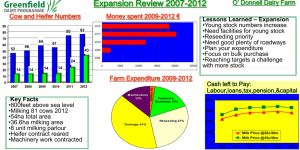

Dairy and Farm Power Costs

advertisement

ANZ Dairy Business of the Year Input Sheets – 2012-13 Business Name: ________________________________________________________ Contact Person/s: ________________________________________________________ Postal Address: ________________________________________________________ ___________________________________ Postcode: ____________ Phone No: (03) __________________________Mobile: _____________________ Email Address: ________________________________________________________ Dairy Company Supplied: ________________________________________________________ Please indicate with a in the appropriate boxes if you wish to participate in: - ANZ Dairy Business of the Year ($2000 for winners) Dairy Farm Benchmarking Program (obtain personal analysis only) Share Dairy Farmer Award (to win $1000) Was the property share farmed in 2012-13 If yes, are you Yes Owner Share Farmer No For share farmed properties to participate in the ANZ Dairy Business of the Year (or to benchmark the combined performance) both the share farmer and farm owner should complete the Input Sheets. Name of ‘other’ party (If applicable): _______________________________________________ Address: ________________________________________________________ ______________________________ Postcode: _______________ FOR ASSISTANCE – Phone a TIA DAIRY ADVISER (03) 6430 5297 Return completed form to TIA, Locked Bag 3523, Burnie 7320 1 AWARD PRIZES Awards and prizes for ANZ Dairy Business of the Year are: Winner: Runners-up: Share dairy farmer: Pasture utilisation: National DBOY entries: $2000 and plaque $500 plus plaque x 2 runners-up $1000 and plaque Certificate Top businesses get their entry paid for national DBOY awards run by Redsky Agricultural P/L 2 Milk production: 1 July 2012 to 30 June 2013 Factory milk Litres….……………………. Calf milk Litres……………………….. Milkfat …………….….….kg Protein …..………………kg Net income received for milk supplied from 1 July 2012 to 30 June 2013 Net Milk Income* Farm Owner Milk Income Share Farmer Milk Income $ ……………………… $ ………………………… $ ………………………… *Net Milk Income = Gross income minus levies, penalties, charges and dilution payments minus GST, plus bonuses, deferred payments and incentives for 2012-13 season Farm areas (1ha = 2.47acres) Available land Freehold home farm ha Freehold run blocks ha Area leased from others ha Total available land (1) ha Lease period…………………….. Land use* Non grazing land, bush, dams etc (2) ha Total pasture area (1-2=3) ha Include main farm and run off Forage crops ha Crop species.......................... Pasture not used by the milking herd (4) ha Eg. run off area Milking area (3-4) ha *Include both main farm and run blocks that are freehold or leased Irrigation Area irrigated ha Total ML applied ML Peak number of cows milked For herds with one calving period, this will be the peak number of cows in milk that completed at least 68 weeks of lactation. For herds with more than one calving period, this is the average number of cows in milk plus the average number of dry cows farmed through the year. Cows First Calvers Total 3 Dairy herd cow liveweight, breed and days in milk ? Lwt…………….kg Days in Milk………………. Breed………….. Average distance walked by milkers Distance from paddock to dairy……………………km x 2 = ……………….km/ milking Number of milkings per day……………………………….. Distance walked per day………………………………….km Home farm terrain: Indicate the steepness of farm with a in the appropriate box Flat Undulating Steep Condition score: On average, across the herd, how much did condition score change from July 12 to June 13 ? ………….. ………….. ………….. Condition Score at 1 July 2012 Lowest condition score Condition Score at 30 June 2013 Herd calving period Start date Finish date Cows calved Calving period 1 Calving period 2 Calving period 3 Owned livestock: numbers, value & ownership Month 1 July 2012 30 June 2013 Stock value, $/hd @ 30 June Who owns stock, farm owner (FO) or share farmer (SF) ? Yearlings 12-24 months Calves 0-12 months Mature cows Other stock ………………. hd hd hd hd hd hd hd hd hd hd $ $ $ Leased dairy livestock Were there leased cows or bulls on the farm ? Nos Bulls over 24 mths Start date Finish date 4 $ $ Non milking stock grazed on farm Milking area Dry Cows Stock 1 Calvers Mature Cows No. Days Non milking area No. Days st Yearlings (12-24 mths) 12-24 months Calves (3-12 months) 3 – 6 months 6 – 12 months Bulls (over 24 months) Beef Sheep Agistment off Type Dry cows Nos Start date Days on agistment Yearlings (12-24 mths) Calves (3-12 months) Bulls (over 24 months) Agistment on – were any stock agisted or parked on the farm during the year ? If yes, Age and nos……………………………….. Start date…………………………………. Days on farm…………………………….. 5 LABOUR Labour: paid and unpaid for dairy enterprise Unpaid Labour & Sharefarmers Weeks per year (A) Hours per week (B) Total Hours (A x B = C) 1 Main operator __________ _____________ ________________ 2_________________________ ___________ _____________ ________________ 3_________________________ ___________ _____________ ________________ 1_________________________ ____________ ____________ _______________ 2_________________________ ____________ ____________ _______________ 3________________________ ____________ ____________ _______________ 4________________________ ____________ ____________ _______________ 5________________________ ____________ ____________ _______________ 6________________________ ____________ ____________ _______________ Paid Labour 6 FARM ASSETS Farm Property & Water Values Value @ 30 Jun 2013 Owned Home Farm Owned Run off blocks Water Rights, not included in property values Leased area value Farm value estimates: Farm sales data in the table below are out of date. During 2012-13 a few dairy farms were sold at per hectare values less than shown below. To estimate the value of your farm multiply your estimated per hectare value by the effective pasture area to get the estimated the market value. Use lower per ha values for run off pastures than for milking area. Dairy farm sales in 2009-11 No. Farm sales analysed $/pasture ha1 Circular Head 9 $19,420 North West 3 $21,620 North Conversion farms and run blocks 4 $19,920 7 $9,700 Region Total farm 1. Total value divided by pasture area Source: David Johnston, December 2011 Plant and Machinery: Include items used by the Dairy Enterprise, either exclusively or in partnership with other enterprises on your property. Where equipment is shared between the dairy and non-dairy enterprises, allocate a value for that equipment which is in keeping with its use by the Dairy Enterprise. Estimate the value of saleable plant and machinery Vehicles: Cars, utilities, trucks, tractors, trailers, motor bikes, etc. Fodder : Hay & silage making and feeding out equipment Cultivation: Discs, drills, harrows Other plant: Spreader, irrigators, laterals, tools, tractor attachments Opening value 1 Jul 2012 Closing value 30 Jun 2013 Opening value 1 Jul 2012 Closing value 30 Jun 2013 Saleable plant and machinery, market value Other dairy assets Milk company shares, market value Other, eg FMDs 7 NON MILK INCOME Value of livestock sales and purchases Exclude GST from sales Stock description, age Farm owner Share farmer Livestock sales $ $ Livestock purchases $ $ Income from sale of hay and/or silage made on the dairy area of the home farm and run-off blocks during the 2011-12 season. Tonnes of Hay Sold from Home Farm tonnes (wet) Tonnes of Hay Sold from Run-off Blocks tonnes (wet) Total Income from Hay Sold $ Who received the income? Tick Box Farm Owner Share Farmer Tonnes of Silage Sold from Home Farm tonnes (wet) Tonnes of Silage Sold from Run-off Blocks tonnes (wet) Total Income from Silage Sold $ Who received the income? Tick Box Farm Owner Share Farmer Dairy enterprise non milk income Farm Owner Share Farmer Dividends on dairy company shares $ $ Subsidies on wages paid to employees: $ $ $ $ $ $ Rebates received on payments made for dairy enterprise inputs. Other Income: eg. house rent received from employees living in homes on the property, etc. (please specify). ____________________________________________ ____________________________________________ 8 VARIABLE COSTS Where costs are shared between the dairy and other enterprises show only the Dairy Enterprise share of the cost. DO NOT INCLUDE GST COMPONENT. Owner Costs, $ Share Farmer Costs, $ AI Costs and Herd Test: Include semen, technician, liquid nitrogen and oestrus synchronisation costs. _________ __________ Animal Health and Veterinary Costs: Drenches, vaccines, antibiotics, inductions, vet. fees, etc. Feed additives should be included as purchased feed _________ __________ __________ __________ Include power for dairy, effluent and stock water power costs. Exclude irrigation pumping costs in this section _________ __________ Calf Rearing up to Weaning: Milk powder, de-horning, drenching, grain, straw and treatment Dairy and Farm Power Costs: Dairy Supplies:. Detergents, rubberware, milking machine checks, tail & ear tags, protective clothing. Do not include new equipment or shed alteration costs Fertiliser Cost: including spreading cost _________ __________ __________ __________ Irrigation Costs: Include irrigation repairs & maintenance, electricity and water purchase costs. Hay and Silage Making: _________ __________ _________ __________ _________ __________ _________ __________ Fuel and Oil Costs: Total fuel and oil costs associated with dairy enterprise. Pasture and Forage Crop Costs: Include herbicide, insecticide, seed, spraying and cultivation contractors. Exclude fertiliser and hay/silage contractors Other Feed Costs: feed additives and cartage costs _________ __________ not already allowed for Purchased Feed: cost of feeds fed during the year. Agistment _________ __________ Grain, concentrates _________ __________ Fodder _________ __________ Other _________ __________ 9 OVERHEAD COSTS Where a cost is shared between the Dairy and Other Enterprises please estimate the cost to the Dairy Enterprise – DO NOT INCLUDE GST COMPONENT. Owner Costs, $ Share Farmer Costs, $ Rates and Land Tax: Paid on Home Farm and Run-off Blocks. _________ _________ Vehicle costs: insurance, registrations etc, exclude fuel costs _________ _________ and repairs Insurance: farm insurances relating to dairy enterprise. _________ _________ Repairs and Maintenance: to plant and machinery, farm buildings, lanes, fences, drains, etc. associated with the dairy enterprise. (Do not include expenditure on new/capital items) Bank charges: _________ _________ _________ _________ Administration Costs: include phone, accountant, lawyer, consultant costs, government fees, office costs etc. _________ _________ Labour Costs for Paid Labour: permanent and seasonal wages for farmwork. Include relief milkers, contract workers, workers compensation, superannuation. (Do not include unpaid or non-wage labour e.g. share farmers. _________ _________ Other Costs: Please specify ______________________________ ____________________________________________ _________ _________ Profit and Loss Statement: Include a copy of the accountant’s Profit and Loss statement for 2012-13, if it is available when you return the input sheets. Or provide a print out of income and expenses from your computerised accounting package if it is available. 10 HAY, SILAGE AND PURCHASED FEED Purchased feed, hay and silage Feed type Eg silage On hand 1 Jul Purchased, t or bales Cost, $ Fed on milking area Fed on non milking area Closing stock 30 Jun 40 b 300 b $21,155 320 b 0 20 b The following bale weights will be assumed unless you provide different weights 4' x 5' round bale of hay = 375 kg wet weight 4' x 5' round bale of silage = 650 kg wet weight Hay made & fed on the farm: exclude purchased hay Hay on hand, 1 July 2012 tonnes Milking Area tonnes (wet ) Nonmilking area tonnes (wet) Hay made on farm Assume 4' x 5' round bale = 375kg approx. Hay fed to milkers & dries Tonnes should reflect transfers between blocks Hay fed to replacements Tonnes should reflect transfers between blocks Fed to non-dairy livestock Tonnes should reflect transfers between blocks Hay at end of year, 30 June 2013 tonnes 11 Silage made and fed: exclude purchased silage Silage on hand, 1 July 2012 tonnes Milking area tonnes (wet ) Nonmilking area tonnes (wet) Silage made on farm 4' x 5' round bale = 650 kg approx. Silage fed to milkers & drys Tonnes should reflect transfers between blocks Silage fed to replacements Tonnes should reflect transfers between blocks Silage fed to non-dairy livestock Tonnes should reflect transfers between blocks Silage at end of year, 30 June 2013 tonnes Note: Show total weight of silage in tonnes, not tonnes as dry matter. 40% dry matter will be assumed. Grain grown on home farm and run-off blocks and fed to dairy stock in 2012-13 season Type of grain grown. (Specify) Tonnes grown Tonnes fed 12 LIABILITIES & FINANCE COSTS Liabilities Opening balance 1 Jul 2012 Bank loans Machinery leases payout value Livestock leases Total interest bearing debt Interest and lease payments $ Bank interest Property leases Machinery lease interest Livestock lease payments Total interest and lease payments 13 Closing balance 30 Jun 2013 FERTILISER Fertiliser details Fertiliser type Distribution of fertiliser Tonnes applied Eg 0-6-17-7 55 14 Irrigated Dryland 70% 30% CONDITIONS OF ENTRY For ANZ Dairy Business of the Year (DBOY) 1. The ANZ DBOY is open to any person or entity operating a dairy farm in Tasmania including share farmers, lessees and owners providing they managed the dairy farm during the year being assessed. 2. The objective of the ANZ DBOY is to calculate the financial performance of the participating dairy farm businesses and advise participants how their performance compared with other participants. Those businesses achieving the highest returns will be identified and field days, workshops and publicity about these businesses will provide other dairy farmers with the opportunity to identify the management strategies that contributed to the success of the high achievers. 3. Finalists in the ANZ DBOY will be selected from the entrants with the highest points calculated using the formula; Finalists points = Entrant’s return on assets % X 20 points + Entrant’s operating profit per ha X 10 points Average return on assets % Average operating profit per ha 4. The ANZ DBOY organising committee will appoint a judging team to judge the finalists and select a winner. The winner of the Award will be selected using a points system. Points will be awarded for financial performance plus management of stock, pastures, environment and people. 5. Participants in the ANZ DBOY must supply a copy of the financial statements for the business prepared by their accountant for the year being assessed. 6. The winner, finalists and most improved winner of the Award must allow a case study of their dairy farming enterprise to be published. 7. The winner of the ANZ DBOY must allow a field day to be held on their property. 8. Winners of the ANZ DBOY can participate in the program in subsequent years but they will be ineligible to win, be a finalist, or win the most improved award for five years after they won the Award. 9. If a past winner achieves a return on assets which is greater than a current year finalist they will receive a Consistency Award certificate. 10. Participants who have entered for the last two years are eligible for the most improved category of the program. The most improved winner will be the participant who has the highest increase in return on assets over the two years. PRIVACY STATEMENT The information on the ANZ Dairy Business of the Year (DBOY) input sheets will be stored and used by TIA for the purpose of conducting the program. Your information will be used to prepare reports on your business and farm performance, assist calculate industry benchmarks that are used in the reports you receive and for industry planning and to decide the winners and finalists of the ANZ DBOY. Information you supply with the name, address and contact details removed may be supplied to other organisations for industry planning and research purposes. Your personal information may be disclosed to staff of TIA and the appointed judges of the ANZ DBOY. Winners and finalists of the ANZ DBOY will be identified and some of their personal information will be published. Some information supplied by participants who are not winners or finalists of the ANZ DBOY will be published but the identity of the farmers who supplied the information will not be disclosed. If the information that we hold about you is not accurate we will take reasonable steps to correct it when you advise us a correction is needed. TIA is committed to ensuring the personal information it collects is managed in accordance with the Personal Information Protection Act 2004. 15