FSG 4.4: Conflicts of Interest Policy

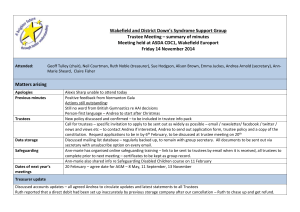

advertisement

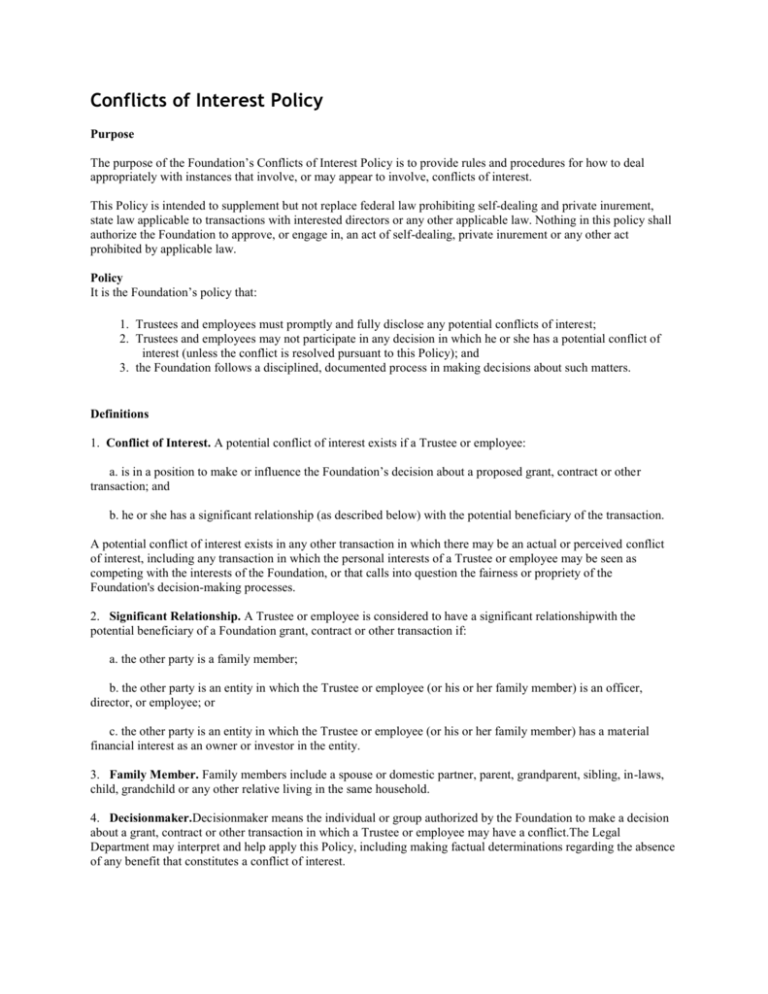

Conflicts of Interest Policy Purpose The purpose of the Foundation’s Conflicts of Interest Policy is to provide rules and procedures for how to deal appropriately with instances that involve, or may appear to involve, conflicts of interest. This Policy is intended to supplement but not replace federal law prohibiting self-dealing and private inurement, state law applicable to transactions with interested directors or any other applicable law. Nothing in this policy shall authorize the Foundation to approve, or engage in, an act of self-dealing, private inurement or any other act prohibited by applicable law. Policy It is the Foundation’s policy that: 1. Trustees and employees must promptly and fully disclose any potential conflicts of interest; 2. Trustees and employees may not participate in any decision in which he or she has a potential conflict of interest (unless the conflict is resolved pursuant to this Policy); and 3. the Foundation follows a disciplined, documented process in making decisions about such matters. Definitions 1. Conflict of Interest. A potential conflict of interest exists if a Trustee or employee: a. is in a position to make or influence the Foundation’s decision about a proposed grant, contract or other transaction; and b. he or she has a significant relationship (as described below) with the potential beneficiary of the transaction. A potential conflict of interest exists in any other transaction in which there may be an actual or perceived conflict of interest, including any transaction in which the personal interests of a Trustee or employee may be seen as competing with the interests of the Foundation, or that calls into question the fairness or propriety of the Foundation's decision-making processes. 2. Significant Relationship. A Trustee or employee is considered to have a significant relationshipwith the potential beneficiary of a Foundation grant, contract or other transaction if: a. the other party is a family member; b. the other party is an entity in which the Trustee or employee (or his or her family member) is an officer, director, or employee; or c. the other party is an entity in which the Trustee or employee (or his or her family member) has a material financial interest as an owner or investor in the entity. 3. Family Member. Family members include a spouse or domestic partner, parent, grandparent, sibling, in-laws, child, grandchild or any other relative living in the same household. 4. Decisionmaker.Decisionmaker means the individual or group authorized by the Foundation to make a decision about a grant, contract or other transaction in which a Trustee or employee may have a conflict.The Legal Department may interpret and help apply this Policy, including making factual determinations regarding the absence of any benefit that constitutes a conflict of interest. Procedures 1. Disclosureof Conflicts of Interest. Trustees and employees must promptly and fully disclose any potential conflict of interest to the relevant decisionmaker before participating in any decision. Any doubt about whether a relationship warrants disclosure should be resolved in favor of disclosure. The Foundation encourages Trustees and employees who are concerned about a relationship to review it with the Legal Department, or bring it forward under the Foundation’s Open Door Policy. 2. Abstention from Participation. Trustees and employees must abstain from participating in any decision in which he or she has a potential conflict of interest (other than by providing information requested by the decisionmaker) unless and until the conflict is resolved pursuant to this Policy. 3. FactualInvestigation. The decisionmaker will investigate the nature of the potential conflict of interest. The decisionmaker may request a written statement from the Trustee or employee which may include: a. the name of the Trustee or employee; b. the name and relationship of the proposed beneficiary of the grant, contract or other transaction; and c. the nature of the potential conflict of interest, including any benefits that the Trustee or employee (or his or her family member) may receive, directly or indirectly, from the proposed grant, contract or other transaction. 4. Determination. If the decisionmaker determines that the proposed grant, contract or other transaction will not provide a benefit to the Trustee or employee (or his or her family member) that (a) that would not otherwise be available to a member of the public on substantially the same terms, or (b) that may influence inappropriately the decisions of the Foundation, then the Trustee or employee will not be considered to have a conflict of interest and he or she may participate fully in the development, approval and administration of the proposed matter. If the decisionmaker determines that the proposed matter will provide such a benefit, then the Trustee or employee may not participate, but the Foundation may still proceed if (a) the Trustee or employee with the conflict is not a disqualified person (as defined under the Internal Revenue Code) and (b) the decisionmaker determines that the proposed transaction (i) is consistent with the Foundation's charitable purposes, (ii) is in the Foundation's best interest and for its benefit, and (iii) is fair and reasonable to the Foundation. 5. Documentation and Record Keeping. Thedecisionmaker will document the decision, which generally will include a copy of the disclosure and summary of actions taken to investigate the nature of the conflict of interest. The Foundation will maintain records of decisions as follows: a. For grants and strategic contributions, documentation should be included in the permanent grant record in GIFTS. b. For matching gifts, documentation should be included in permanent records maintained by Grants Administration. c. For contracts and other transaction, documentation should be included with the record of the matter. Other Interests Covered by this Policy In addition to decisions about grants, contracts and other transactions, other situations may present risks to impartial decision-making, legal compliance and the Foundation’s reputation.The Foundation’s rules on several recurring situations are set out below. 1. Acceptance of Gifts.Trustees and employeesmay not accept anything of value (including gifts, loans, and entertainment) from recent, current or potential grantees, vendors, suppliers, consultants or others who have existing or proposed grants, contracts or other transactions with the Foundation.Trustees and employeesmay accept gifts, meals and other benefits of nominal value so long as acceptance would not obligate theTrustee or employeeto take any action or decision on behalf of the Foundation or call into question the fairness or propriety of the Foundation's decision-making processes.There is no precise definition of what constitutes nominal value but as a general guideline, a gift having a retail value of less than $25 is nominal and a gift having a wholesale or other cost of acquisition of more than $100 is not nominal.In all cases, the determination of what constitutes a gift of nominal value depends on the particular circumstances. Where it would be awkward to decline a gift, Trustees and employees may accept gifts on behalf of the Foundation. 2. Payments of Expenses by Grantees.Trustees and employees maynotaccept a gift or reimbursement of business travel or expenses from grantees, potential grantees or other third persons in connection with a grant or proposed grant.This rule is designed to ensure that grantees use their available resources for their own charitable purposes and not to benefit the Foundation or its Trustees or employees.The Foundation will reimburse Trustees and employees for all of their ordinary and reasonable out-of-pocket business expenses in accordance with the Foundation's Travel and Entertainment Policy. 3. Acceptance of Honoraria.Trustees and employeesmay not accept honoraria from actual or potential grantees without the approval of the President or the General Counsel. 4. Matching Gifts.Trustees and employeesmay not request a matching gift under the Foundation’s Matching Gift Program if the Trustee or employee (or his or her family member) will receive a financial or other substantial benefit not otherwise available to the general public from the entity receiving the matching gift.The receipt of incidental and customary benefits of nominal value, such as mementos, guest passes, discounts, or food and beverage at fundraising events do not constitute a substantial benefit and therefore do not disqualify or reduce the amount of a matching gift. 5. Employment of Relatives.The Foundation has no general prohibition against hiring relatives of Trustees or employees. While the Foundation will consider employment applications from relatives, generally the Foundation will not hire or transfer family members into positions where they directly or indirectly manage or are managed by another family member. Further, the Foundation generally will not place relatives into positions where they work with or have access to sensitive information regarding a family member, or if the Foundation’s management determines that there may be an actual or perceived conflict of interest. 6. Employment by Grantees.Occasionally an employee will seek employment with a grantee while they are an employee of or after they depart the Foundation.The Foundation has no general prohibition against grantees hiring current or former employees so long as the grantee’s hiring decision is entirely independent of and not influenced by the Foundation or the interested employee, and the Foundation complies with this Policy with respect to all proposed grants, contracts or other transactions with the grantee.In order to ensure the integrity of the grantee’s hiring process, current employees who solicit or respond to solicitation of future employment with an active or potential grantee must disclose the potential conflict to his or her manager or the Legal Department.If the Foundation is notified by a grantee that it is considering hiring a former employee of the Foundation, the recipient of such notice must notify the Legal Department who will confirm that (i) the former employee did not solicit employment while he or she was an employee of the Foundation, unless that solicitation was disclosed at the time, and (ii) the grantee’s hiring decision is being made entirely independent of and not influenced by the Foundation. 7. Other Situations.No policy can encompass every situation that presents risks to impartial decision-making.In the end, the Foundation’s effective management of conflicts depends on the good judgment and integrity of its Trustees and employees.The Foundation encourages individuals to talk to the Legal Department if they have questions or concerns about specific situations. Violations of this Policy If any Trustee or employee has cause to believe that another Trustee or employee failed to disclose a potential conflict of interest, he or she should inform both the decisionmaker and the Legal Department of the basis of such belief. If, after investigating, the decisionmaker determines that the individual has in fact failed to disclose a conflict of interest, the Foundation will take disciplinary and corrective action as it deems appropriate, in consultation with the President, General Counsel, and Chief Talent Officer. Annual Conflicts of Interest Disclosure Statement Every Trustee or employee, upon election, engagement or hiring, and annually thereafter, must complete and sign the Foundation’s Conflicts of Interest Disclosure Statement.Disclosure of conflicts of interest in the Foundation’s Conflicts of Interest Disclosure Statement does not eliminate the requirement for later disclosure of potential conflicts of interest relating to specific grants, contracts or other transactions. Periodic Reviews of this Policy The Board will periodically review this Policy, and at such time each Trustee will certify his or her understanding and compliance with this Policy. Policy Contact Questions regarding the interpretation or application of this Conflicts of Interest Policy should be referred to the Legal Department.