Lecture 3 Problems

advertisement

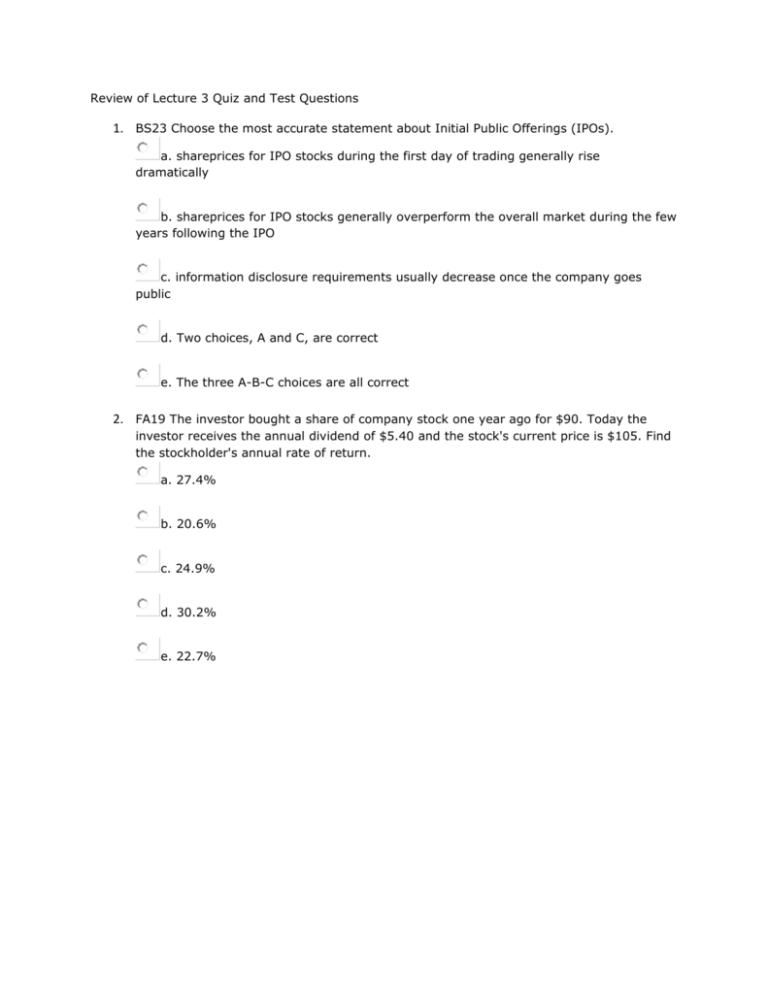

Review of Lecture 3 Quiz and Test Questions 1. BS23 Choose the most accurate statement about Initial Public Offerings (IPOs). a. shareprices for IPO stocks during the first day of trading generally rise dramatically b. shareprices for IPO stocks generally overperform the overall market during the few years following the IPO c. information disclosure requirements usually decrease once the company goes public d. Two choices, A and C, are correct e. The three A-B-C choices are all correct 2. FA19 The investor bought a share of company stock one year ago for $90. Today the investor receives the annual dividend of $5.40 and the stock's current price is $105. Find the stockholder's annual rate of return. a. 27.4% b. 20.6% c. 24.9% d. 30.2% e. 22.7% 3. FA15c At year-end 2525 the company has Total assets of $6,200 financed by Debt of $3,300 and Stockholders' equity of $2,900. For 230 common shares outstanding, the equity price-to-book ratio at year-end 2525 is 1.23. During 2526, the company expects an asset turnover ratio (= Salest / Total assetst-1 ) of 4.0 and an operating margin (= (Sales - operating expenses) / Sales ) of 5.8%. Interest charges will equal 6% of Debt. Corporate taxes equal 30% of taxable income and the payout ratio always is 35%. Your analyst tells you that at year-end 2526 the company price-to-earnings ratio will equal 4.5. What is the shareholders' rate of return for year 2526? a. 19.9% b. 16.4% c. 21.9% d. 18.1% e. 24.0% 4. BS30 A company going through an initial public offering ("IPO") hires an investment banker to assist with the process. The extreme types of contract arrangement between company and investment banker are the "firm commitment" contract and the "best efforts" contract. Which statement most accurately describes these alternatives? a. With the firm commitment contract an investment banker buys the company shares at a fixed price, resells the shares through the IPO, and the company bears all the risk of adverse price movements b. With the best efforts contract an investment banker receives a negotiated fee, assists the company to sell its shares through the IPO at the best price the company can get, and the investment banker bears all the risk of adverse price movements c. The initial one day average return on an IPO is about 15% to 25% and, irrespective of the contract with the investment banker, the issuing company does not receive that day's capital gain d. Two choices, A and C, are correct e. None of the A-B-C choices are correct 5. FA8 Today the company announces net income equals $40 million. They have 10 million shares outstanding, and today's share price is $198.40. Find the company's price-toearnings ratio. a. 45.1 b. 54.6 c. 49.6 d. 41.0 e. 60.0 6. TR42 Select the statement below that is most consistent with the classroom and textbook discussion about typical financial ratios. a. A company that successfully avoids the "land-rich, cash poor" syndrome probably has normal or relatively high liquidity ratios. b. A company with very little excess borrowing capacity probably has relatively low debt ratios. c. The asset turnover ratio (= Sales ÷ Total assets) probably is lower for a discount grocery store than for a nuclear power plant. d. Two choices, A and C, are correct e. The three A-B-C choices are all correct 7. BA6 The DuPont formula relates return on equity (= Net incomet / Stockholders equityt) to the company's net profit margin (= Net income / Sales), asset turnover (= Salest / Total assetst), and equity multiplier (= Total assets / Stockholders equity). This Company is in an industry where the average net profit margin is 5.24%, the debt-to-asset ratio (= Debt / Total assets) is 44.2%, and return on equity is 27.89%. The Company's financial statements for year 2525 show that year-end Total assets of $6,150 include Plant, property, & equipment (PP&E) of $4,400. The assets are financed by Debt of $2,750 and Stockholders' equity of $3,400. The annual Sales for 2525 equal $18,450, total costs equal $17,270, and Net income equals $1,180. For the company relative to the industry, select the one statement most consistent with the DuPont analysis. a. the company's asset turnover indicates sales are unusually large relative to its assets b. the company's asset turnover indicates sales are unusually small relative to its assets c. the company's equity multiplier indicates the firm has an unusually large debt burden d. the company's profit margin indicates its revenues are unusually large relative to its costs e. the company's equity multiplier indicates the firm has an unusually small debt burden 8. FA14 Shareholders had a good year, earning a 23% annual rate of return. The P/E ratio today is 22.9 and the company just announced earnings per share of $3.30 . The company has a 90% payout ratio. How much did the stock price change over the past year? a. $11.72 b. $9.68 c. $12.89 d. $10.65 e. $8.80