CIS200 * Homework #1 * Simple Formulas & Functions

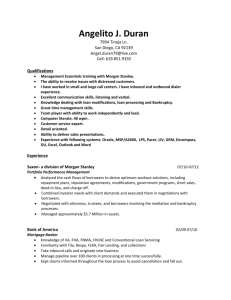

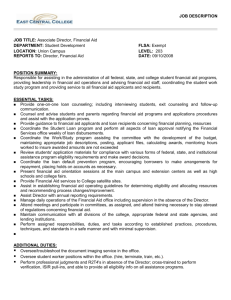

advertisement

Practice Problem 7.2: Mortgage Loan Analysis A B 1 2 3 Purchase Price 4 5 Option# 6 1 7 2 8 3 9 4 10 5 11 6 12 7 Down Payment 10% 20% 5% 10% 20% 10% 20% C D E F G H I J K L Loan Analysis Worksheet $ 250,000 Nominal Actual Interest Duration Loan Monthly Amount Rate/yr (yrs) Payment Borrowed Points Fees Value 8.50% 30 2 350 225,000 ($1,730.06) 220,150 8.25% 30 2 350 200,000 ($1,502.53) 195,650 8.90% 30 2 350 237,500 ($1,893.91) 232,400 9.00% 30 0 0 225,000 ($1,810.40) 225,000 8.50% 30 0 0 200,000 ($1,537.83) 200,000 8.00% 15 1 350 225,000 ($2,150.22) 222,400 7.60% 15 1 350 200,000 ($1,865.41) 197,650 APR 8.74% 8.49% 9.14% 9.00% 8.50% 8.19% 7.79% Payment with Balloon Option# ($1,724.00) 1 ($1,496.16) 2 ($1,888.34) 3 ($1,804.94) 4 ($1,531.77) 5 ($2,121.32) 6 ($1,835.47) 7 You are about to buy your first home and have just met with several banks to discuss financing. At the end of a very long day you totally confused. So like all good CIS200 students you’ve decided to create a spreadsheet to analyze the problem. You have listed the purchase price of the home and the different values for each of the loan variables. Down Payment – the amount of money you will pay at the time you purchase your home. The difference between the sale price and your down payment is the face value of your mortgage loan. Points – these are additional charges banks sometimes require you to pay when you take out a mortgage. Banks usually offer mortgage loans in a variety of interest rate and point combinations. Frequently you will find that the higher the points the lower interest rates. One point equals one percent of the loan value – so 1 point on a $7500 loan is $75. Fees – these are additional amounts the banks charge when taking out a mortgage. These amounts vary by bank and loan type. Typical types of charges are application fees, appraisals fees, credit report fees etc. When answering the questions below please use cell references wherever possible in your answers. Only part of the spreadsheet you have created in shown above. For some questions you will be writing formulas for cells not shown. 1. Write an Excel formula in cell G6, which can be copied down the column, to calculate the face value of the mortgage – the purchase price of your new home less the down payment. =C$3 – B6 * C$3 ALSO C$3 * (1- B6) 2. Write an Excel formula in cell H6, which can be copied down the column, to calculate the mortgage payment for this loan amount (G6) over the duration of the loan at the nominal interest rate per year indicated. Assume the loan is compounded monthly. =PMT(C6/12,D6*12,G6) 3. Write an Excel formula in cell I6, which can be copied down the column, to calculate the actual amount you will borrow after the points and fees have been deducted. =G6-0.01*E6*G6-F6 4. To take these fees into account your lender is required by law to tell you the APR of your loan actual percentage rate of interest being charged. The APR calculation should be based on the payments you calculated in column H and actual amount borrowed that you calculated in column I, and the duration of the loan (compounded monthly). Write an Excel formula in cell J6, which can be copied down the column, to calculate the rate (APR) actually being charged for this mortgage. =12*RATE(D6*12, H6, I6) 5. The loan in Option 1 and the loan in Option 4 require the same down payment and are for the same duration. The interest rates and points vary. Which mortgage would you be better off with if plan on owning your home for the next 30 years, and which mortgage would you be better off with if you plan on only owning this home for the next 2 years. (Explain) If you own the home the full term of the mortgage then you are over the years paying the APR of the loan. Thus the lower APR rate loan (option 1) would be cheaper. If you sell the house after only two years you would still have spend the points and fees and not made up for it by lower payments over the two year time span. So in the case of selling after two years you are better off with Option 4. 6. Write an Excel formula in cell L14 (not shown) to determine which payment option has the lowest APR? =VLOOKUP(MIN(J6:J12),J6:L12,3,FALSE) 7. Using the nominal interest rate and face value of the loan determine the new monthly loan payment if you altered the loan to include a $10,000 balloon payment at the end of the loan duration. Write your Excel formula in cell K6 and assume it will be copied down the column. =PMT(C6/12, D6*12,G6, -10000) 8. The seller has offered you a private loan for 80% of the value of the house. They want you to pay $8000 per quarter for the next 10 years. Write an Excel formula, in cell L15 (not shown) to determine the annual interest rate they are charging. =4*RATE(10*4,-8000,0.8*C3) 9. You are negotiating with the seller and tell him you are willing to pay $5000 per quarter at 7.5 % interest per year compounded quarterly. You will borrow everything but a 5% down payment. Write an Excel formula in cell L16 (not shown) to determine how many years will it take to pay off the loan? =NPER(0.075/4,-5000,0.95*C3)/4 10. Eight years ago, for your college graduation present, your Mom gave you a bank CD worth $10,000. The CD earns 7.25% annual interest compounded yearly. Write an Excel formula in cell L17 (not shown) to determine (True/False) if you have sufficient funds from this CD for Option 1’s down payment? =FV(0.0725,8,,-10000)>=B6*C3