Financial Management

advertisement

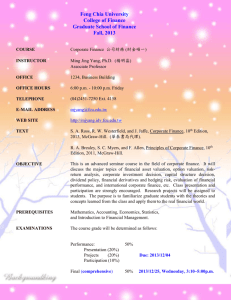

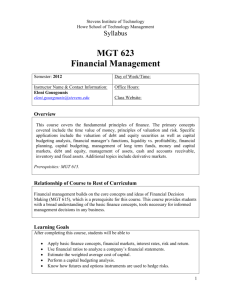

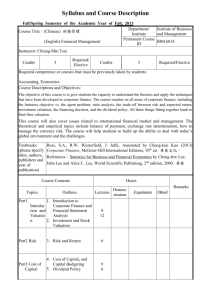

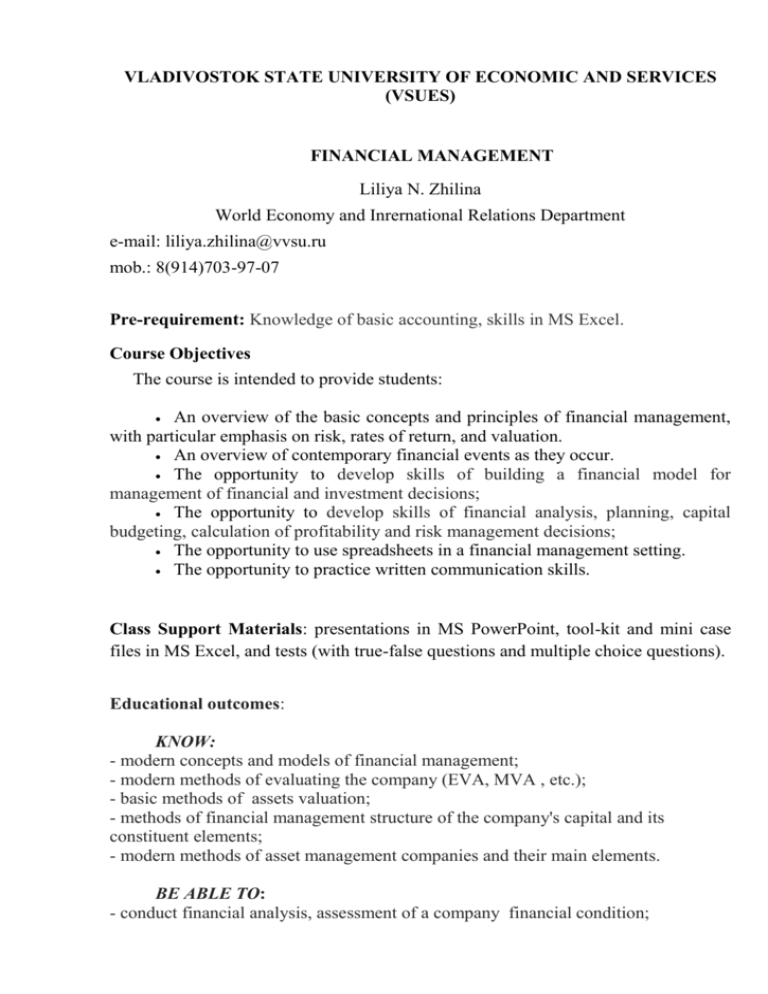

VLADIVOSTOK STATE UNIVERSITY OF ECONOMIC AND SERVICES (VSUES) FINANCIAL MANAGEMENT Liliya N. Zhilina World Economy and Inrernational Relations Department e-mail: liliya.zhilina@vvsu.ru mob.: 8(914)703-97-07 Pre-requirement: Knowledge of basic accounting, skills in MS Excel. Course Objectives The course is intended to provide students: An overview of the basic concepts and principles of financial management, with particular emphasis on risk, rates of return, and valuation. An overview of contemporary financial events as they occur. The opportunity to develop skills of building a financial model for management of financial and investment decisions; The opportunity to develop skills of financial analysis, planning, capital budgeting, calculation of profitability and risk management decisions; The opportunity to use spreadsheets in a financial management setting. The opportunity to practice written communication skills. Class Support Materials: presentations in MS PowerPoint, tool-kit and mini case files in MS Excel, and tests (with true-false questions and multiple choice questions). Educational outcomes: KNOW: - modern concepts and models of financial management; - modern methods of evaluating the company (EVA, MVA , etc.); - basic methods of assets valuation; - methods of financial management structure of the company's capital and its constituent elements; - modern methods of asset management companies and their main elements. BE ABLE TO: - conduct financial analysis, assessment of a company financial condition; - build operating forecast and free cash flow (OCF, FCF) of a company; - calculate cost of capital of a company; - carry out planning and analysis of long-term investment decisions; - evaluate decisions based on the time value of money and risk; - develop the financial strategy of a company current asset management. OWN BY: - understanding financial markets functioning; - skills of gathering financial information on a company and its industry; - skills for calculating the financial model parameters; - skills to rationalize a company capital structure; - methods of financial planning and budgeting ; - basic methods of financial risk analysis. COURSE CONTENTS 1. Overview of Financial Management (2 hours) Structure of National Financial System. What questions does financial management seek to answer. Career Opportunities in Finance. Principles of Financial Management. System View on the Basic Concepts of FM. Forms of business organization. Goals of the corporation. Agency relationships. 2. Financial Environment: Markets and Institutions (2 hours) Types of Financial markets. Markets for financial assets. Money versus capital markets. Primary versus secondary markets. Spot versus future markets. Types of financial institutions. Determinants of interest rates. Factors that affect the cost of money. Real and nominal rates. Yield curves. The Pure Expectations Hypothesis. 3. Financial Statements Analysis and Forecasting (4 hours) Balance sheet. Income statement. Statement of cash flows. Accounting income versus cash flow. Market value added (MVA) and Economic value added (EVA). Ratio analysis. Du Pont system. Effects of improving ratios. Limitations of ratio analysis. Qualitative factors. Plans: strategic, operating, and financial. Pro forma financial statements. Steps in financial forecasting. Sales forecasts. Percent of sales method. Additional funds needed (AFN) formula. 4. Risk and Return. CAPM-model (2 hours) Basic return/risk concepts: investment returns, investment risk. Investment risk measures: standard deviation, coefficient of variation. Stand-alone risk. Portfolio (market) risk. Company specific (Diversifiable) risk. Risk and return: Capital Assets Pricing Model (CAPM) / Security Market Line (SML). Beta’s calculating. Expected versus Required Returns. 5. Cost of Capital. WACC model (2 hours) Cost of Capital Components: debt, preferred, common Equity. After-tax capital costs. Cost of preferred stock. Ways that companies can raise common equity. Three ways to determine the cost of equity, ks: CAPM, DCF, Own-BondYield-Plus-Risk Premium. WACC model. 6. Time Value of Money (2 hours) Time lines and cash flows: lump sum, uneven CFs, ordinary annuity, annuity due. Future value (FV): compounding. Present value (PV): discounting. Excel functions for FV, PV. Special Excel functions for annuities. Rates of return: nominal, periodic, effective. Financial amortization schedule in Excel. 7. Basic Model of Capital Assets Valuation: Discounted Cash Flows. Bonds and Stocks Valuation (2 hours) Key features of bonds: par value, coupon interest rate, maturity, issue date, default risk. Deferred call and a declining call premium. Bond valuation. Measuring yield: current yield and capital gains yield. Assessing risk. Factors that affect default risk and bond ratings. Features of common stock. Approaches for valuing of common stock: dividend growth model, using the multiples of comparable firms, free cash flow method. Efficient markets. Preferred stock. 8. Corporate Valuation and Value-Based Management (4 hours) Operating and nonoperating assets, Value of operations. Value of nonoperating assets. Claims on corporate value. The Corporate valuation model. Constant Growth formula. Value of Equity. Breakdown of corporate Value. Nonconstant growth and horizon Value. Value-Based Management. MVA and the Four Value Drivers. Corporate Governance. 9. Capital Budgeting. Cash Flow Estimation and Risk Analysis (4 hours) The concept of capital budgeting. Independent and mutually exclusive projects. Steps of capital budgeting. CFs estimation. Riskiness of CFs assessing. WACC for project. Capital rationing: NPV, IRR, MIRR, payback periods. Excel calculations. Cash flow estimation: relevant cash flows, working capital treatment, inflation. Risk Analysis: sensitivity analysis, scenario analysis, and simulation analysis. 10. Current Asset Management (2 hours) Gross working capital, total current assets. Alternative working capital policies. Cash Conversion Cycle. Cash management. Ways to Minimize Cash Holdings. Inventory management. Accounts receivable management. Textbook: Fundamentals of Financial Management, 12th edition. Eugene F. Brigham, Joel F. Houston, South-Western Cengage Learning, 2009. (Free PDF copy) Internet sites: http://www.wikiwealth.com/company http://www.mckinsey.com/client_service/corporate_finance http://www.managementstudyguide.com/financial-management.htm