Supplemental Instruction Finance 301 12/4/08

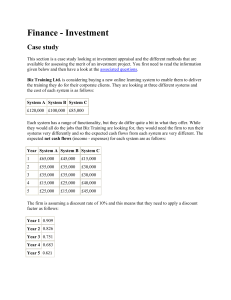

advertisement

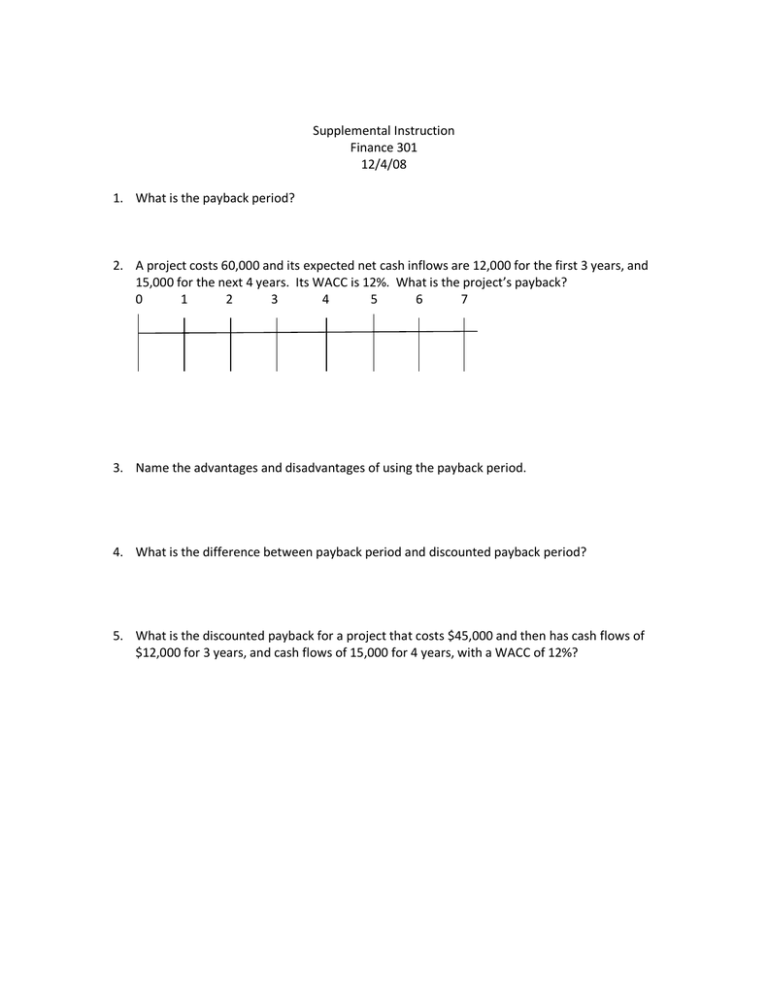

Supplemental Instruction Finance 301 12/4/08 1. What is the payback period? 2. A project costs 60,000 and its expected net cash inflows are 12,000 for the first 3 years, and 15,000 for the next 4 years. Its WACC is 12%. What is the project’s payback? 0 1 2 3 4 5 6 7 3. Name the advantages and disadvantages of using the payback period. 4. What is the difference between payback period and discounted payback period? 5. What is the discounted payback for a project that costs $45,000 and then has cash flows of $12,000 for 3 years, and cash flows of 15,000 for 4 years, with a WACC of 12%? 6. When do you use MIRR instead of IRR? What is the decision rule for IRR? 7. A firm with a 12% WACC is evaluating 2 projects for this year’s capital budget. After tax cash flows, including depreciation are as follows: Time Project A Project B 0 -5,000 -18,000 1 2,000 5,600 2 2,000 5,600 3 2,000 5,600 4 2,000 5,600 5 2,000 5,600 Calculate NPV and IRR for each project. Which would you accept if the projects are independent? Which would you accept if the projects are mutually exclusive?