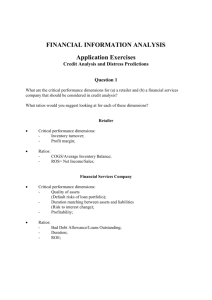

Discussion

advertisement

John Mullins Managing Cash for Growth Most of the time, entrepreneurs in need of growth capital would prefer to take on debt rather than part with equity in their companies. As we shall see in this case discussion, if you are the entrepreneur, making the decision between debt and equity represents a trade-off between commercial risk and financial risk. If you are the banker, making the decision whether or not to lend to a growing company means assessing two things: the adequacy of the collateral the borrower can provide, if any; and the amount and certainty of the cash flows that will be available to service the debt. CASE: Butler Lumber (HBSP) PREPARATION: If you are cast in the role of the banker, would you extend the larger credit line that Mr. Butler has requested? Why or why not? If you are cast in the role of Mr. Butler, what steps if any, could you take to mitigate the need for external finance? The reading below will help you think about this question. READING: © John Mullins Churchill and Mullins, ‘How Fast Can Your Company Afford to Grow?’