tugas peramalan

advertisement

TUGAS PERAMALAN

Anggota

1. Abid hasbiya

(M0108024)

2. Sofiin

(M0109062)

3. Livvia Paradisea S

(M0110050)

4. Moch. Arif hidayatullah

(M0110056)

5. Retno jati sahari

(M0110079)

12.

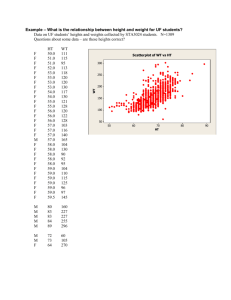

Paul Raymond, president of Washington Water Power, is worried about the possibility of a

takeover

attempt and the fact that the number of common shareholders has been

decreasing since 1983. He instruct you to study the number of common shareholders since

1968 and forecast for 1996. You decide to investigate three potential predictor variables:

earnings per share (common), dividends per share (common), and payout ratio. You collect

the data from 1968 to 1995 as shown in Table P-12.

a. Run these data on the computer and find the best prediction model.

b. Is serial correlation a problem in this model?

c. If serial correlation is a problem, write a memo to Paul that discusses various solutions

to the autocorrelation problem and includes your final recommendation.

Solution

Table P-12

Common

Earning Dividend Payou

Sharehold

s per

s per

t

ers

Share

Share

Ratio

Y

X1

X2

X3

1968

26472

1.68

1.21

1969

28770

1.7

1970

29681

1971

Year

Differenc Differenc

Difference

Differe

eY

e X1

X2

nce X3

72

*

*

*

*

1.28

73

2298

0.02

0.07

1

1.8

1.32

73

911

0.10

0.04

0

30481

1.86

1.36

72

800

0.06

0.04

-1

1972

30111

1.96

1.39

71

-370

0.10

0.03

-1

1973

31052

2.02

1.44

71

941

0.06

0.05

0

1974

30845

2.11

1.49

71

-207

0.09

0.05

0

1975

32012

2.42

1.53

63

1167

0.31

0.04

-8

1976

32846

2.79

1.65

55

834

0.37

0.12

-8

1977

32909

2.38

1.76

74

63

-0.41

0.11

19

1978

34593

2.95

1.94

61

1684

0.57

0.18

-13

1979

34359

2.78

2.08

75

-234

-0.17

0.14

14

1980

36161

2.33

2.16

93

1802

-0.45

0.08

18

1981

38892

3.29

2.28

69

2731

0.96

0.12

-24

1982

46278

3.17

2.4

76

7386

-0.12

0.12

7

1983

47672

3.02

2.48

82

1394

-0.15

0.08

6

1984

45462

2.46

2.48

101

-2210

-0.56

0.00

19

1985

45599

3.03

2.48

82

137

0.57

0.00

-19

1986

41368

2.06

2.48

120

-4231

-0.97

0.00

38

1987

38686

2.31

2.48

107

-2682

0.25

0.00

-13

1988

37072

2.54

2.48

98

-1614

0.23

0.00

-9

1989

36968

2.7

2.48

92

-104

0.16

0.00

-6

1990

34348

3.46

2.48

72

-2620

0.76

0.00

-20

1991

34058

2.68

2.48

93

-290

-0.78

0.00

21

1992

34375

2.74

2.48

91

317

0.06

0.00

-2

1993

33968

2.88

2.48

86

-407

0.14

0.00

-5

1994

34120

2.56

2.48

97

152

-0.32

0.00

11

1995

33138

2.82

2.48

88

-982

0.26

0

-9

a. With least square method using Minitab 16 software we get the model

Regression Analysis: Y versus X1, X2, X3

The regression equation is

Y = - 14502 + 15124 X1 - 11272 X2 + 430 X3

Predictor

Coef

SE Coef

T

P

-14502

33684

-0.43

0.671

X1

15124

14678

1.03

0.313

X2

-11272

19416

-0.58

0.567

X3

430.5

449.2

0.96

0.347

Constant

S = 3975.23

R-Sq = 54.1%

R-Sq(adj) = 48.3%

Analysis of Variance

Source

DF

SS

MS

F

P

Regression

3

446239155

148746385

Residual Error

24

379258158

15802423

Total

27

825497313

Source

DF

Seq SS

X1

1

263649350

X2

1

168075347

X3

1

14514459

9.41

0.000

Durbin-Watson statistic = 0.413926

\

From the result of Minitab we see the Durbin Watson Statistics 𝐷𝑊 = 0.413926

With an alpha 0.01, 𝑑𝐿 = 0.969 and 𝑑𝑈 = 1.414

Because the Durbin Watson statistics 𝐷𝑊 < 𝑑𝐿 , so the conclusion is there is a possitive

autocorrelation in model. We know that autocorrelation makes the model bad, so we

must solve the problem.

b. Yes, the problem is serial correlation.

c. We will try to difference the data and make autoregressive model to vanished the

autocorrelation.

1. Best Subset by Minitab

Best Subsets Regression: Y versus X1, X2, X3

Response is Y

Vars

1

1

1

2

2

2

3

R-Sq

51.7

31.9

18.9

53.4

52.3

52.0

54.1

R-Sq(adj)

49.9

29.3

15.8

49.7

48.5

48.2

48.3

Mallows

Cp

1.2

11.6

18.3

2.3

2.9

3.1

4.0

S

3915.0

4648.6

5073.4

3922.2

3968.7

3980.1

3975.2

X X X

1 2 3

X

X

X

X

X

X X

X X

X X X

The best model if variable independent just X2, dividens per share

2. Model Difference

Regression Analysis: C11 versus C12, C13, C14

The regression equation is

C11 = - 864 - 8484 C12 + 34640 C13 - 271 C14

27 cases used, 1 cases contain missing values

Predictor

Constant

C12

C13

C14

Coef

-863.7

-8484

34640

-270.9

S = 1661.68

SE Coef

427.9

4605

8332

138.6

T

-2.02

-1.84

4.16

-1.95

R-Sq = 46.7%

P

0.055

0.078

0.000

0.063

R-Sq(adj) = 39.7%

Analysis of Variance

Source

Regression

Residual Error

Total

Source

C12

C13

C14

DF

1

1

1

DF

3

23

26

SS

55632421

63506828

119139249

MS

18544140

2761166

F

6.72

P

0.002

Seq SS

4080932

41004363

10547126

Unusual Observations

Obs

15

19

20

C12

-0.120

-0.970

0.250

C11

7386

-4231

-2682

Fit

2415

-2927

536

SE Fit

636

1190

825

Residual

4971

-1304

-3218

St Resid

3.24R

-1.13 X

-2.23R

R denotes an observation with a large standardized residual.

X denotes an observation whose X value gives it large leverage.

Durbin-Watson statistic = 1.38324

Note: The Durbin Watson Statistics 𝐷𝑊 = 1.38324

With alpha 0.01 𝑑𝐿 = 1.20, 𝑑𝑈 = 1.41. The value 𝑫𝑾 < 𝒅𝑳 , so there is still possitive

correlation in the difference model. Now, we check the residual autocorrelations for the

first few lags.

From the plot ACF indicates that they are well within their two standard error limits(the dashed

lines in the figure) for the first few lags.

Conclusion : The serial Correlation has been eliminated and Raymond will use the fitted

equation for forecasting.

The final model:

y = - 864 - 8484 X1 + 34640 X2 - 271 X3

3. Transform the model into Ln

Regression Analysis: C22 versus C23, C24, C25

The regression equation is

C22 = - 0.0205 - 0.118 C23 + 1.21 C24 - 0.137 C25

27 cases used, 1 cases contain missing values

Predictor

Constant

C23

C24

C25

Coef

-0.02051

-0.1178

1.2081

-0.1371

S = 0.0457880

SE Coef

0.01214

0.3354

0.4220

0.3121

R-Sq = 36.7%

T

-1.69

-0.35

2.86

-0.44

P

0.105

0.729

0.009

0.665

R-Sq(adj) = 28.4%

Analysis of Variance

Source

Regression

Residual Error

Total

Source

C23

C24

C25

DF

1

1

1

DF

3

23

26

SS

0.027908

0.048221

0.076128

MS

0.009303

0.002097

F

4.44

P

0.013

Seq SS

0.002755

0.024748

0.000405

Unusual Observations

Obs

15

C23

-0.037

C22

0.17388

Fit

0.03258

SE Fit

0.01278

Residual

0.14129

St Resid

3.21R

R denotes an observation with a large standardized residual.

Durbin-Watson statistic = 1.53713

DW>Du, No Autocorrelation.

4. Model Autoregressive

Using software E-views we get the model autoregressive

Explanation:

Because we use lagged data so, we can’t using Durbin watson statistics to test the

autocorrelation. So, we must use Durbin Watson h.

h 1

d

2

N

1 - N Var 3

ℎ = (1 −

1.379333

27

)√

= −0.00412

2

1 − 27(−8466)

Conclusion for h statistics :

1. if h > 1,96 so there is possitive autocorrelation.

2. If h < -1,96 so there is possitive autocorrelation

3. If h-statistic between -1,96 dan +1,96 { -1,96 ≤ h ≤ 1,96 } , there is no autocorrelation

Because h-statistics between -1,96 and 1,96, so there is no autocorrelation.

Memo To Paul

1. For the best prediction you must using model difference, ln difference or model

autoregressive, because the model out of autocorrelation. It’s good to forecast.

2. The best model is Autoregressive model because the R-square adjusted up to 91 %, it

mean, 91 % variability can explained by the model.

3. The best model

𝒚 = −𝟏𝟖𝟓𝟓𝟏𝟔. 𝟐 − 𝟖𝟒𝟔𝟔𝑿𝟏 + 𝟑𝟒𝟕𝟗𝟕𝑿𝟐 − 𝟐𝟔𝟗. 𝟕𝑿𝟑 + 𝟎. 𝟗𝟗𝟓𝑨𝑹(𝟏)

13. Thompson Airlines has determined that 5% of the total number of U.S. domestic airline

passengers fly on Thompson planes. You are given the task of forecasting the number of

passengers who will fly on Thompson Airlines in 2004. The data are presented in Table P13.

a.

Develop a time series regression model, using time as the independent variable and the

number of passengers as the dependent variable.

b.

Are the error terms for this model dipersed in a random manner?

c.

Transform the number-of-passengers variable so that the error terms will be randomly

dispersed.

d.

Run a computer program for the transformed model developed in part c.

e.

Are the error terms independent for the model run in part d.

f.

If the error terms are dependent, what problems are involved with using this model?

g.

Forecast the number of Thompson Airlines passengers for 2004.

Solutions:

Table P-13

Number of

Year

Passengers

Ln Year

Ln Passengers

(thousands)

Difference Ln

Difference Ln

Year

Passengers

1979

22.8

7.59035

3.12676

-

-

1980

26.1

7.59085

3.26194

0.0005052

0.135175

1981

29.4

7.59136

3.38099

0.0005049

0.119059

1982

34.5

7.59186

3.54096

0.0005047

0.159965

1983

37.6

7.59237

3.62700

0.0005044

0.086045

1984

40.3

7.59287

3.69635

0.0005042

0.069347

1985

39.5

7.59337

3.67630

0.0005039

-0.020051

1986

45.4

7.59388

3.81551

0.0005037

0.139211

1987

46.3

7.59438

3.83514

0.0005034

0.019630

1988

45.8

7.59488

3.82428

0.0005031

-0.010858

1989

48.0

7.59539

3.87120

0.0005029

0.046917

1990

54.6

7.59589

4.00003

0.0005026

0.128833

1991

61.9

7.59639

4.12552

0.0005024

0.125486

1992

69.9

7.59689

4.24707

0.0005021

0.121545

1993

79.9

7.59740

4.38078

0.0005019

0.133710

1994

96.3

7.59790

4.56747

0.0005016

0.186692

1995

109.0

7.59840

4.69135

0.0005014

0.123880

1996

116.0

7.59890

4.75359

0.0005011

0.062242

1997

117.2

7.59940

4.76388

0.0005009

0.010292

1998

124.9

7.59990

4.82751

0.0005006

0.063632

1999

136.6

7.60040

4.91706

0.0005004

0.089544

2000

144.8

7.60090

4.97535

0.0005001

0.058297

2001

147.9

7.60140

4.99654

0.0004999

0.021183

2002

150.1

7.60190

5.01130

0.0004996

0.014765

2003

151.9

7.60240

5.02322

0.0004994

0.011921

Regression Analysis: passengers versus Year

The regression equation is

passengers = - 11830 + 5.98 Year

Predictor

Constant

Year

Coef

-11829.7

5.9813

S = 11.0171

SE Coef

608.4

0.3056

R-Sq = 94.3%

T

-19.44

19.58

P

0.000

0.000

R-Sq(adj) = 94.1%

Analysis of Variance

Source

Regression

Residual Error

Total

DF

1

23

24

SS

46509

2792

49300

MS

46509

121

F

383.18

Durbin-Watson statistic = 0.158667

a. Model:

passengers = - 11830 + 5.98 Year

P

0.000

b. Probability normal Plot

It looks that the residuals normal

The residual have the pattern, it looks have some trend. It is not random, so there is

autocorrelation. Error dependent.

So the error terms not dispersed in random manner.

c. We try to transform model to Ln.

Regression Analysis: C8 versus C7

The regression equation is

Ln y = - 5.21 + 10539 ln x

24 cases used, 1 cases contain missing values

Predictor

Constant

C7

Coef

-5.215

10539

S = 0.0564879

SE Coef

3.316

6603

T

-1.57

1.60

R-Sq = 10.4%

P

0.130

0.125

R-Sq(adj) = 6.3%

Analysis of Variance

Source

Regression

Residual Error

Total

DF

1

22

23

Unusual Observations

SS

0.008130

0.070200

0.078329

MS

0.008130

0.003191

F

2.55

P

0.125

Obs

7

16

C7

0.000504

0.000502

C8

-0.0201

0.1867

Fit

0.0963

0.0723

SE Fit

0.0158

0.0123

Residual

-0.1163

0.1144

St Resid

-2.15R

2.07R

R denotes an observation with a large standardized residual.

Durbin-Watson statistic = 1.21315

With n=25, k=1, alpha=0.01, we get 𝑑𝐿 = 1.037, 𝑑𝑈 = 1.119. Because 𝐷𝑊 =

1.21315 > 1.119 the model effective to eliminate autocorrelation.

Versus Fits

(response is C8)

0.10

Residual

0.05

0.00

-0.05

-0.10

-0.15

0.05

0.06

0.07

0.08

Fitted Value

0.09

0.10

After we do regression difference ln y and difference ln x we get the random model.

Model Regression :

Difference ln y = - 5.21 + 10539 difference ln x

d. Have been done in part c

e. Yes the error independent, because there is no indicates autocorrelation

f. Because the error have been independent, so the question can’t be answered.

g. Forecast for 2004

0.11

ln 𝑦 = −5.21 + 10539 (𝑙𝑛2004 − 𝑙𝑛2003) + 𝑙𝑛151.9

= −5.21 + 10539(7.6029 − 7.6024) + 5.023

𝑦 = 𝑒 5.0825 = 𝟏𝟔𝟏. 𝟏𝟕𝟔

So, the forecast for 2004 is 161.176 thousands passengers