File - NR Consulting Group Overview

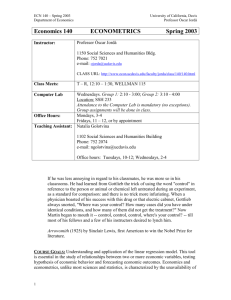

advertisement

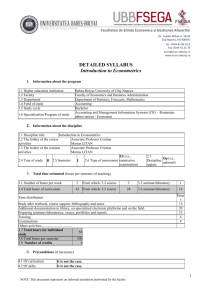

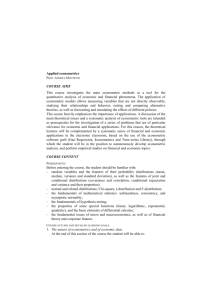

Course Title: Introduction to financial econometrics Course Code : Fin 485 Prerequisites : Eco 244, Bus 173, Fin 435, Fin 440 Course Description: This course will contain the quantitative and statistical aspects of economic principles. As different facets of the smaller economy are interrelated, a certain analysis of these relationships is necessary to understand the different individual components and their effects on the full economy at large. This course will make a student efficient for this analysis. In addition, a number of different models will be taught in order to find the economic data that benefits the finance industry and investment research in general. The most beneficial aspect of this discipline can be seen in the fields of portfolio management and risk management. Students benefit: The course is designed for the undergraduate students who require a broad knowledge of modern econometric techniques commonly employed in the finance literature. This course will be covering financial time-series analysis. Although the applications and motivations for model-building taught are drawn from finance, the empirical testing of theories are derived in many other disciplines, such as management studies, business studies, real estate, economics and so on, may usefully employ econometric analysis, For this group, the course may also prove useful. Resource book: 1. Introductory Econometrics for Finance by Chris Brooks 2. The Econometrics of Financial Markets by John Y Campbell, Andrew W. Lo & A Craig Mackinley Contents: 1. Introduction to Econometrics What is econometrics? Returns in financial modeling Steps involved in formulating an econometric model Econometric packages for modeling financial data 2. 3. 4. 5. 6. 7. Econometric software package suppliers using steps involved in formulating an econometric model according to the points to consider when reading articles in empirical finance Discussion on the use of a simple t-test to test a theory in finance. Can Bangladeshi mutual funds beat the market? A brief overview of the classical linear regression model What is a regression model? Regression versus correlation, Simple regression Simple linear regression in EViews -- estimation of an optimal hedge ratio Mathematical derivations of CLRM results. Hypothesis testing in EViews -- example : hedging revisited Estimation and hypothesis testing in EViews -- example the CAPM Further development and analysis of the classical linear regression model Sample EViews output for multiple hypothesis tests Multiple regression in EViews using an APT-style model Mathematical derivations of CLRM results A brief introduction to factor models and principal components analysis Classical linear regression model assumptions and diagnostic tests Multicollinearity Adopting the wrong functional form Omission of an important variable Inclusion of an irrelevant variable Univariate time series modelling and forecasting Forecasting in econometrics Unit root testing on Financial data Examples of time series modelling in finance Financial Forecasting using ARMA and ARIMA models, application in EViews Estimating exponential smoothing models using EViews Building ARMA models: the Box--Jenkins approach Multivariate models An application of a simultaneous equations approach to modelling bid--ask spreads and trading activity. Vector autoregressive models, VAR model example: the interaction between property returns and the macro economy. VAR model example: the interaction between property returns and the macroeconomy Modelling long-run relationships in finance Cointegration, Testing for cointegration in regression: a residuals-based approach Lead--lag and long-term relationships between spot and futures markets Testing the expectations hypothesis of the term structure of interest rates Testing for co integration and modelling co integrated systems using EViews VAR model example: the interaction between property returns and the macroeconomy 8. Modelling volatility and correlation Autoregressive conditionally heteroscedastic (ARCH) models Generalised ARCH (GARCH) models, Estimation of ARCH/GARCH models Uses of GARCH-type models including volatility forecasting Asymmetric GARCH models, The GJR model Volatility forecasting: some examples and results from the literature Stochastic volatility models revisited Estimating a time-varying hedge ratio for FTSE stock index returns Parameter estimation using maximum likelihood Testing non-linear restrictions or testing hypotheses about non-linear models Volatility forecasting: some examples and results from the literature 9. Switching models A Markov switching model for the real exchange rate A Markov switching model for the gilt--equity yield ratio Threshold models and the dynamics of the FTSE 100 index and index futures markets Specification tests in the context of Markov switching and threshold autoregressive models: a cautionary note A SETAR model for the French franc--German mark exchange rate 10. Simulation methods Monte Carlo simulations Monte Carlo simulations Disadvantages of the simulation approach to econometric or financial problem solving An example of Monte Carlo simulation in econometrics: deriving a set of critical values for a Dickey--Fuller test An example of how to simulate the price of a financial option An example of bootstrapping to calculate capital risk requirements