Blanket Hazard Portfolio

advertisement

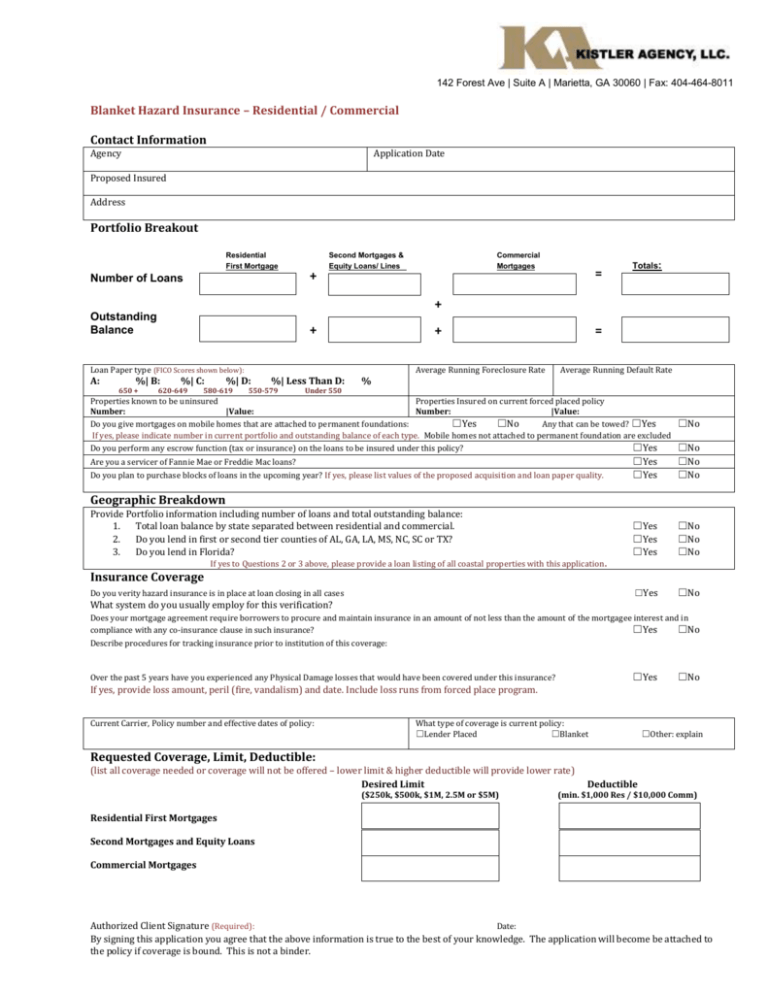

142 Forest Ave | Suite A | Marietta, GA 30060 | Fax: 404-464-8011 Blanket Hazard Insurance – Residential / Commercial Contact Information Agency Application Date Proposed Insured Address Portfolio Breakout Residential First Mortgage Number of Loans + Second Mortgages & Equity Loans/ Lines Commercial Mortgages = Totals: + Outstanding Balance + Loan Paper type (FICO Scores shown below): A: %| B: 650 + %| C: 620-649 %| D: 580-619 %| Less Than D: 550-579 Under 550 + % Average Running Foreclosure Rate = Average Running Default Rate Properties known to be uninsured Properties Insured on current forced placed policy Number: |Value: Number: |Value: Do you give mortgages on mobile homes that are attached to permanent foundations: ☐Yes ☐No Any that can be towed? ☐Yes ☐No If yes, please indicate number in current portfolio and outstanding balance of each type. Mobile homes not attached to permanent foundation are excluded Do you perform any escrow function (tax or insurance) on the loans to be insured under this policy? ☐Yes ☐No Are you a servicer of Fannie Mae or Freddie Mac loans? Do you plan to purchase blocks of loans in the upcoming year? If yes, please list values of the proposed acquisition and loan paper quality. ☐Yes ☐Yes ☐No ☐No ☐Yes ☐Yes ☐Yes ☐No ☐No ☐No ☐Yes ☐No Geographic Breakdown Provide Portfolio information including number of loans and total outstanding balance: 1. Total loan balance by state separated between residential and commercial. 2. Do you lend in first or second tier counties of AL, GA, LA, MS, NC, SC or TX? 3. Do you lend in Florida? If yes to Questions 2 or 3 above, please provide a loan listing of all coastal properties with this application. Insurance Coverage Do you verity hazard insurance is in place at loan closing in all cases What system do you usually employ for this verification? Does your mortgage agreement require borrowers to procure and maintain insurance in an amount of not less than the amount of the mortgagee interest and in compliance with any co-insurance clause in such insurance? ☐Yes ☐No Describe procedures for tracking insurance prior to institution of this coverage: ☐Yes Over the past 5 years have you experienced any Physical Damage losses that would have been covered under this insurance? ☐No If yes, provide loss amount, peril (fire, vandalism) and date. Include loss runs from forced place program. Current Carrier, Policy number and effective dates of policy: What type of coverage is current policy: ☐Lender Placed ☐Blanket ☐Other: explain Requested Coverage, Limit, Deductible: (list all coverage needed or coverage will not be offered – lower limit & higher deductible will provide lower rate) Desired Limit ($250k, $500k, $1M, 2.5M or $5M) Deductible (min. $1,000 Res / $10,000 Comm) Residential First Mortgages Second Mortgages and Equity Loans Commercial Mortgages Authorized Client Signature (Required): Date: By signing this application you agree that the above information is true to the best of your knowledge. The application will become be attached to the policy if coverage is bound. This is not a binder.