Roberts, A (2013).

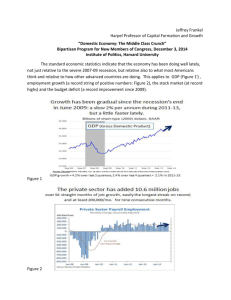

advertisement

Roberts, A (2013). Financing Social Reproduction: The Gendered Relations of Debt and Mortgage Finance in Twenty-first-century America According to Adrienne Roberts, what is social reproduction ? (a) biological reproduction and social construction of what a mother is ; what motherhood involves in the context of the social conditions (b) Labour force is reproduced and maintained through providing food education and training as workers In a democracy: when the govt. makes policies, it assumes : Equality of Individuals Gender inequalities in the labour market and in holding assets are ignored Social divisions and inequalities are reproduced due to unpaid labour: women’s biological reproduction work, motherhood and family household work Capital and financial market accumulation rests on these inequities between gender, race and class The role of state is to protect capital accumulation In US, 2000-2007: Average household income: stagnant US household debt: doubled to $13.8 trillion debt to GDP ratio: 98 % liabilities to disposable income ratio: 138% Security for debt: residential real estate as > 80% household liabilities Sharp rise in consumer debt: credit card, auto loans and student Poor classes debt dramatically grew by 90% In 1998- 2008, mostly low income and average Americans were given 15 million subprime loans Central arguments in this paper: 1. Social reproduction is privatized: • Healthcare and education services are privatized • Social welfare is cutback • Old age security is individualized • Social housing is unavailable • Public subsidy for private homeownership 2. Working class, single women, racial minorities have become increasingly dependent on the financial markets 3. Financial system in the US encouraged subprime mortgage lending, creation and sale of mortgage-backed securities (MBSs) and derivatives, with the result: • Debt increased for poorer classes and minorities • Rapid accumulation of capital for Investors • Poorer classes took out mortgage loans in order to meet their daily and long term needs. • Deepening indebtedness has perpetuated divisions and inequalities in wealth and asset ownership along gendered lines: Why? • Mortgage indebtedness. • Gender differences in women’s ability or asset-capacity to borrow is not recognized but penalized The Mortgage Interest Deduction (MID) tax benefit: Highly regressive that subsidizes the rich homeowners Private homeownership is promoted as a right in a ownership society But no democratic measures to equalize the credit and borrowing for the poor These conditions increase the wealth of the richer borrowers When the system fails, e.g., mortgage loans not paid back- the poor women and minorities lose all the equity they have built up Section1: the concept of social reproduction Section 2: explains how under neoliberalism, the debt in general, and mortgage debt in particular, are the financial system’s re-privatization of social reproduction Section 3: Shows the connection between finance, social policy and social reproduction MID tax benefit turned into an indirect subsidization of private homeownership for the wealthiest segments of the population As a result, the poor borrowers of mortgage loans helped redistribute resources to the wealthy. Section 4: subprime mortgage loans discriminated against the women, minorities and the poor. Thus financial markets and operations are not technical but human with prejudices and discriminatory biases. Market citizenship and social reproduction under capitalism : Society assumes that social reproduction of labour will occur without formal recognition of who is involved and how it is performed- no costs or compensation is involved for reproducing labour as if it were automatic The new concept of ‘market citizenship’ under neoliberalism vs. social citizenship: Neoliberal market considers individuals as technical without social context of class, gender, etc. Thus market distributes goods and services for all assuring the well-being of all regardless of differences and divisions within a population Market citizenship: George W. Bush’s ‘Ownership Society’ Thatcher ‘s Ownership Society ( to justify the privatisation of public housing in the 1980s Bush - twenty-first century justification for eliminating public rental housing when they were turning them into privatized housing The state/employer was responsible for the costs of public housing – now it was shifted to families and/or the private sector. This is a trend of ‘reprivatisation of social reproduction’ Society assumes that women no longer were dependent on the ‘male-breadwinner’ Now it is assumed that women are a part of single or dual earner family system in society It does not recognize the inequalities in the labour market sectors where women find jibs or their lack of equal pay in the market. a dual-earner model is also disadvantageous for women, particularly given that dominant trends are away from full-time, permanent employment US, UK and Canada: Prevalence of this trend where policies assume that all are equal regardless of gender, etc. Ignore the gendered nature of poverty globally: e.g., in Canada, women earn an average of 71 per cent of what men do, pay equity is not enforced in certain sectors. Fiscal policies are governed by ‘market citizenship’ Policies are made as technically dealing with issues rather than considering whom they apply to or affect , e.g., reduce government revenues throuhg lower taxes for the rich that reduces the benefits for workers or of women, e.g. child-care while at work. Debt and the reprivatisation of social reproduction Cutting of Social support through public housing is opposed to MID for the well-off, subsidizes the wealthy and transfers the assets from the marginalized populations to the well-off. This trend as redistributed wealth and social power upward, from the poor to the rich, from women to men and from some races to white men and their families. In 2010, MID subsidization cost govt. $108 billion- this was double the total set up for ($48 billion) the Department of Housing and Urban Development (HUD) This department was mandated to improve access to affordable housing and to eliminate discrimination in housing markets. 80 % of the benefits from mortgage-interest and property-tax deduc- tions go to the top 20 per cent of taxpayers while 3.5% of the benefits go to the bottom 60% of earners Mortgage debt was used by the poor and working class to pay off consumer debts: credit card, education loans and health care. Medical indebtedness is linked to mortgage debt- 60 % ‘medically indebted’ households that refinanced their homes in 2005 used the money to pay credit card loans More women are bankrupted by health-care costs due to: lower incomes, lack of access to employer-based health insurance, costs of pregnancies, and having dependent children who need health care MID is class and race biased. This tax deduction is highly skewed against blacks, Hispanics and women, who have relatively lower incomes, lower rates of homeownership, and lower house values Among women: Racial inequalities Women’s ownership of homes (2007): 57 % white (2007- 22%Hispanic – 33% black Median home value of women of colour • White $74,000 • Black: $47,000 • Hispanic: $35,000 Fiscal policies have differential impact based on gender and race as benefits that encourage property and asset accumulation are different Tax provisions relating to inheritance, capital gains taxes, pension provisions, child care credits also affect them differently In Brooklyn, Mortgage Crisis Eats Away Wealth of Several Generations of Hispanics http://www.youtube.com/watch?v=oF5JQfcd0-Y 1min Blacks in US face greatest loss of wealth in US history 2008 http://www.youtube.com/watch?v=lcPJ2o6j7i8 7 min The role of class, gender and race in determining (lack of )access to credit at the market rate of interest Historically, women, the working poor and radicalized minorities were excluded from access to credit Under subprime borrowing system: inequitable and predatory loans ($85,000 and $186,000 more in interest than average loans) Based on assessing them as higher risk borrowers: People with high credit scores to merit regular rate loans were made to borrow at predatory rates (more than 50% high-interest loans) In the short term: The result was the social reproduction of the millions of Americans who have lost their homes and savings in the foreclosure crisis . Long term implication: They will not be able to have social mobility as the foreclosure crisis has precluded the possibility of using home equity to pay for higher education, supplement retirement savings, or to rely on it as a safety net of last resort in cases of illness, job loss. Even if income and credit risk are equal, African Americans – 34% more likely to get higher-rate and subprime loans than their white counterparts Subprime lending is 5 times more among African American neighbourhoods than in similar white areas. Impact of the loss of home equity and rising levels of unsecured debt after the housing collapse- (2005 – 2009) class- and race-based inequalities in wealth, Increased: On average, net worth decline: Hispanic households - fell 66% from $18,359 to $6,325. Black households: Fell 53%, from $12,124 to $5,677 White households: fell 16 %, from $134,992 to $113,149