Commonwealth Property Management Framework Lease

advertisement

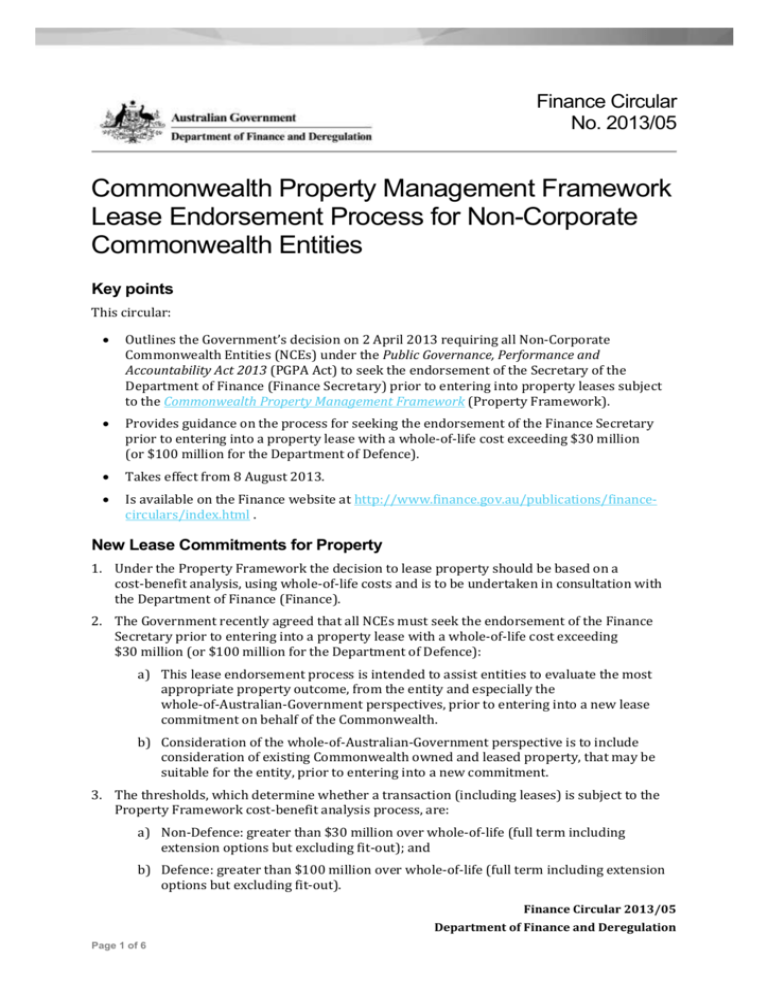

Finance Circular No. 2013/05 Commonwealth Property Management Framework Lease Endorsement Process for Non-Corporate Commonwealth Entities Key points This circular: Outlines the Government’s decision on 2 April 2013 requiring all Non-Corporate Commonwealth Entities (NCEs) under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) to seek the endorsement of the Secretary of the Department of Finance (Finance Secretary) prior to entering into property leases subject to the Commonwealth Property Management Framework (Property Framework). Provides guidance on the process for seeking the endorsement of the Finance Secretary prior to entering into a property lease with a whole-of-life cost exceeding $30 million (or $100 million for the Department of Defence). Takes effect from 8 August 2013. Is available on the Finance website at http://www.finance.gov.au/publications/financecirculars/index.html . New Lease Commitments for Property 1. Under the Property Framework the decision to lease property should be based on a cost-benefit analysis, using whole-of-life costs and is to be undertaken in consultation with the Department of Finance (Finance). 2. The Government recently agreed that all NCEs must seek the endorsement of the Finance Secretary prior to entering into a property lease with a whole-of-life cost exceeding $30 million (or $100 million for the Department of Defence): a) This lease endorsement process is intended to assist entities to evaluate the most appropriate property outcome, from the entity and especially the whole-of-Australian-Government perspectives, prior to entering into a new lease commitment on behalf of the Commonwealth. b) Consideration of the whole-of-Australian-Government perspective is to include consideration of existing Commonwealth owned and leased property, that may be suitable for the entity, prior to entering into a new commitment. 3. The thresholds, which determine whether a transaction (including leases) is subject to the Property Framework cost-benefit analysis process, are: a) Non-Defence: greater than $30 million over whole-of-life (full term including extension options but excluding fit-out); and b) Defence: greater than $100 million over whole-of-life (full term including extension options but excluding fit-out). Finance Circular 2013/05 Department of Finance and Deregulation Page 1 of 6 4. For the purposes of this lease endorsement process, a lease refers to a legal agreement made between the lessee and a lessor which grants possession of a premises for a fixed period in exchange for the payment of rent. This can relate to land, buildings or other assets where access is granted via a lease, memorandum of understanding between agencies or license for use for a defined period and is used for the purpose of carrying out the functions of an entity. Endorsement Process for Leases Subject to the Property Framework 5. Where an entity identifies a property transaction that is subject to the Property Framework cost-benefit analysis process, it should prepare a cost-benefit analysis of the options in consultation with Finance. During this process entities will engage with Property and Construction Division (PCD) and their respective Budget Group Agency Advice Unit (AAU) in Finance, to develop the preferred option. 6. Where the preferred option involves a new lease commitment, the entity is to seek formal endorsement from the Finance Secretary with the assistance of PCD and their respective AAU. A flowchart detailing the lease endorsement process is provided at Attachment A. 7. When seeking the endorsement of the Finance Secretary for a proposed lease, entities should outline the outcome of the cost-benefit analysis including the key parameters of the lease, why it was selected as the preferred option, and include a brief discussion of other options considered including the whole-of-Australian-Government option through a whole-of-life cost-benefit analysis. 8. Entities must be able to demonstrate that there is sufficient uncommitted funding to undertake the lease transaction. Ideally, this information would be provided as part of the correspondence to the Finance Secretary. 9. Where the proposed lease option is endorsed by the Finance Secretary, the entity may proceed with this transaction. If the cost-benefit analysis or preferred solution presented does not meet the requirements of the Property Framework (which includes consideration of the whole-of-Australian-Government outcome), the Finance Secretary may request that the proposal be amended or that alternative options be considered. 10. Where the Finance Secretary’s endorsement is not provided, a recommendation will be provided to the entitiy to reconsider its cost-benefit analysis with the whole-of-AustralianGovernment perspective appropriately considered. Once this has been included, the entity can then re-submit its cost-benefit analysis to the Finance Secretary. 11. Entities should note that the Finance Secretary’s endorsement of a property decision does not constitute funding support for the property lease proposal and the final decision rests with the entity. If the preferred solution requires additional funding, this will need to be sought through the Budget process consistent with the Budget Process Operational Rules. Entities should also still have regard to any other regulatory requirements. It is not intended that entities be forced into a property commitment through this endorsement process but rather that the whole-of-Australian-Government perspective is appropriately considered. Exceptions to the Lease Endorsement Process 12. In cases where the entity is both landlord and tenant, the lease endorsement process does not apply to the leases within the landlord’s portfolio. 13. In cases where an urgent or unforseen event occurs, it may be appropriate for an entity to seek exemption from the lease endorsement process. If an entity is considering a request for exemption, it should contact Finance to outline the event and the reason for the exemption. It is envisaged that exemptions will be rare and apply largely to overseas leases. Exemptions Finance Circular 2013/05 Department of Finance and Deregulation Page 2 of 6 will not be granted on the grounds that an entity has failed to plan for the time required to seek the Finance Secretary’s endorsement. Finance Circular 2013/05 Department of Finance and Deregulation Page 3 of 6 Assistance with Seeking the Finance Secretary’s Endorsement 14. To assist entities to present the preferred solution to the Finance Secretary, Finance has developed a cost-benefit analysis template for property that entities may wish to complete to support the preferred option. Entities will also have access to a standard correspondence template to assist them in seeking endorsement from the Finance Secretary. Copies of the templates can be obtained by emailing propertyframework@finance.gov.au. Frequently Asked Questions 15. Why has the Government agreed to incorporate this new process into the Property Framework? The amendments to the Property Framework facilitate consideration of entity and whole-of-Australian-Government property options to promote the best use of existing resources. 16. When should funding be sought for a new lease? A new lease should not be entered into before the necessary funding is sought (if any). Entities should also ensure they have obtained the endorsement of the Finance Secretary before entering into a new lease. 17. What is the timeframe for seeking the Finance Secretary’s endorsement? Entities should initially allow for three weeks of consultation with PCD in Finance when conducting their cost-benefit analysis. This time will allow Finance to review the costbenefit analysis to ensure it complies with the Property Framework and provide guidance on any whole-of-Australian-Government outcomes that should be considered. Once the cost-benefit analysis is complete, agencies should then allow for three weeks from the date of seeking the Finance Secretary’s endorsement to the date that they receive a formal response. 18. How can an agency ensure that the whole-of-Australian-Government perspective has been appropriately considered? As a first priority, entities should consult with Finance to examine the suitability of any existing, vacant space in the Commonwealth’s owned or leased estate for their property needs. To assist in this process, Finance has set up an accommodation register on Govdex which is a website aimed at supporting collaboration across agencies. Collaboration on property issues is also supported through the Band-1 Property Steering Committee and Senior Property Officers’ Forum. 19. What assistance can Finance offer with leasing? In cases where suitable vacant space has been found in the Commonwealth’s leased or owned portfolio, Finance has developed sub-leasing and lease assignment guidance documents and memoranda of understanding to facilitate inter-government leasing arrangements. For space outside this portfolio, the Commonwealth National Lease and supporting guidance is available to both entities entering into a lease as a tenant as well as assistance with general negotiation strategy. Contact 20. The cost-benefit analysis model, the cost-benefit analysis report template and associated guidance is available by emailing propertyframework@finance.gov.au. 21. Further information on the Property Framework can be found on the Finance website: Finance Circular 2013/05 Department of Finance and Deregulation Page 4 of 6 http://www.finance.gov.au/property/property/property-management-framework.html. 22. Further information on the Public Works Committee can be found on the Finance website: http://www.finance.gov.au/property/public-works-committee/index.html. Dr Guy Verney Assistant Secretary Policy and Advice Branch Business, Procurement and Asset Management Group 11 June 2014 Finance Circular 2013/05 Department of Finance and Deregulation Page 5 of 6 Finance Circular 2013/05 Department of Finance and Deregulation Page 6 of 6