Finance 101

advertisement

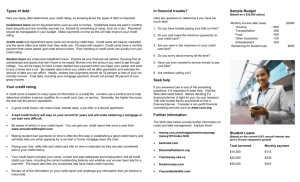

Finance 101 Cash • Checking accounts – NOW accounts • Money Market accounts • CDs Bonds – Fixed Income • Savings Bonds • Corporate Bonds – A, AA, C – can default – Ownership in companies • Municipal Bonds – City/state/government – Funds schools/projects • Treasury Bonds – Full faith & credit of US Government Bonds • Principal remains the same – Dividends are paid – quarterly – $5,000 @ 5% - 3 years • $5,000 purchase price • $62.50 per quarter • $5,000 @ maturity • Treasury – Purchased at discount – $5,000 @ 5% - 3 years • 4,250 purchase price • $5,000 @ maturity Stocks – Growth • Individual stocks – ownership in companies – Proctor & Gamble – Microsoft • Mutual funds – ability to diversify holdings – Fidelity – Peter Lynch/Magellan – Morningstar rating • REITS ( Real estate investment trust) – Invest in real estate for minimum amounts Stocks • Dow Jones – 30 companies • S&P 500 – 500 large cap • Nasdaq – 5,000 – Value can increase/decrease – Dividends paid quarterly – High/low – Long term investment US Stock Market History Proctor & Gamble Other financial terms • IRA – can open even while in 401(k) • 401 (k) – payroll deduction/company match. • Estate – value of all you own when you pass. • Will – road map for disposition of assets upon death. • Trust – various uses during life and after. Credit/Loans • Credit cards – Interest rates – Minimum payment • Auto loans – Installment – e.g. $7,000 x 8.75% for 5 years = $173 per month – Rates & terms determined if new car vs old car • Mortgages – Similar to installment loans – e.g. $100,000 @ 6.25% for 30 years = $615 per month • Home Equity loans – Lines of credit and installment loans • Student loans Credit,Capital,Capacity • Credit – Credit history – important all through life! – Determines rate • Capital – Other assets – Value of collateral – if offered • Capacity – Cash flow analysis – ability to repay Cash flow analysis • Example of loan – $10,000 @ 8.75% for 4 years • Cash flow analysis – Income • Annual salary = $50,000/12 • Investment income = $5,000 stock x 2% TOTAL MONTHLY INCOME $4,166.00 100.00 $4,266.00 – Expenses • Rent • Credit Card debt ($1,000 x 3.5%) • Other debt – student loans etc. TOTAL MONTHLY DEBT DEBT/INCOME = 28% ACCEPTABLE RATIO THIS EXAMPLE = $4,266/$1,535 = 35% $1,000.00 35.00 500.00 $1,535.00 BUDGET Total gross income 4,000.00 Total net income 2,800.00 Rent 1,000.00 Food 400.00 Insurance 100.00 Car loan 350.00 Credit card 35.00 Student loan 500.00 Gas 150.00 Miscellaneous 150.00 Total monthly expenses Net - savings 2,685.00 115.00 Your financial health • Take control • Read more about finances • Monitor your own accounts – (identity theft) • Seek advice • Keep to budget • Plan for future – 401(k) A MUST HAVE Word of Wisdom • The only way not to think about money is to have a great deal of it….Edith Wharton • Money frees you from doing things you dislike. Since I dislike doing nearly everything, money is handy…. Groucho Marx • If you would be wealthy, think of saving as well as getting….Benjamin Franklin • We make a living by what we get, we make a life by what we give….Sir Winston Churchill