of Agriculture. 2010 Annual Report. Grain, Inspection, Packers, and Stockyards Administration, Washington, D. C., 2011. Lawrence, J.D. “Hog Marketing Practices and Competition Questions.” Choices, 25,2(2010). Menkhaus, D.J., O.R. Phillips, and C.T. Bastian. “Impacts of Alternative Trading Institutions and Methods of Delivery on Laboratory Market Outcomes.” American Journal of Agricultural Economics 85(2003):1323-1329. Menkhaus, D.J., O.R. Phillips, C.T. Bastian, and L.B. Gittings. “The Matching Problem (and Inventories) in Private Negotiation.” American Journal of Agricultural Economics 89(2007):1073-1084. 26 Muth, M.K., Y. Liu, S.R. Koontz, and J.D. Lawrence. “Differences in Prices and Price Risk Across Alternative Marketing Arrangements Used in the Fed Cattle Industry.” Journal of Agricultural and Resource Economics 33(2008):118-135. Neter, J., W. Wasserman, and M.H. Kutner. Applied Linear Statistical Models: Regression, Analysis of Variance, and Experimental Design, second edition. Homewood, Illinois: Richard D. Irwin, Inc., 1985. Phillips, O.R., D.J. Menkhaus, and J.L. Krogmeier. “Laboratory Behavior in Spot and Forward Markets.” Experimental Economics 4(2001):243-256. Plott, C.R. “Industrial Organization Theory and Experimental Markets.” Journal of Economic Literature 20(1982):1485-1527. Schroeder, T.C., R. Jones, J. Mintert, and A.P Barkley. “The Impact of Forward Contracting on Fed Cattle Prices.” Review of Agricultural Economics 15(1993):325337. Schroeder, J. and A. Azzam. “Econometric Analysis of Fed Cattle Procurement in the Texas Panhandle.” Washington, D. C.: U. S. Department of Agriculture, Grain, Inspection, Packers and Stockyards Administration, U.S. Department of Agriculture, 1999. Schroeder, J. and A. Azzam. “Captive Supplies and Spot Market Prices of Fed Cattle.” Agribusiness: An International Journal 19(2003):489-504. Smith, V.L. and A.W. Williams. “The Boundaries of Competitive Price Convergence.” in Bargaining and Market Behavior: Essays in Experimental Economics, (2000), edited by V.L. Smith. Cambridge, England: Cambridge University Press. 27 Vukina, T., C. Shin, and X. Zheng. “Complementarity among Alternative Procurement Arrangements in the Pork Packing Industry.” Journal of Agricultural & Food Industrial Organization 7(2009): Article 3. Available at http://www.bepress.com/jafio/vol7/iss1/art3 Ward, C.E. “Meatpacking Plant Capacity and Utilization: Implications for Competition and Pricing.” Agribusiness 6 (1990):65-73. Ward, C.E., S.R. Koontz, and T.C. Schroeder. “Impacts from Captive Supplies on Fed Cattle Transaction Prices.” Journal of Agricultural and Resource Economics 23(1998):494-514. Ward, C.E., M.L. Hayenga, T.C. Schroeder, J.D. Lawrence, and W.D. Purcell. “Contracting in the U.S. Pork and Beef Industries: Extent, Motives, and Issues.” Canadian Journal of Agricultural Economics 48(2001):629-639. Ward, C.E. Preferential Cattle and Hog Pricing by Packers: Evidence from Mandatory Price Reports. 2008. Available at http://ageconsearch.umn.edu/handle/37989. Ward, C.E. “Economics of Competition in the U.S. Livestock Industry. 2010a. Available at http://www.justice.gov/atr/public/workshops/ag2010/016/AGW-15639a.pdf. Ward, C.E. “Assessing Competition in the U.S. Beef Packing Industry.” Choices, 25,2(2010b). 28 PRODUCTION DESICION BARGAINING PERIOD ONE WAIT BUYERS BARGAINING PERIOD TWO PERIOD ONE RANDOMLY PAIRED BUYERS & SELLERS TRADE FOR ONE MINUTE (Negotiate for trade price) RANDOMLY PAIRED BUYERS & SELLERS TRADE FOR THREE ONE MINUTE ROUNDS. SELLERS Some supply is committed in bargaining period one while the remaining is traded in the second bargaining period. Control is bargaining period two only. PRODUCE UNITS Figure 1. Experimental session organization 29 Market outcome Table 1. Experimental design – the base treatment and three treatments with two bargaining periods (BP1 and BP2) per trading period Treatment No. of No. of No. of No. of No. of No. of Buyers Sellers Matches Buyers Sellers Matches BP1 BP1 BP1 BP2 BP2 BP2 Base 0 0 0 4 4 3 25% 1 1 1 4 4 3 50% 2 2 1 4 4 3 75% 3 3 1 4 4 3 30 Table 2. Production costs and redemption values for each unit traded Redemption Values for Production Costs for Buyers Sellers Unit (tokens) (tokens) 1 130 30 2 120 40 3 110 50 4 100 60 5 90 70 6 80 80 7 70 90 8 60 100 31 Table 3. Asymptote coefficients, (standard errors) and [convergence levels] for bargaining period two with three bargaining rounds only as the base. Treatment Asymptotes Trades Prices Base 14.62 72.91 -2.87*a 9.08*a (0.84) (1.55) [11.75] [81.99] -1.14*b 1.96b (0.51) (1.88) [13.48] [74.79] -1.64*b 4.25*b (0.42) (0.93) [12.98] [77.16] 0.99 0.99 25% Treatment 50% Treatment 75% Treatment R2 Note: (*) indicates that the estimated convergence level is significantly different from the base value, α = 0.05. Note: a,b,c - same letter indicates no significant difference between the estimated convergence levels. Different letter indicates a significant difference between the estimated convergence levels, α = 0.05 32 Table 4. Averages of units produced and percentages of trades in bargaining period one, bargaining period two, and of units not sold, across the last five periods and three replications for each committed procurement treatment. Treatment Average Average % of Average % of Units units traded in units traded in Average % of Produced BP1 BP2 units not sold 25% 17 14.38 82.67 2.95 50% 17 20.85 73.72 5.43 75% 20 32.75 58.73 8.52 33 Table 5. Average prices last five trading periods by replication and treatment (Rep), bargaining period (BP) and difference (Diff) between bargaining period one and two (BP1-BP2). 25% 50% 75% BP1a BP2b Diffc BP1b BP2b Diffd BP1b BP2b Diffd Rep1 91.00 78.20 12.80 70.20 73.40 -3.20 70.60 73.40 -2.80 Rep2 89.00 74.20 14.80 81.25 79.60 1.65 88.00 79.80 8.20 Rep3 96.25 89.60 6.65 77.20 80.00 -2.80 75.20 76.60 -1.20 a Price significantly different from the predicted competitive equilibrium – 80 tokens, α = 0.10, t-test, skewness not severe. b Price not significantly different from the predicted competitive equilibrium – 80 tokens, α = 0.10, t-test, skewness not severe. c Price in bargaining period one significantly higher than price in bargaining period two - α = 0.10, t-test, skewness not severe. d Price in bargaining period one not significantly different than price in bargaining period two, α = 0.10, t-test, skewness not severe. 34 Table 6. Average prices across last five periods in bargaining period two for seller(s) matched in bargaining period one against seller(s) unmatched in bargaining period one by treatment and replication – H0: M-UM = 0. P – Value Seller Average Matched Unmatched Price (M) (UM) M – UM Replication 1 88.05 76.21 11.84 Replication 2 73.28 75.76 -2.48 Replication 3 97.25 89.08 8.17 Replication 1 74.57 73.03 1.54 Replication 2 82.61 79.54 3.07 Replication 3 74.69 83.59 -8.90 Replication 1 74.91 71.81 3.10 Replication 2 82.90 76.90 6.00 Replication 3 79.94 71.62 8.32 25% treatment 50% treatment 75% treatment 35 (one-tail t-test) 0.1534 0.3702 0.0308 Table 7. Average prices across last five periods in bargaining period two for buyer(s) matched in bargaining period one against buyer(s) unmatched in bargaining period one by treatment and replication – H0: M-UM = 0. P – Value Buyer Average Matched Unmatched Price (M) (UM) M - UM Replication 1 79.80 80.77 -0.97 Replication 2 65.23 77.88 -12.65 Replication 3 84.26 91.78 -7.52 Replication 1 69.68 76.86 -7.18 Replication 2 81.25 80.40 0.85 Replication 3 75.93 85.09 -9.16 Replication 1 72.62 77.89 -5.26 Replication 2 78.23 87.00 -8.77 Replication 3 77.65 78.55 -0.90 25% treatment 50% treatment 75% treatment 36 (one-tail t-test) 0.0862 0.1168 0.0802

![Labor Management Relations [Opens in New Window]](http://s3.studylib.net/store/data/006750373_1-d299a6861c58d67d0e98709a44e4f857-300x300.png)