Verizon Communications (VZ)

advertisement

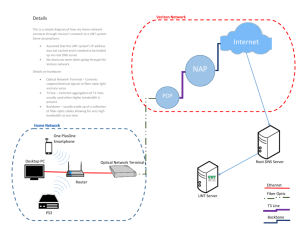

Investment Analyses – Verizon Communications, Inc. Overview Verizon Communications, Inc., a technology company that operates through its subsidiaries, provides communications, information, and entertainment products and services to consumers, businesses, and governmental agencies worldwide. Their focus is mostly in expanding the wireless market, as in smartphones, basic cell phones, tablets, notebook computers, and has a multitude of LTE internet options available as well as a high speed-internet service. It offers machine-to-machine services that support devices used in health monitoring, education, manufacturing, utilities, distribution, and consumer products markets. As of December 31, 2014, it had 108.2 million retail connections. The company was founded in 1983 and is based in New York, New York (Yahoo!Finance). As of Spring 2015, Verizon Communications, Inc., holds approximately 35.93% of industry market share. Industry Outlook Due to growth in technology demand, this industry is expected to grow at a rate of 2.8% over the next year. Part of this is due to the increasing reliability on wireless telecommunications, and the unveiling of new and improved smartphones, tablets, and notebook computers. Ticker VZ Market $110,984.00 Value of Investment Investment Student Group Equity Management Industry Utility Telephone IVA Rating BB ESG Related Issues The main issues with companies in the telecommunication industry usually include environmental and social governance issues. In Verizon Communication’s situation, the primary topics involve issues in the labor management, privacy and data security, and access to communications, based on MSCI’s Intangible Value Assessment (IVA) on Verizon Communications, Inc. Their overall IVA rating went down from the previous year, going from a BBB to a BB. Since Verizon has recently acquired the largest percentages of shares in the market with their acquisition of Alltel, they have a very large labor workforce to account for with approximately 176,800 employees, the biggest amount in the industry set. They have been facing periodic labor disputes with unions in the US, combined to high exposure to operational risks associated with labor management issues, making their overall labor management score much lower than the rest on the industry, with a score of 2.8 out of 4.8 (the industry average). Since 2009, they have laid off about 25,000 employees due to restructuring its business specifically in the wireline segment. This puts the company at risk for added strain on employee relations and elevates risk of disruptions. However, Verizon has been noted in recently improving the strength of their training programs, hopefully decreasing governance risk within the company. The telecommunications industry is known for facing high exposure to regulatory reputational risks when it comes to privacy and data issues. Verizon is the second largest telecommunications operator in the US, therefore making them responsible for a large quantity of customer information which now includes not only names and addresses but also call records, websites visited and information gathered through mobile devices and apps. If breached, it could be a major liability for the company, especially as increased privacy and data security regulation in the US continues to evolve. This issue was rated as “severe” according to the IVA assessment, although they have many preventative procedures in place and have never been involved in significant data breaches in the last 3 years. This specific company received a score of 3.6 out of the industry average 3.1, and is only included in ESG risks for being so vulnerable to the breaching of data. Another major issue for Verizon is their access to communications. Domestically, they are doing an outstanding job, even making devices for seniors, services tailored for the visually impaired, making technology more user-friendly for students in every-day applications, and a major focus on expanding high speed access in rural areas. However, this may benefit them greatly for now, but there are few opportunities for long-term growth in the developing countries market, unlike a few of its peers. There is a much less competitive market within the developing countries as their middle classes and increasing demand for access to the digital world. If they do not act soon, this puts them at risk for losing major profits in the long-term frame of mind. - Tyler Gilmore for the Sustainable Investing Advisory Committee September 2015 References Verizon Communications, Inc, (2015). Profile, business summary. Yahoo!Finance. Retrieved from http://finance.yahoo.com/q/pr?s=vz Blau, G. (2015, August) Wireless Telecommunications Carriers in the US. Retrieved from www.ibisworld.com MSCI Intangible Value Assessment (2014, January), Verizon Communications, Inc. Retrieved from www.esgoncampus.msci.com