Outline of remarks - Harvard Kennedy School

advertisement

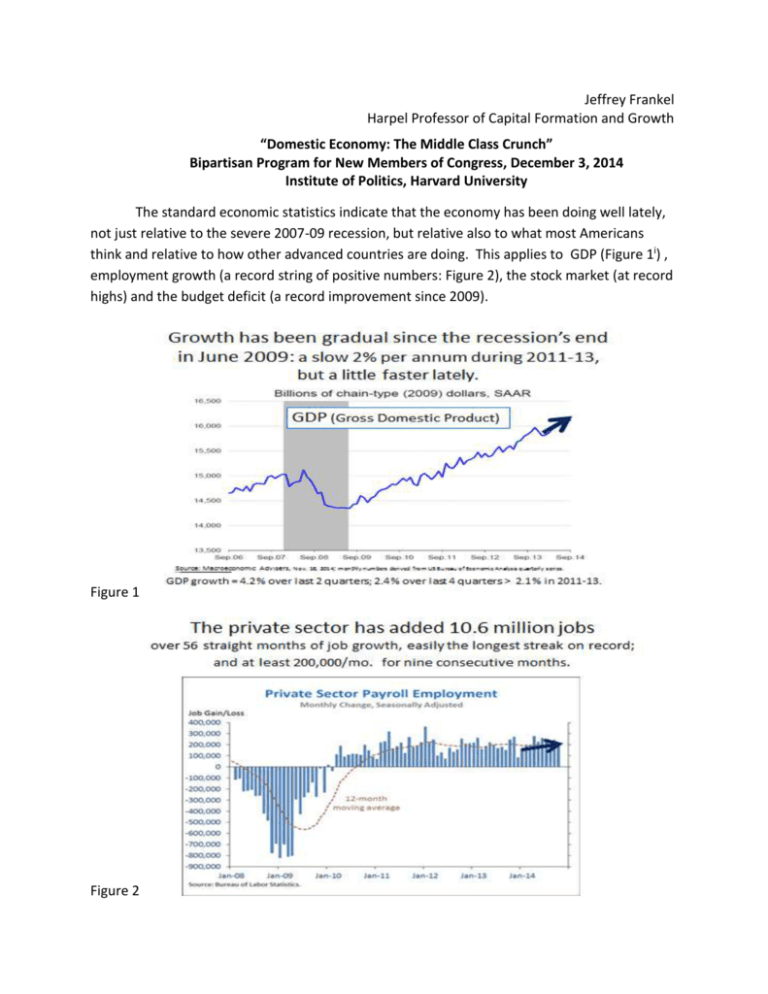

Jeffrey Frankel Harpel Professor of Capital Formation and Growth “Domestic Economy: The Middle Class Crunch” Bipartisan Program for New Members of Congress, December 3, 2014 Institute of Politics, Harvard University The standard economic statistics indicate that the economy has been doing well lately, not just relative to the severe 2007-09 recession, but relative also to what most Americans think and relative to how other advanced countries are doing. This applies to GDP (Figure 1i) , employment growth (a record string of positive numbers: Figure 2), the stock market (at record highs) and the budget deficit (a record improvement since 2009). Figure 1 Figure 2 Figure 3 If the economy is doing so well, then why don’t Americans feel it? The “middle class” doesn’t feel it because the gains have accrued to people at the top. Median family income is still 8 per cent below its pre-recession level and even further below its 2000 peak (Figure 4). It has barely risen above its 1990 level. Figure 4 Consider eight policies that are well worth pursuing. Some will sound popular, some very unpopular; some associated with “liberals”, some with “conservatives.” Heavy support from economists, regardless of party, is what the policies all have in common – even the very unpopular ones. Universal pre-school education Spend on infra-structure o For now, could be financed by Treasury borrowing: 1% is a very attractive interest rate! o For the longer term: Finance roads-and-bridges by putting the Federal Highway Trust Fund on a sound footing. o That means restoring real gas taxes to their past levels and putting the tax rate on an upward path over time. Very unpopular of course. But the best time to start this process is now, when gas taxes are falling and inflation is low. Take steps today to put social security on a sound footing for the long term o We spent the last three years getting fiscal policy exactly backwards The US fiscal problem, measured for example by the path of the federal debt, is in future decades, not today. We hurt the economy cutting spending and raising taxes 2011-2013 and have done nothing to address the big future deficits in social security and medicare, exactly the opposite of what we should have been doing: allowing deficits while the economy has been weak, while taking steps to address entitlements on a long-term basis. o Specific policies to put social security on sound footing: Raise the retirement age (while accommodating blue collar workers) Slow the rate of growth of benefits for future retirees. At the same time, make payroll taxes less regressive: Exempt low-income workers. o Much as we should expand the Earned Income Tax Credit, especially for young single workers who miss out. Raise the maximum-income threshold (from $118,500). Reverse the long-term rise in household debt: housing, auto, and student loans o Reduce especially the heavy policy tilt toward getting American families up to their eyeballs in mortgage debt that they can’t afford (which mainly drives up housing prices, without much raising home ownership rates for the middle class). Require a serious minimum down payment Require that mortgage-originators keep “skin in the game.” Curtail tax deductibility of mortgage interest, which benefits the well-off (the deduction generally gives households earning $65,000 a year less than $200 in tax savings.) Reduce deductions at upper end (like Rep. Dave Camp’s proposal to cut from $1m to $500k). Especially stop subsidizing mortgages if used for something other than purchase of residence (i.e., second home or “cash out” home equity line of credit). o Car-dealers should not have been exempted from the Consumer Finance Protection Bureau. o Most college educations are still a good deal, and worth going into debt for if that is the only way a student can go. But some enterprises are bad deals. Government should expand student loans, but require that the college or university have a decent record regarding rates of graduation and employment. Tax reform o We can’t afford to cut tax revenues. o But we can reduce the most distortionary tax polices (those that most discourage work or encourage harmful activities) and raise a given amount of revenue in a less distortionary way. o For the corporate tax system, that means cutting the overall tax rate some, but making up the lost revenue by eliminating wasteful exemptions, like oil subsidies. o For household taxes, I have in mind: Expanding the Earned Income Tax Credit. Eliminating the payroll tax on lower-income working Americans (currently their marginal tax rate is often higher than anybody’s; currently 63% of taxpayers pay more in payroll taxes than income taxes), but making up the lost revenue by curtailing or eliminating distortionary deductions (e.g., mortgage debt). Allow fracking o Actually encourage it by expediting LNG export facilities o but regulate it carefully, e.g., to prevent methane leaks. Resume US global economic leadership: o Pass TPA (for WTO, TPP & TTIP) o Pass IMF quota reform Do No Harm: Avoid going back to the dysfunctional fiscal policy of the past. The uncertainty created by the morass of cliffs, shutdowns, debt-ceiling standoffs (Figure 5) together with the reality of the sequesters, held back growth by at least 1 per cent per annum during 2011-13.ii One reason growth has been stronger lately is that 2014 is the first year in the last four when Congress has not impeded growth very actively. Figure 5 3.9 % in the 3rd quarter of 2014 (11/24 revision) + 4.6 % in the 2 nd quarter, averaging to 4 ¼ %. 2.4% over last four quarters. As compared to 2.0% during 2011-13. i ii “The Cost of Crisis-Driven Fiscal Policy” MacroAdvisers, Oct. 15, 2013.