Balance Sheets for GCSE Business

advertisement

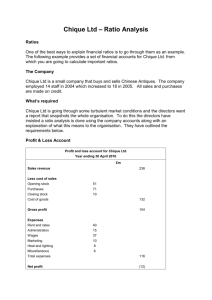

Balance Sheets for WJEC GCSE Business Topic Outcomes: All will be able to define “Net Assets and Capital Employed”. Most will be able to explain in one sentence what a Balance Sheet is showing us! Some will be working towards discussing why a potential investor in a business will want to see its Balance Sheet Level 1 Grade E Knowledge Level 2 Grades D to C – Analysis of an issue Level 3 Grades B to A* Judgement and Evaluation A Balance Sheet is … (Key Term) A Balance Sheet summarises: Where ALL the money has been SPENT (on the top half of the sheet) as well as Where ALL the money INVESTED in the company has come FROM (on bottom half of the sheet) The two halves of the balance sheet will ALWAYS have the same figure (BALANCE) at the bottom – hence the name (Balance Sheet)! A Balance Sheet is … (Key Term) A Balance Sheet tells stakeholders in a company how wealthy a company is at a SINGLE POINT IN TIME. Wealth is assets, money, profits MINUS anything a business owes! Minty Ltd Balance Sheet as at 31st December 2010 NET ASSETS (Things they own minus anything they need to repay inside a year) Note down these key terms! CAPITAL EMPLOYED (Where the money has come from to help pay for their assets/ possessions) (Minty – Word Doc called Balance Sheet WJEC 2011 Resource Activity Cards) Tasks Using the sheets provided, we are going to learn about the STRUCTURE of the balance sheet and how it is laid out at the simplest level. Let’s … 1. Look at Minty Ltd together, 2. Complete activities called: Pinky Ltd and Genie Ltd, 3. Write in the definitions in the boxes and gaps provided, 4. Then we are ready to look more closely at the detail in the balance sheets…. Notes: Two key terms… • Fixed Assets - Items the firm owns that will last MORE than a year – like buildings or computers. • Current Assets – Items the business OWNS or is OWED that will be turned in to CASH that is used up within a year e.g. stock; debtors; cash in the current bank account. Notes : Two key terms… • Current Liabilities - Items the firm OWES that it will have to PAY off in LESS than a year – such as its TRADE CREDITORS. • Working Capital – Current Assets MINUS Current Liabilities – in other words the money the business has working for it on a SHORT TERM day to day basis. Key Terms… • Net Assets - The total of HOW all the capital in the business is being used. It is found by adding WORKING CAPITAL to FIXED ASSETS. • Net Assets are the total of the TOP HALF of the Balance Sheet! Notes : Two key terms… • Long Term Liabilities - Items the firm OWES that it will have to PAY off in MORE than a year – such as its mortgage or a long term bank loan. • Share or Owners’ Capital – The money invested in the business by its owners. Notes : Two key terms… • Retained Profit - Profit the company has chosen to KEEP in the business for future investment or expansion rather than paying it out as dividends. • Capital Employed – The total of all the money invested in the business – the bottom half of the balance sheet. Next – let’s look at the various sections of the balance sheet in more detail…. • We’ll look at Genie Ltd together • Then you can test yourselves by working out the gaps for Jelly Bean Ltd and Piggy Ltd. Notes: Two more key terms… • Trade Debtors - where people/ customers owe you money because your business has sold them goods on credit (usually in business, if you sell goods to another business, you give them 30 days to pay) • Trade Creditors – when YOU/ YOUR business BUYS its SUPPLIES on TRADE CREDIT (again usually 30 days to pay). More Current Assets…. • Stock - is the value of goods the business has left on its premises when the balance sheet is written. It is a best estimate of what the goods in a shop or factory are worth if they were sold off in the next 12 months. Now – let’s test our understanding of the balance sheet in more detail…. • Now you can test yourselves by working out the gaps for Jelly Bean Ltd and Piggy Ltd. Challenge question - imagine…. • In the following year, imagine Genie Ltd had a really bad year and their sales and profits fall by £2,000 so profits end up being £3,000. • What items might change by £2,000 on the opposite side of the balance sheet? (as we know the balance sheet always has to balance) BIG Question! • If someone was thinking of investing in a business, WHY might they be interested in seeing the balance sheet? • Are there any SPECIFIC things you think they’d look at on the balance sheet? Explain why you think this…. Review of Topic Outcomes … All will be able to define “Net Assets and Capital Employed”. Most will be able to explain in one sentence what a Balance Sheet is showing us ! Some will be working towards discussing why a potential investor in a business will want to see its Balance Sheet Level 1 Grade E Knowledge Level 2 Grades D to C – Analysis of an issue Level 3 Grades B to A* Judgement and Evaluation Using and Interpreting Balance Sheets Using and Interpreting Balance Sheets: Outcomes All will be able to define “Liquidity” Most will be able to explain why being able to calculate liquidity of a business is useful. Some will compare liquidity of different businesses and offer recommendations. Level 1 Grade E Knowledge Level 2 Grades D to C – Analysis of an issue Level 3 Grades B to A* Judgement and Evaluation Liquidity Liquidity means HOW QUICKLY a business has access to CASH* in order to be able to run day to day. (* by cash, we mean bank account balances and cheques too!) It’s important to know the liquidity of a company because ….? If you are the owner or thinking of investing in it, a GOOD business has GOOD liquidity – meaning it can always PAY its bills!