Notes on replicating results and constructing series shown in graphs

advertisement

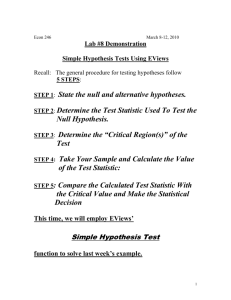

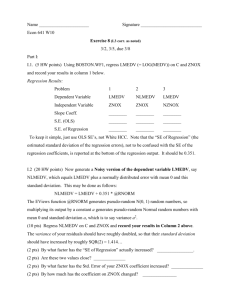

Notes on replicating results and constructing series shown in graphs in Dawson and Seater, “Federal Regulation and Aggregate Economic Growth,” Journal of Economic Growth, 2013, DOI: 10.1007/s10887-013-9088-y All results reported in the paper were generated in Eviews (Version 7). Procedures in Eviews are performed by selecting commands from menus and specifying options for the procedure, so no program or code is required. Eviews files containing original data, data transformations, reported results, and generated series are provided separately. 1. Results reported in Table 1 are descriptive statistics for the regulation page-count series, growth in the regulation series, and underlying data for page counts in the individual titles of the CFR. These descriptive statistics can be generated in Eviews using commands to produce descriptive statistics of series and correlations between the individual titles. Underlying CFR title data are available at the website provided in the paper. 2. Results in Table 2 are obtained in Eviews using the command for performing Granger causality tests on a group of series. Individual titles were used in the examples reported in Table 2. 3. Figures 1-4 are time plots of individual series along with the corresponding HodrickPrescott filtered series. The H-P filtered series can be generated using the appropriate command within Eviews. The H-P filtered series are saved in the Eviews file as x_HP, where “x” is the name of one of the variables (i.e., original data) considered in the paper (output y, total factor productivity tfp, physical capital pk, labor n, regulation reg, taxes mtr, or government purchases g). 4. Results in Table 3 are provided in the Eviews file “10887_2013_9088_MOESM3_ESM.wf1”. Results for the Dickey-Fuller GLS tests are saved as DFGLS_Lx where “x” is one of the variables considered in the paper. DL-GLS tests are performed in Eviews by selecting the appropriate test type within the unit-root test command. Results for the Zivot-Andrews tests are saved as ZA_Lx, again where “x” represents the variable of interest. Zivot-Andrews test results are generated within Eviews using the add-in “ZAURoot*” available on the Eviews website. This add-in must be downloaded and installed in your copy of Eviews to perform this test. Critical values for the ZA tests reported in Table 3 are finite-sample values calculated using Monte Carlo methods for a sample size of 58 based on 10,000 replications and no trimming (i.e., critical values reported in Eviews are not valid in small samples). Note that all tests are performed using the logged values of the variables. 5. Results in Table 4 are also provided in the Eviews file “10887_2013_9088_MOESM3_ESM.wf1” and saved as GRANGER_LREG. The Granger causality tests are generated using the appropriate command within Eviews on the group of variables in question. Note that all tests are performed using the logged values of the variables. 6. Model estimates reported in Tables 5 and 6 are provided in the Eviews file “10887_2013_9088_MOESM4_ESM.wf1”. Regression results reported in the table are saved as TB_x_SAIKKONEN, where “x” is the dependent variable of interest (y, tfp, n, or pk). (Note again that logged values of the variables are used in all model estimates.) Models are estimated in Eviews by selecting the “least squares” estimation method within the estimate command. The model in Equation (6) in the paper is estimated with leads and lags of first-differenced reg and mtr variables included to correct for cointegration (see the paper for additional discussion of the Saikkonen methodology). The final model reported in the paper for each dependent variable is determined by throwing out statistically insignificant terms according to the Schwarz-Bayes criterion as described in the paper. Thus, the models for different dependent variables will have different sets of coefficients. In some cases, the sums or products of estimated coefficients are reported in the tables, as these have economic relevance in the discussion of the results. F-tests on coefficient estimates can be performed in Eviews using appropriate commands applied to a given model estimate. The t-statistics reported in the paper are corrected for serial correlation using the non-parametric procedure described in Hamilton (1994), pp. 608612, which uses the standard t-statistics reported by Eviews and a correction factor obtained from an autoregression of the residuals of the estimated model. These residual series can be generated in Eviews using the appropriate command and are saved in the Eviews file as RESIDS_x. An AR(2) model is used for the residuals and the residual models are saved in the Eviews file as RESIDS_x_AR. The non-parametric correction to obtain the t-statistics reported in the paper is calculated manually. Note that results from the estimated model for a given dependent variable are split between Tables 5 and 6, with the coefficients pertaining to regulation reported in Table 5 and coefficients pertaining to taxes, other parameters, and basic model statistics reported in Table 6. 7. The series shown in Figures 5-12 are generated manually in Eviews. The formulae for obtaining these series must be derived algebraically from the underlying model (Equation (6) in the paper). Several series or other details are needed along the way to obtain the series graphed in the figures. These include: a. The time trend in regulation, obtained by regressing LREG on time (saved as TRENDREGNW in the Eviews file); b. The time trend in the marginal tax rate, obtained by regressing LMTR on time (saved as TRENDMTRNW in the Eviews file); c. A series for the amount of regulation added since 1949, created with the command REGADDED=REG-19335 where 19335 is the amount of regulation in 1949; d. The square of the REGADDED series, created by the command REGADDED2=REGADDED^2; e. A series for the ratio of actual regulation to its initial value in 1949, created as REGRATIO=REG/19335. Note that the exact formula used to generate any series can be seen in Eviews by clicking on the series and selecting the “spreadsheet” view. The formula will be shown at the top of the spreadsheet. 8. The series in Figure 5 is saved as TB_Y_TRDALL in the Eviews file. It is created by the command TB_Y_TRDALL=TB_Y_TRDR + TB_Y_TRDRINT. a. TB_Y_TRDR is created by the command TB_Y_TRDR=TB_Y_SAIKKONEN.C(3)*REGADDED+ TB_Y_SAIKKONEN.C(4)*REGADDED(-1)+ TB_Y_SAIKKONEN.C(5)*REGADDED(-2)+ TB_Y_SAIKKONEN.C(6)*(REGADDED2+2*19335*REGADDED). Note that the TB_Y_SAIKKONEN.C(n) terms in the command pick up the coefficient estimates for the appropriate term in the TB_Y_SAIKKONEN model estimate in Eviews. b. TB_Y_TRDRINT is created by the command TB_Y_TRDRINT=TRENDREGNW.C(2)*TB_Y_SAIKKONEN.C(20). This term represents the effect of regulation on the intercept and is the product of two coefficients: the coefficient on time in the regression of LREG on time and the exponent on REG in the regression equation for Y. TB_Y_TRDRINT measures the effect of the level of REG on the trend in Y, which occurs through two channels. One channel is by entering as a determinant of the trend in Y (through the linear and quadratic terms in the coefficient of time in the exponential trend term). The other channel is through the trend in REG itself, and that introduces a separate trend in Y. See the discussion in the paper for additional intuition. 9. For constructing the effect of regulation on the trend of other variables, such as TFP in Figure 9, perform the steps analogous to those above (for Figure 5). Replace the TB_Y_SAIKKONEN terms with TB_TFP_SAIKKONEN and note that the regression for TFP has a different set of significant coefficients than that for Y, so the construction in the foregoing steps must be modified accordingly. The series shown in Figure 9 is saved as TB_TFP_TRDALL in the Eviews file. 10. The series in Figure 6 is constructed with the command TB_Y_HYPORATIO=Y/TB_Y_HYPO which is the ratio of actual Y to what Y would have been if regulation had remained at its 1949 level (i.e., the hypothetical level of Y). The series TB_Y_HYPO is constructed with the command TB_Y_HYPO=Y*(exp(TB_Y_TRDR*@TREND)*REGRATIO^(TB_Y_SAIKKONEN.C(20)))*(REGRATIO(-1)^(-TB_Y_SAIKKONEN.C(21)))). Note the negative signs in front of each of the exponential terms. This command takes the original output series Y and removes the effect of regulation on the trend in Y and on the cyclical components of Y. The first exponential term removes the trend effect and the other terms remove the cyclical effect. Note that @TREND is the syntax for the trend function in Eviews. 11. Figures 7-8 are simply time plots of the growth rates of the original Y and TFP series along with their Hodrick-Prescott filtered counterparts. 12. Steps similar to those above can be used to construct the effect of the marginal tax rate on the dependent variables, with MTR replacing REG as the explanatory variable. Similarly, the effect of both REG and MTR on the dependent variable can be obtained by including both explanatory variables in the steps above. In the Eviews file, the series TB_TFP_TRDRALL is the effect of regulation on the trend in TFP and the series TB_TFP_TRDTALL is the effect of the marginal tax rate on the trend in TFP. The series TB_TFP_TRDCOMB is the effect of both regulation and the marginal tax rate on the trend in TFP. Data for the effect of MTR on TFP are used in constructing Figures 11 and 12, as explained below. 13. Figures 10, 11, and 12 show the changes (i.e., growth rates) in the ratio of actual to counterfactual TFP induced by REG, MTR, and both REG and MTR. Counterfactual (or hypothetical) TFP is interpreted as the level of TFP that would have occurred had REG or MTR (or both) remained at their 1949 levels. The procedure for obtaining the three ratio series is analogous to that described for Y above (in the discussion of Figure 6). TB_TFP_HYPORATIO_R is the ratio of actual to hypothetical TFP assuming regulation had remained at its 1949 level. TB_TFP_HYPORATIO_T is the ratio of actual to hypothetical TFP assuming the marginal tax rate had remained at its 1949 level. TB_TFP_HYPORATIO_COMB is the ratio of actual to hypothetical TFP assuming both regulation and the marginal tax rate had remained at their 1949 levels. Once these hypothetical ratio series are in hand, obtaining the first-differences (in logs) and the H-P filtered series shown in the figures is straightforward.