Gillan

advertisement

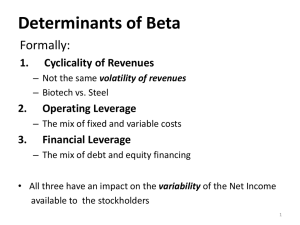

Cashman Capital Structure 1.MacroHard has 10 million shares outstanding each selling at $22.50 per share. The market value of debt represents 30% of the firm’s capital structure and the yield to maturity on debt is 12%. The corporate tax rate is 30%. a) What is the market value of equity, the market value of debt, and the market value of the whole firm? MV(E) = 225 million MV(D) = .3(V) → MV(E) = .7(V) 225 = .7(V) → V = 225/0.7 V = 321.43 So MV(D) =.3(321.43) MV(D) = 96.43 b) Assume the firm’s levered cost of equity is 16%. What is the firm’s weighted average cost of capital (WACC)? D E rD 1 Tc rE DE DE 96.43 225 0.121 .3 0.16 321.43 321.4 0.0252 0.112 rW ACC rW ACC rW ACC rW ACC 13.72% c) Assume the firm’s levered cost of equity is 16%. What would the firm’s weighted average cost of capital (WACC) be if it were all-equity financed? Explain why the allequity cost of capital is the same, higher, or lower than the levered firm’s weighted average cost of capital. D rE rA (rA rD )(1 TC ) E 96.43 (rA 0.12)(1 0.3) 225 0.16 rA 0.4285778(rA 0.12)(0.7) Lower as we are decreasing the risk to shareholders 0.16 rA 0.30000444(rA 0.12) 0.16 rA 0.16 1.30000444rA 0.036 0.196 1.30000444rA rA 15.10% 2. Slo Co. currently has an equity beta of 2.84, is financed with 10% debt (and 90% equity) and has a total firm value of $10 billion. Slo’s CFO thinks that they should increase the firm’s leverage by issuing $2 billion of debt and buying back $2 billion of equity. This debt will be perpetual and have yield of 7%. The expected return on the market is 13% and the risk free rate is 3%. Slo has a 35% tax rate. What is Slo’s value after the swap, and how much of that value will be equity? Increase value = PV(Tax Shields) = 0.35*(2 billion) = .7 billion (or 700 million) So, the balance sheet is Before swap D= 1 E= 9 V=10 Therefore, E must equal V-D = 7.7. After swap: D=3 E=? V=10.7 (Old value of 10 + .7 PV of tax shields) 3. Pages.com is a publishing company, with an equity beta of 1 and a debt-to-equity ratio of 1. The firm is considering a new line of business, making movies of its books. They have found a company – Films, Inc. – that only makes movies, has a debt-to-equity ratio of 2 and an equity beta of 1.8. Films, Inc. has zero-coupon bonds outstanding, which trade at 400 (face value of 1,000) and have 10 years remaining to maturity. Pages.com believes it can borrow at a similar cost to that of Films, Inc. The risk free rate is 6%, and the market risk premium is 6%, what discount rate should Pages.com use on its movie projects (assuming they maintain their current capital structure)? The tax rate is 40%. We need to find the assets beta of Films, so first we need to find Film’s debt beta N = 10; I/Y = ? ; PV = 400; PMT = 0; FV = 1,000 I/Y = 9.596% 0.09596 = 0.06 + Beta Debt * 0.06 0.03596 = Beta Debt * 0.06 Beta Debt = 0.59933 Now we need to find Film’s asset beta Beta equity = Beta Assets + (D/E*)(Beta Assets – Beta Debt)*(1-Tc) 1.8 = Beta Assets + (2) (Beta Asset – 0.59933) (1-0.4) 1.8 = Beta Assets + 1.2*(Beta Assets -0.59933) 1.8 = Beta Assets + 1.2*Beta Assets – 0.7192 2.5192 = 2.2*Beta Assets Beta Assets = 1.145 This 1.145 represents the systematic risk of the making movies, however if Pages expands into this area it will have to account for its own level of financial risk so Beta equity = Beta Assets + (D/E*)(Beta Assets – Beta Debt)*(1-Tc) Beta Equity Beta Equity Beta Equity Beta Equity = 1.145 + (1) (1.145 – 0.59933) (1-0.4) = 1.145 + 0.6*(0.54567) = 1.145 + 0.3274 = 1.4724 Cost of equity E(R) =0.06 + 1.4724(0.06) E(R) = 14.834% Cost of debt is the same as Films: 9.596% After tax this is 9.6(1-0.4) = 5.76 WACC = 0.5(0.0576) + 0.5(0.14834) = 10.297% 4. Suppose the risk free rate is 3%, and the expected return on the market is 8%. GM’s market value of equity is 19.4 billion, they have 0.566 billion shares outstanding, and the market value of debt is 219 billion. Suppose GM were to replace $25 billion of debt by issuing $25 billion of equity (and that this swap would be in perpetuity). Assume that GM has an equity beta of 1.3, a tax rate of 20%, and a cost of debt equal to 8%. What would the total value of GM be after the swap? Debt would go from 219 to 194 =219-25 The equity holders would lose the tax shield → TcD = .2(25 Bill) = 5 Billion. So the existing equity would fall to 14.4 = 19.4 – 5. At the same time, we’re adding $25 billion in equity, → 14.4 + 25 = 39.4 The total value of the firm would be 39.4 + 194 = 233.4. V new = V old – PV (lost tax shields) = 238.4 – 5 = 233.4 5. The Mandem Co., has a debt to equity ratio of .45. The firm’s required return on unlevered equity is 17%, and the pre-tax cost of debt is 9%. Sales revenues are expected to be $23.5 million in perpetuity and variable costs are expected to be 60% of sales. The tax rate is 40%, and the company pays out all earnings as dividends at the end of each year. If the company were financed only by equity, what would it be worth? Revenues VC @ .6 Tx @ .4 23.5 14.1 9.4 3.76 5.64 Cash flow to the unlevered firm. Value = C/r = 5.64/.17 = 33.176 6. Your friend Toni, is interning in the CFO’s office at Frys. Shares of Frys are currently trading at $22, and the firm has 800 million shares outstanding. Toni estimates that Frys beta is 0.04; the current yield-to-maturity on T-Bills is 1.7%, and the market risk premium is 9.5%. Using this information, according to the CAPM, the cost of equity for Frys is: 1.7% + 0.04 (9.5%) = 2.08%. Further, based on their latest balance sheet, Frys’ long-term debt is $10 billion, and the book value of equity is $3.2 billion. The firm’s debt is currently selling at 95% of par ($1,000) and has a yield-to-maturity of 7%. Fry’s marginal tax rate is 35%. Toni calculates Frys’ after-tax weighted average cost of capital as 3.95% based on the following: E rS D rB 1 TC rW ACC ED ED 3.2 0.0208 10 0.07 1 0.35 0.0395 13.2 13.2 a) Carefully assess Toni’s analysis leading to the WACC and identify any potential problems with the analysis. If those problems involve a calculation, show what calculation you would use as an alternative. (5 points) The problem is that Toni is using book values not market values. Calculation should be: E = 22 * 800m = 17,600m D = 10,000m * 0.95 = 9,500m V = 1,760m + 9,500m = 27,100m WACC = (17,600/27,100)*(0.0208) + (9,500/27,100)*(0.07)*(1-0.35) = 2.9459% b) If Fry’s were to increase their debt level, would the shareholders’ required return change? Explain. (5 points) The shareholders would require a higher return on their investment as the risk of their claim on the company has increased. This makes sense as shareholders are residuals claimants, as we increase the level of debt we are exposing them to more risk, and thus their required return increases.