June 2011 - Norton & Smailes

advertisement

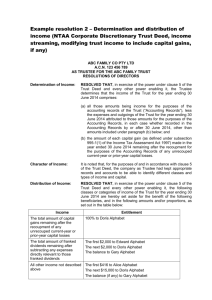

June 2011 In this Issue: Proposed New Trust Streaming Provisions Overview On 2 June 2011, Tax Laws Amendment (2011 Measures No. 5) Bill 2011 was introduced into Federal Parliament. The Bill contains important amendments which are designed to modify the taxation treatment of trusts with effect for the 2010-11 and possibly later income years. The amendments seek to ensure that, where permitted by the terms of a trust deed, the streaming of capital gains and franked distributions (including any attached franking credits) to beneficiaries will be effective for tax purposes. The amendments do not give a trustee the power to stream it is the long held ATO view that streaming can only take place if the relevant trust deed contains such a power. Further, the amendments do not allow for tax effective streaming of any other forms of income (for example, foreign income or interest income). The ATO view is that streaming of such other income is ineffective for tax purposes, and great care should therefore be taken when considering whether to stream such other income. Beneficiary must be specifically entitled The proposed legislation provides that for the streaming of capital gains and franked distributions to be effective for tax purposes, the trustee must in accordance with the terms of the trust make a particular beneficiary specifically entitled to those amounts. To be specifically entitled: (a) a beneficiary must receive, or reasonably be expected to receive, an amount equal to the net financial benefit referable to the capital gain or franked distribution in the trust; and (b) the entitlement must be recorded, in its character as referable to the capital gain or franked distribution, in the accounts or records of the trust. Receive or reasonably expected to receive be To be specifically entitled, a beneficiary must receive, or reasonably be expected to receive, an amount equal to their share of the net financial benefit that is referable to the capital gain or franked distribution. The Explanatory Memorandum to the Bill states that this does not require tracing to the actual trust proceeds from the event that gave rise to a capital gain or the receipt of a franked distribution. For example, it does not matter that the proceeds from the sale of an asset or a franked distribution were reinvested during the year, provided that a beneficiary receives (or can be expected to receive) an amount equivalent to their share of the net financial benefit. A specific entitlement can be expressed as a share of the trust gain or distribution. If done correctly, a specific entitlement can be expressed by reference to a formula even though the formula is to be calculated later. However, the formula must relate to the capital gain or franked distribution it cannot relate merely to trust income , even if the trust income IMPORTANT: The articles in this newsletter are in summary form and should not be relied on as a substitute for detailed advice. DV:00251608:tm:jen NORTON & SMAILES TAX matters includes a capital gain or franked distribution. A beneficiary is considered to have received an amount when the amount has been credited or distributed to them, or paid or applied on their behalf or for their benefit. A beneficiary can reasonably be expected to receive an amount if: (a) the beneficiary has a present entitlement to the amount; (b) the beneficiary has a vested and indefeasible interest in trust property representing the amount; or (c) the amount has been set aside exclusively for the beneficiary. The net financial benefit is the financial benefit or actual proceeds of the trust referable to the capital gain or franked distribution reduced by certain losses or expenses. beneficiary will meet the requirement of being recorded in its character as referable . However, a record merely for tax purposes will not be sufficient. The timing rules are critical. For capital gains, under the proposed legislation a beneficiary s entitlement must be recorded no later than two months after the end of the income year. Accordingly, if a trustee resolution is to be used to record a beneficiary s entitlement to a capital gain for the 2010-11 income year, then this would need to be prepared in writing by 31 August 2011. For franked distributions, a beneficiary s entitlement must be recorded by the end of the income year. Accordingly, if a trustee resolution is to be used to record a beneficiary s entitlement to a franked distribution for the 201011 income year, then this would need to be prepared in writing by 30 June 2011. Record keeping requirements In order for there to be an effective streaming for tax purposes, the amount of benefit that a beneficiary has received or can reasonably be expected to receive must be recorded in its character as referable to the capital gain or franked distribution. The accounts or records of the trust include the trust deed, statements of resolution or distribution statements, including schedules or notes attached to, or intended to be read with them. By way of example, the Explanatory Memorandum to the Bill states that a trustee resolution to distribute all of the dividends of the trust to a The manner in which a trustee resolution is prepared is also critical. A trustee resolution must clearly record a beneficiary s entitlement in its character as being referable to a capital gain or franked distribution. A specific entitlement cannot be created if the trustee resolution merely records a beneficiary s entitlement by reference to trust income , even if that trust income includes a capital gain or franked distribution. Exclusions page 2 a number of circumstances including the following: (a) no beneficiary can be specifically entitled to the part of a capital gain that arises because of the application of the market value substitution rule; (b) it is not possible to stream tax amounts to beneficiaries where there is no referable net financial benefit remaining in the trust, such as when the gross benefit has been reduced to zero by losses or directly relevant expenses; (c) generally no beneficiary can be specifically entitled to a purely notional gain, for example, a deemed capital gain for tax purposes which arises from a trust ceasing to be resident trust. This is because there is no net economic benefit referable to the notional gain that beneficiaries can receive; (d) it is not possible to make a beneficiary specifically entitled to franking credits, or to separately stream franked distributions and franking credits; (e) importantly, it is not possible to make a beneficiary specifically entitled where the beneficiary is entitled to an unspecified amount such as the balance of trust income, all of the trust income , half of the trust income or $100 of trust income . This is because the entitlements have not been recorded in their character as referable to a capital gain or franked distribution. A trustee cannot make a beneficiary specifically entitled in IMPORTANT: The articles in this newsletter are in summary form and should not be relied on as a substitute for detailed advice. DV:00251608:tm:jen NORTON & SMAILES TAX matters page 3 Implications Review of Trust Deeds Disclaimer Where a beneficiary has a specific entitlement to a capital gain or franked distribution, the associated tax consequences in respect of that distribution will apply to that beneficiary. Accordingly, trust deeds should therefore be reviewed, and if necessary amended, to ensure that trustees have sufficient power to stream capital gains and franked distributions in accordance with the new law. This publication is intended to provide general commentary and information. It is not intended to be a complete or definitive statement of the proposed new streaming provisions. In particular, this publication is based on the terms of Tax Laws Amendment (2011 Measures No. 5) Bill 2011 which was introduced into Federal Parliament on 2 June 2011. The Bill may be amended and enacted in a different format to its current form. This publication should therefore not be relied upon as legal advice. Professional legal advice should be sought before any action is taken in relation to the matters described in this publication. For trusts with no capital gains or franked distributions, the new streaming amendments will have no effect. For trusts that have capital gains or franked distributions but do not (or cannot) stream them to specific beneficiaries, the amendments apply but they generally produce the same outcome as under the current law. That is, capital gains and franked distributions to which no beneficiary is specifically entitled will flow proportionally to beneficiaries, based on their share of the income of the trust, or be taxed in the hands of the trustee depending on the operation of section 97 of the Income Tax Assessment Act 1936 (Cth). Action required by 30 June 2011 It is important to keep in mind that the new streaming provisions can only apply where a trust deed permits a trustee to stream amounts to beneficiaries. Further, as stated earlier, for the 2010-11 income year, the new streaming provisions can only apply where a beneficiary s entitlement is recorded in the accounts or records of the trust by: (a) in the case of franked distributions 30 June 2011; and (b) in the case of capital gains 31 August 2011. Trustee Resolutions In the case of franked distributions, trustees must ensure that a beneficiary s specific entitlement to a franked distribution is appropriately recorded in the accounts or records of the trust on or before 30 June 2011. Importantly, it will not be possible to rely on the ATO s long standing administrative practice in Income Tax Ruling IT 328 for such a resolution or determination to be put in place by 31 August 2011. Trustees should also implement other trust resolutions or determinations when required by year end under the trust deed. For example, a trust may have derived other forms of trust income, and the trustee may therefore need to pass a resolution in relation to those other forms of trust income by 30 June 2011. Should you have any questions please contact Richard Norton, Chris Smailes, Daniel Fry or Craig McKie. Norton & Smailes We advise on: income tax, GST, capital gains tax, FBT superannuation superannuation deeds and In the case of capital gains, trustees must ensure that a beneficiary s specific entitlement is appropriately recorded in the accounts or records of the trust by 31 August 2011. stamp duties, payroll tax and other State taxes We can assist objections and appeals Please contact us if you would like our assistance to review, and if necessary, update any existing trust deeds, or to advise on suitable trustee resolutions to comply with the proposed new law. wills, estate planning and business succession planning trusts and trust deeds tax and commercial litigation commercial IMPORTANT: The articles in this newsletter are in summary form and should not be relied on as a substitute for detailed advice. DV:00251608:tm:jen