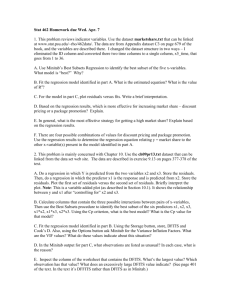

Chapter 12 Minitab Instructions

advertisement

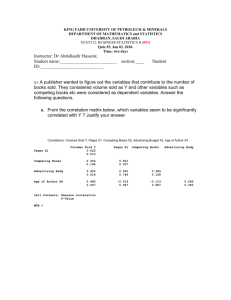

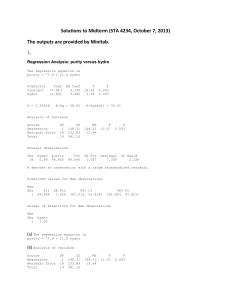

Chapter 12 Minitab Instructions Constructing a Scatterplot with Trendline A. (Replicating 12.2) Copy and paste the data labeled Debt_Payments from the text website into a Minitab spreadsheet. B. From the menu choose Graph > Scatterplot > With Regression. Select Debt as Y variables and select Income as X variables. Click OK. C. Minitab shows the following graph. Double-click on title and/or axes titles to make any necessary edits. 1 Scatterplot with a superimposed trend line 1300 Debt payments ($) 1200 1100 1000 900 800 700 60 70 80 90 Income ($1,000s) 100 110 Simple Linear Regression A. (Replicating Example 12.2) Copy and paste the data labeled Debt_Payments from the text website into a Minitab spreadsheet. B. From the menu choose Stat > Regression > Regression. Select Debt as Response and select Income as Predictors. Click OK. 2 C. Minitab reports the following output. Regression Analysis: Debt versus Income The regression equation is Debt = 210 + 10.4 Income Predictor Constant Income Coef 210.30 10.441 S = 63.2606 SE Coef 91.34 1.222 R-Sq = 75.3% T 2.30 8.54 P 0.030 0.000 R-Sq(adj) = 74.2% Analysis of Variance Source Regression Residual Error Total DF 1 24 25 SS 292137 96046 388182 MS 292137 4002 F 73.00 P 0.000 Unusual Observations Obs 1 Income 104 Debt 1285.0 Fit 1291.0 SE Fit 38.1 Residual -6.0 St Resid -0.12 X X denotes an observation whose X value gives it large leverage. 3 Multiple Regression A. (Replicating Example 12.3) Copy and paste the data labeled Debt_Payments from the text website into a Minitab spreadsheet. B. From the menu choose Stat > Regression > Regression. Select Debt as Response and select Income and Unemployment as Predictors. Click OK. C. Minitab reports the following output. Regression Analysis: Debt versus Income, Unemployment The regression equation is Debt = 199 + 10.5 Income + 0.62 Unemployment Predictor Constant Income Unemployment Coef 199.0 10.512 0.619 SE Coef 156.4 1.477 6.868 S = 64.6098 R-Sq = 75.3% T 1.27 7.12 0.09 P 0.216 0.000 0.929 R-Sq(adj) = 73.1% Analysis of Variance Source Regression Residual Error Total Source DF 2 23 25 DF SS 292171 96012 388182 MS 146085 4174 F 35.00 P 0.000 Seq SS 4 Income Unemployment 1 1 292137 34 Unusual Observations Obs 1 23 Income 104 70 Debt 1285.0 832.0 Fit 1290.9 942.5 SE Fit 38.9 39.8 Residual -5.9 -110.5 St Resid -0.11 X -2.17RX R denotes an observation with a large standardized residual. X denotes an observation whose X value gives it large leverage. 5