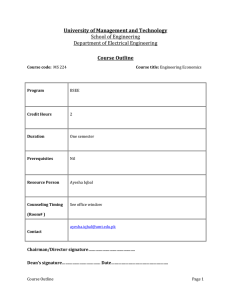

MEE 501 – Engineering Economics COURSE PARTICULARS

advertisement

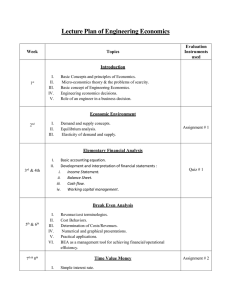

MEE 501 – Engineering Economics COURSE PARTICULARS Course Code: MEE 501 Course Title: Engineering Economics No. of Units: 3 Course Duration: Two hour of Lecture and two hours of tutorial per week for 14 weeks. Status: Compulsory Course Email Address: tcakintayo@futa.edu.ng Course Webpage: Prerequisite: MEE525 (Computer Aided Design) COURSE INSTRUCTOR AKINTAYO, Tunde Claudius, B. Sc. (Ife). M. Sc. (Lagos) Dept. of Mechanical Engineering, The Federal University of Technology, Akure, Nigeria. Phone: +2348062866061, Email: tcakintayo@futa.edu.ng COURSE DESCRIPTION Law of managerial economics. Management models. Revenue of the firm: production decisions, cost of production, profit analysis of the firm, pricing techniques. Marketing, Demand and Forecasting. Distributive trade in Nigeria. Business finance & investment. Capital budgeting & management control. Government policies and the firm. Financing technology: capital equioment, investment appraisal methods. Break-even analysis. Fundamrntal of cost accounting with emphasis on production costing. Areas of conflicts between engineers and accountants. Engineering valuation. COURSE LEARNING OBJECTIVES The objectives of this course are to: I. II. III. review with students basic economic principles with students; introduce to students basic capital appraisal methods used for carrying out economic analysis of different alternatives of engineering projects or works; educate the students on how to systematically evaluate the various cost elements of a typical manufactured product, an engineering project or service, with a view to determining the price offer. 1 COURSE LEARNING OUTCOMES Upon successful completion of this course, the student will be able to: explain the basic economic principles of wants, scarcity, choice, opportunity cost, etc as applied to business organizations and engineering firms; understand the time value of money, and how to sketch the cashfow diagram; calculate common capital appraisal techniques such as NPV, IRR, Profitability Index, Payback period, and use these figures of merits to determine the most profitable alternative; understand the various sources available to raise equity funds and debts funds for a business organization; understand the concept of depreciation of fixed assets and know how to calculate depreciation values using different methods of depreciation; carry out the cost analysis of a manufactured product; prepare a manufacturing account, profit&loss account, balance sheet; calculate important financial ratios and know how to make useful deductions from the values of these ratios; apportion budgeted overheads on most equitable basis; identify areas of conflicts between engineers and accountants. evaluate the profit of a firm, carry out the break even analysis and employ this tool to make production decision; GRADING SYSTEM FOR THE COURSE This course will be graded as follows: Short Quizzes 20% Main Test 20% Final Examination 60% TOTAL 100% GENERAL INSTRUCTIONS Attendance: It is expected that every student will be in class for lectures and tutorial classes.. Attendance records will be kept and used to determine each person’s qualification to sit for the final examination. A minimum of 70% attendance is required for a student to be allowed to sit for the final exam. In case of illness or other unavoidable cause of absence, the student must communicate as soon as possible with theinstructor, stating the reason for the absence. Academic Integrity: Dishonesty and cheating in assignments, class short quizzes, tests or examinations, or any act tantamount to the violation of academic integrity is totally prohibited. You are not allowed to make copies of another person’s work and submit it as your own; that is plagiarism. All cases of academic dishonesty will be reported to the University Management for 2 appropriate sanctions in accordance with the guidelines for handling students’ misconduct as 12 Wide Area Network, The Internet and World Wide spelt out in the Students’ Handbook. Code of Conduct in Lecture Rooms and Laboratories: Students should turn off their cell phones during lectures. Students are prohibited from engaging in other activities (such as texting, watching videos, etc.) during lectures. Food and drinks are not permitted in the laboratories. READING LIST Riggs, J; Bedworth, D & Ranhawa, S. (1995). Engineering Economics. 4 th Edition. McGraw-Hill Publishing, USA. Park, C. S. (2002). Cntemporary Engineering Economic. 3 rd Edition. Prentice Hall. Steiner, H. M. (1992). Engineering Economics Principles. NcGraw-Hill, Inc., New York. Principle COURSE OUTLINE Week 1 2 3 4 5 Topic Review of definitions of economics, basic concepts of wants, scarcity, choice, opportunity cost, demand and supply curves, price determination and elasticityproduction systems, de. Defintion of etc as applied to business organizations and engineering firms Time value of money. The cashfow diagram. Determination of NPV, Profitability Index, Payback period, and selection criteria. Minimum Attractive Rate of Returns, Internal Rate of Reurns (IRR) Sources of funds for business organization. 6 Causes of depreciation of assets. Calculate of depreciation values using different methods of depreciation 7 Introduction to Cost Accounting: Fixed cost and Variable Cost. Direct costs and Indirect costs. Break-even analysis. Standard Cost. Apportionment of budgeted Overheads on appropriate bases. 7 8 9 10 11 12 13 14 3 Remarks 13 14 Virtual Reality and Video Conferencing Virtual Reality Video Conferencing Practical Class 15 REVISION Networking using workstation and base station will be used to buttress information technology in Manufacturing This is the week preceding the final examination. At this time, evaluation will be done to assess how far the students’ expectations for the course have been met. Second test 4