June 2013 - Valley Hills Federal Credit Union

advertisement

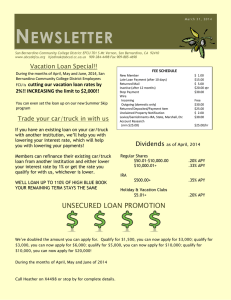

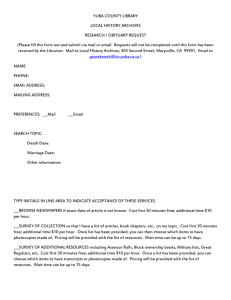

June 30, 2013 N EWSLETTER San Bernardino Community College District EFCU 701 S Mt Vernon, San Bernardino, CA 92410 www.sbccdefcu.org hjedinak@sbccd.cc.ca.us 909-384-4498 Fax 909-885-4690 We’ve Lowered Our Car/Truck Loan Rates!! Both new and used Car/Truck Loan rates have dropped to as low as 1.99%*, with terms up to 84 months. If you’re in the market to buy a car, SBCCDEFCU is the place for you! *Rates are based on TransUnion FICO score At San Bernardino Community College District Employees Federal Credit Union, our goal is to make it possible to offer you financial services you need; to expect convenience; build your wealth; protect your assets; and fulfill your dreams. That’s why we have partnered with Real Estate Mortgage Network, or REMN, one of the best mortgage providers serving our market. Founded in 1989, Real Estate Mortgage Network, Inc. serves the lending needs of home buyers and home owners, real estate professionals and builders across the country. REMN has home financing programs for conventional, FHA, VA, Remodeling, First Time Home Buyers, Investment Properties, JUMBO and much more. Their Representatives ensure that they find the right mortgage that fits your needs. They closely monitor the loan process to make your buying experience convenient and an enjoyable one. They are committed to providing superior customer service, competitive rates, combined with excellent problem-solving skills, making the difference in potential borrowers becoming home owners. To take advantage of this www.remn.com/jeremykearney. great service, call Jeremy Kearney at 951.571.5265, or 2nd Quarter 0% Loan Drawing Winner Congratulations to Anquanetta May, winner of our 0% loan drawing for loans funded in the second quarter of 2013. “Thank you San Bernardino Community College District Employees Federal Credit Union. You were there when I needed you the most. The loan I applied for was a pain free process versus the hassles you get from your community banking institution. Paper work was easy to understand and Heather Jedinak was a great help.” visit Page 2 Newsletter Summer Hours Dividends as of July 1, 2013 Regular Shares $50.00-$10,000.00 $10,000.01+ .20% APY .33% APY Valley College: M, W, TH: 9:00-12:00 and 1:30-5:00 Closed Tuesdays and Fridays .35% APY At Valley College, the credit union is located in the Liberal Arts building, room 122. IRA $500.00+ Holiday & Vacation Clubs $5.00+ .20% APY Through August 3rd, 2013, the summer hours for the credit union are: Crafton Hills College: Tues 2:00-3:30 At Crafton Hills College, the credit union is located in the LADM building, room 161. BEGINNING JULY 9, 2013 FEE SCHEDULE New Member Late Loan Payment (after 10 days) Returned Mail Inactive (after 12 months) Stop Payment Wire Incoming Outgoing (domestic only) Returned Deposited/Payment Item Unclaimed Property Notification Levies/Garnishments-IRA, State, Marshall, Etc Account Research (min $25.00) $ 1.00 $15.00 $ 5.00 $20.00 qtr $30.00 Free $30.00 $25.00 $ 2.00 $30.00 District Offices: 2nd Tues of the month 9:00-10:30 At the District, the credit union is located in conference room 2. Coming Soon-VISA Gift Cards SBCCDEFCU has just entered into an agreement to offer its members VISA gift cards. $25.00/hr Watch your college e-mail for our live date, estimated August 1, 2013. Loadable from $10.00 to $1,000.00. Stop Junk Mail and Telemarketing* . Continue to Go Green in 2012, by eliminating junk mail and telemarketing calls. About 62 million trees and 25 billion gallons of water are used to produce a typical year’s worth of junk mail in the U.S. Here’s how you can stop the steady flow of unwelcome mail and telemarketers: • Call the Consumer Credit Bureau’s Main opt-out line at (888) 567-8688 to discontinue receiving junk mail for two years. • Call Experian’s Consumer Services at (402) 458-5247 to remove your name from non-credit offers such as samples, coupons, catalogs, and flyers. • Contact the Direct Marketing Association (DMA) to opt-out at Mail Preference Service at P.O. Box 282, Carmel, NY 10512 or use the DMA Mailing List web form at www.DMAChoice.org. • For telemarketers, you can state “Put me on your do-not-call list” when they call. • For unwanted mail, write to the company or call them at their “800” number requesting that your name and address be removed from their mailing list, or write that request in the postage-paid envelope inside the solicitation. These methods can work for you, but be patient. It may take three to six months before you see a decrease in your junk mail. Source: http://www.fightidentitytheft.com/junkmail.htm Your Credit Union Officials BOARD OF DIRECTORS Yendis Battle-President Manuel Loera-Vice President Mark Williams-Secretary Baybie Scudder-Treasurer Kenn Couch-Director SUPERVISORY COMMITTEE Martha Camacho-Kelly-Chairperson Noemi Elizalde-Member Dan Kelly-Member Heather Jedinak-Manager