ACCT 2210 - Tax Accounting

advertisement

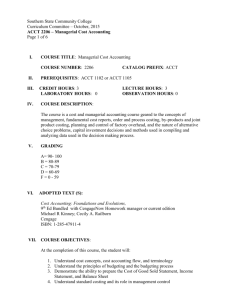

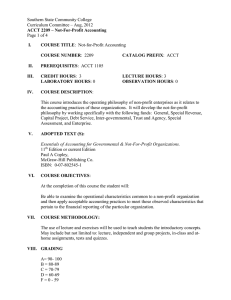

Southern State Community College Curriculum Committee –September, 2014 ACCT 2210 – Tax Accounting Page 1 of 5 I. COURSE TITLE: Tax Accounting COURSE NUMBER: 2210 II. PREREQUISITES: None III. CREDIT HOURS: 3 LABORATORY HOURS: 0 IV. COURSE DESCRIPTION: CATALOG PREFIX: ACCT LECTURE HOURS: 3 OBSERVATION HOURS: 0 This is an introductory course in personal tax accounting. Emphasis is focused on the principles of federal income taxation as they relate to individuals and simple trusts, including the laws, rulings, and regulations that govern the preparation of individual tax returns. V. ADOPTED TEXT (S): Income Tax Fundamentals Current edition Whittenberg Cengage Learning VI. COURSE OBJECTIVES: Upon completion of this course the student will: Demonstrate a basic knowledge of the federal individual income tax rules and regulations. Demonstrate a basic knowledge of tax determination, including filing status, exemptions, and property transactions. Demonstrate a basic knowledge of the concept of gross income. Demonstrate a basic knowledge of tax deductions and losses, both personal and business. Southern State Community College Curriculum Committee –September, 2014 ACCT 2210 – Tax Accounting Page 2 of 5 VII. COURSE METHODOLOGY: The use of lecture and exercises will be used to teach students the introductory concepts. May include but not limited to: lecture, independent and group projects, in-class and athome assignments, tests and quizzes. VIII. GRADING A= 90- 100 B = 80-89 C = 70-79 D = 60-69 F = 0 - 59 IX. SUGGESTED COURSE OUTLINE: Week 1 Class Assignments Chapter 01: Individual Income Tax Return 2 Chapter 02: Gross Income and Exclusions 3 4 Chapter 03: Business Income and Expenses Part I * Quiz 1 Chapters 1 and 2 Chapter 04: Business Income and Expenses Part II 5 *Quiz 2 Chapters 3 and 4 Chapter 05: Itemized Deductions and Other Incentives 6 Chapter 06: Credits and Special Taxes 7 *Quiz 3 Chapters. 5 and 6 Review for Mid-Term 8 *Mid-term Exam –Chapters 1- 6 9 10 Chapter 07: Accounting Periods and Methods of Depreciation Chapter 08: Capital Gains and Losses 11 * Quiz 4 Chapters 7 and 8 12 Chapter 09: Withholding, Estimated Payments and Payroll Taxes Southern State Community College Curriculum Committee –September, 2014 ACCT 2210 – Tax Accounting Page 3 of 5 X. 13 Chapter 10: Partnership Taxation 14 *Quiz 5 Chapters 9 and 10 Chapter 11: Corporate Income Tax 15 Chapter 12 Tax Administration and Tax Planning 16 FINAL EXAM OTHER REQUIRED BOOKS, SOFTWARE AND MATERIALS: H & R Block Software XI. EVALUATION: Knowledge of content is evaluated by written tests, assignments, and work projects per instructor. All exams are comprehensive; quizzes are not. Class participation will be evaluated by the student’s ability to contribute to class discussion. No make-up tests will be given. Sample Grading Scale: Quizzes (5) Mid-term Examination Final Examination Comprehensive Tax Problem Attendance and Participation Total Points XII. 70 100 200 50 30 500 14% 20% 40% 20% 06% 100% SPECIFIC MANAGEMENT REQUIREMENTS: Attendance Policy To meet the objectives of Tax Accounting, students must attend all scheduled classes. At the beginning of the semester, all instructors will distribute a “Class Schedule”, which may or may not be a part of the syllabus. If a student must miss class due to extenuating circumstances, the student is expected to call and inform the instructor by either talking with the instructor, e-mail, or leaving a message should the instructor not be available.. If you wish to drop the course you must take positive action. Do not assume that the Instructor will automatically drop you if you stop attending class. Southern State Community College Curriculum Committee –September, 2014 ACCT 2210 – Tax Accounting Page 4 of 5 Missing a Mid-Term Examination There will be no make-up mid-term examinations given. If, for any reason, you are not able to take the mid-term examinations at the scheduled time and date, the examination that you missed will be assigned the same percentage grade that you receive on the course Final Examination. Exceptions to this policy are anticipated to be very rare. Contact your Instructor one week prior to the mid-term examination if you wish to discuss the possible granting of an exception to this policy. Missing a Quiz There will be no make-up quizzes. This policy applies to all quizzes. If, for any reason, you are not able to take one of the quizzes on the scheduled date, the quiz that you missed will be assigned the same percentage grade that you receive on the course Final Examination. Missing a Due Date for: the Comprehensive Problem Project The due dates for this project are shown on the Course Outline above. The project is to be turned-in on, or before, the assigned date and time. If a project is not turned- in by the assigned date and time, you will be assigned a grade of zero points for the project. Instructor and Student Responsibilities and Academic Dishonesty Students are required to submit only their own original work with proper citation of third party sources quoted in that work, this includes the team papers; it must be original work produced by the team. The College’s Plagiarism Checker includes a database of all past papers submitted by SSCC students. Submission of copied or purchased assignments is likely to be caught by Turnitin and the resulting sanctions under the Code of Conduct can include a failing course grade, suspension, or expulsion from the College. IT Proficiency The mission of Southern State Community College is to provide accessible, affordable and high quality education to the residents of its service area. We believe that education is more than a mastery of a body of technical and professional knowledge and the achievement of technical or professional proficiency. We provide students with the life-long ability to acquire knowledge and translate it into Southern State Community College Curriculum Committee –September, 2014 ACCT 2210 – Tax Accounting Page 5 of 5 responsible action in a competitive global environment. Toward that end, we seek to develop future professionals who will be critical thinkers with the international/diversity perspectives and IT skills necessary to be effective and ethical communicators/decision makers in an increasingly complex and multicultural environment. Among the primary skills(s) developed in this class will be IT proficiency. In part, this skill will be promoted by: Interacting with the H & R Block software Retrieving financial information from government web sites XIII. OTHER INFORMATION CLASSROOM CONDUCT: Civility in the classroom is very important. As professionals, we expect students to conduct themselves in a courteous and respectful manner. Disruptive, rude, sarcastic, obscene or disrespectful speech or behavior have a negative impact on everyone, and will not be tolerated. Students need to remember that the online discussion boards and chat rooms in the online courses are considered classrooms and the same rules apply. Students will use these tools in the online classroom for information that pertains to the class; it is not to be used for personal exchanges of a social nature. If you engage in any such conduct you will be asked to leave and you will receive a “zero” for any work completed that day. The instructor reserves the right to permanently remove a student from the class for inappropriate conduct after consultation with the Department Coordinator and Academic Dean. FERPA: Students need to understand that your work may be seen by others. Others may see your work when being distributed, during group project work, or if it is chosen for demonstration purposes. Other instructors may also see your work during the evaluation/feedback process. DISABILITIES: Students with disabilities may contact the Disabilities Service Office, Central Campus, at 800-628-7722 or 937-393-3431.