assignment 1

advertisement

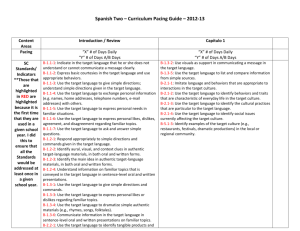

ASSIGNMENT 1 ACCOUNT RECEIVABLE AND CREDIT SALES APPLE BLOSSOM COLOGNE COMPANY SUBSTANTIVE AUDIT PROCEDURES: ACCOUNTS RECEIVABLE AND BAD DEBTS To begin your substantive audit work in the accounts receivable area, you obtain an aged trial balance from Don McKenna. This schedule is included in the working papers with this assignment section referenced B-1. Your may assume that you can check the aged trial balance with the accounts receivable subsidiary ledger and that the subsidiary ledger supports the aged trial balance as to both amounts due and age of accounts. On Monday, January 3, with the client’s assistance, you prepared and mailed both positive and negative accounts receivable confirmations. Positive confirmations were sent to five customers, as follows: (1) Frankie’s Floral Fragrances, (2) Tears and Doefall Company, (3) Anne Charlotte Cosmetics, (4) Young and Beautiful, and (5) Darings. Negative confirmations were mailed to all other customers with an accounts receivable balance. The confirmation from Capitol Odors was returned by the post office because of inability to deliver. You have received replies on all of the positive confirmations and no replies to the negative negative confirmations. The positive confirmations are referenced B-2 through B-4. Upon checking with John Roberts, you learn that a $1.450 credit should have been issued to Anne Charlotte Cosmetics but the credit was never posted. You have also discussed the delinquent accounts with John Roberts, and he had the following comments about those customers and their paying habits: Alpha Aroma Good account Anne Charlotte Cosmetics Credit of $1.450 should be allowed Bobell Beauty Supply Never been delinquent before Body Bar Slow paying, good account Capitol Odors Probably will collect nothing Cut-Rate Discount Stores Slow paying, but has always paid Darings Established company, good pay Inceses, Inc Never been delinquent before Janis Dept. Store Slow paying, good account Rausch’s Department Store Good account John Robert indicated that he had spoken with both Parker Shelton, controller, and Ellen Jacobs, sales manager, about the delinquent Capitol Odors account. They were in agreement that it should be written off. Account amounting to $11,700 had been written of during the year, you noted that all write-offs were approved by Mr. Roberts. From the cash receipts journal you were able to learn of the following subsequent payments on the accounts receivable balances as of December 31, 2011 Customer Anne Charlotte Cosmetics Body Bar Capitol Odors Payment Amount $30,900 1,850 3,600 Date January 12 January 09 January 14 Cut-Rate Discount Stores Darings Incense, Inc. Janis Department Store Lone Star Supply Rausch’s Department Store Tears and Doefall Company Young and Beautiful 1,800 36,000 6,000 5,200 2,400 3,400 70,000 18,000 Apple Blossom Cologne Company Account Receivable-Aged Trial Balance 31 December 2011 (Prepare By Client) Cutomer Current 30-60 days Alpha Aroma 1,180 900 Anne Charlotte Cosmetics 30,900 1,450 Bobell Beauty Supply 1,460 Body Bar 2,100 800 Capitol Odors Cut-Rate Discount Stores 2,380 1,720 Darings 36,500 7,600 Franscies Floral Flag 22,300 Incense, Inc. 6,300 600 Janis Department Store 4,600 Lone Star Supply 3,290 Rausch’s Department Store 2,700 1,350 Tears and Doefall Company 77,540 William's Fragrances 1,850 Young and Beautiful 23,000 Various Other Accounts 4,830 Total 214,870 20,480 January 07 January 03 January 07 January 03 Janyary 14 January 07 January 03 January 04 60-90 days > 90 days 1,050 800 400 1,250 2,700 800 Total 2,080 32,350 1,460 3,950 800 4,500 44,100 22,300 6,900 5,850 3,290 4,050 77,540 1,850 23,000 4,830 238,850 CONFIRMATION REPLIES – CURRENT YEAR (2011) -----------------------------------------------------------------------------------------------------------------------------------------CONFIRMATION OF ACCOUNTS RECEIVABLE B-2 Confirmation Request No. 1 Anderson, Odds, and Watershed Certified Public Accountants 615 Big City Bank Building Chicago, Illinois Dear Sir, The statement of our account showing a balance of $ 22,300 as of 31/12/2011 is correct except as noted below. Very truly yours, Frankie’s Floral Fragrances, James Whitemore Chief Accountant Date: January 17, 2012 Exceptions: No exceptions -----------------------------------------------------------------------------------------------------------------------------------------CONFIRMATION OF ACCOUNTS RECEIVABLE B-3 Confirmation Request No. 2 Anderson, Odds, and Watershed Certified Public Accountants 615 Big City Bank Building Chicago, Illinois Dear Sir, The statement of our account showing a balance of $ 77,540 as of 31/12/2011 is correct except as noted below. Very truly yours, Tears and Doefall Company William O’Keefe Chief Accountant Date: January 21, 2012 Exceptions: $70,000 payment made prior to December 31, 2011. Balance as of December 31, 2011 should be $7,540 -----------------------------------------------------------------------------------------------------------------------------------------CONFIRMATION OF ACCOUNTS RECEIVABLE B-4 Confirmation Request No. 3 Anderson, Odds, and Watershed Certified Public Accountants 615 Big City Bank Building Chicago, Illinois Dear Sir, The statement of our account showing a balance of $ 32,350 as of 31/12/2011 is correct except as noted below. Very truly yours, Anne Charlotte Cosmetics William Brown Chief Accountant Date: January 17, 2012 Exceptions: We returned $1,450 of merchandise in November. We were promised credit but have not yet received it. -----------------------------------------------------------------------------------------------------------------------------------------CONFIRMATION OF ACCOUNTS RECEIVABLE B-5 Confirmation Request No. 4 Anderson, Odds, and Watershed Certified Public Accountants 615 Big City Bank Building Chicago, Illinois Dear Sir, The statement of our account showing a balance of $ 23,000 as of 31/12/2011 is correct except as noted below. Very truly yours, Young and Beautiful Roger McAdams President Date: January 17, 2012 Exceptions: We only owe $5,000. Balance above is incorrect -----------------------------------------------------------------------------------------------------------------------------------------CONFIRMATION OF ACCOUNTS RECEIVABLE B-6 Confirmation Request No. 5 Anderson, Odds, and Watershed Certified Public Accountants 615 Big City Bank Building Chicago, Illinois Dear Sir, The statement of our account showing a balance of $ 44,100 as of 31/12/2011 is correct except as noted below. Very truly yours, Dearings Rosemary William Chief Accountant Date: January 14, 2012 Exceptions: No exception ----------------------------------------------------------------------------------------------------------------------------------------Excerpt of the above confirmation replies: B-2 Frankie’s Floral Fragrances, balance of $22,300, exceptions: none B-3 Tears and Doefall Company, balance of $77,540, exceptions: $70,000 payment made prior to 12/31/2011, balance as of 12/31/2011 should be $7,540 B-4 Anne Charlotte Cosmetics, balance of $32,350, exceptions: We returned $1,450 of merchandise in November 2011. We were promised credit but have not yet received it. B-5 Young and Beautiful, balance of $23,000, exceptions: We only owe $5,000. Balance above is incorrect. B-6 Darings, balance of $44,100, exceptions: no exceptions. Instructions: 1. Begin with the list of typical Errors or Irregularities below, write your audit program to detect these potential errors or irregularities. a. Sales amounts may have been incorrectly recorded b. Goods may have been shipped but not billed to the customer c. Sales may have been billed to the customer but not shipped d. Sales may have been recorded in the wrong accounting period e. Merchandise may have been sold to customers who were bad credit risks f. Unauthorized sales may have occurred g. Sales may have been posted to the wrong account h. Unauthorized write-offs of receivables may have occurred 2. Begin with the list of assertions below and add others you think appropriate. Then write your audit program to test those assertions. a. None of the accounts receivable are fictitious b. No accounts receivable has been omitted from the balance sheet c. The accounts receivable are collectible in the normal course of business d. The accounts receivable are bona fide claims owed the company e. Pledged accounts receivable or accounts receivable used as collateral are all disclosed. f. Receivables from directors, officers, and affiliates are all separately disclosed. 3. Study the prior year’s working papers, schedules B-1 through B-5. Note the use of “tick marks” to evidence the audit work and the system of cross-referencing the working papers. Perform all required audit work on schedules B-1 through B-6 and prepare schedule B-7 to analyze the allowance account for the current year (2011), performing all appropriate audit work. You have determined that the expected uncollectible percentages from the prior year are still appropriate for the current year. PREVIOUS YEAR (2010) WORKING PAPER CONFIRMATION REPLIES – PREVIOUS YEAR (2010) -----------------------------------------------------------------------------------------------------------------------------------------CONFIRMATION OF ACCOUNTS RECEIVABLE B-2 Confirmation Request No. 1 Anderson, Odds, and Watershed Certified Public Accountants 615 Big City Bank Building Chicago, Illinois Dear Sir, The statement of our account showing a balance of $ 10,500 as of 31/12/2010 is correct except as B-1 noted below. Very truly yours, Frankie’s Floral Fragrances, James Whitemore Chief Accountant Date: January 15, 2011 Exceptions: No exceptions -----------------------------------------------------------------------------------------------------------------------------------------CONFIRMATION OF ACCOUNTS RECEIVABLE B-3 Confirmation Request No. 2 Anderson, Odds, and Watershed Certified Public Accountants 615 Big City Bank Building Chicago, Illinois Dear Sir, The statement of our account showing a balance of $ 840 as of 31/12/2010 is correct except as noted B-1 below. Very truly yours, --------------Date: ________________ Exceptions: Confirmation to Kanine Kaffiures returned by post office unopened. Should write off as bad debt. Ref B-1 for proposed AJE ------------------------------------------------------------------------------------------------------------------------------------------ CONFIRMATION OF ACCOUNTS RECEIVABLE B-4 Confirmation Request No. 3 Anderson, Odds, and Watershed Certified Public Accountants 615 Big City Bank Building Chicago, Illinois Dear Sir, The statement of our account showing a balance of $ 56.250 as of 31/12/2010 is correct except as B-1 noted below. Very truly yours, Tears and Doefall Company William O’Keeefl Chief Accountant Date: January 18, 2011 Exceptions: Traced $43,000 of this amount to January collection recorded in cash receipts journal. B-1 -----------------------------------------------------------------------------------------------------------------------------------------CONFIRMATION OF ACCOUNTS RECEIVABLE B-5 Confirmation Request No. 4 Anderson, Odds, and Watershed Certified Public Accountants 615 Big City Bank Building Chicago, Illinois Dear Sir, x The statement of our account showing a balance of $ 11,750 as of 31/12/2010 is correct except as B-1 noted below. Very truly yours, William’s Fragrance William Brown Chief Accountant Date: January 21, 2011 Exceptions: No exception x traced $9,000 of this amount to January collection recorded in cash receipts journal. B-1 ------------------------------------------------------------------------------------------------------------------------------------------ CONFIRMATION OF ACCOUNTS RECEIVABLE B-6 Confirmation Request No. 5 Anderson, Odds, and Watershed Certified Public Accountants 615 Big City Bank Building Chicago, Illinois Dear Sir, x The statement of our account showing a balance of $ 11,250 as of 31/12/2010 is correct except as B-1 noted below. Very truly yours, Young and Beautiful Roger M Adams President Date: January 15, 2011 Exceptions: No exception x Traced $11,250 to January collection recorded in cash receipt journal. B-1 ----------------------------------------------------------------------------------------------------------------------------------------Apple Blossom Cologne Company Allowance for Bad Debts December 31, 2010 B-5 22-1-2011 Prepared by: Denies Balance per 31-12-2010 2009 Write –off 12,250 10,850 1,400 99,257 WTB – IS 11,325 WTB – BS 840 10,485 (current balance) 2010 Provision Balance per 31-12-2010 Adjustment # 1 Adjusted Balance PROVISION FOR BAD DEBTS REASONABLENESS TEST Age Amount 1 – 30 days – see B-1 30 – 60 days – see B-1 60 – 90 days – see B-1 Over 90 days – see B-1 91,876 18,057 14,088 0 Expected Uncollectible (%) 1.5% 10% 50% 100% Balance per analysis Adjusted balance Estimated Uncollectible 1,378 1,806 7,044 0 10,022 10,488 WTB – BS Adjusted Notes: 1. 2. 3. 4. Beginning balance agree to prior year’s working paper All bad debt write off are approved Provision for bad debts appear reasonable and in line with prior year Allowance balance is in line with prior year and appear reasonable based upon above reasonableness test. 5. Over 90 days: $840-840 = 0, see B-1/AJE # 1 CURRENT YEAR (2012) WORKING TRIAL BALANCE Apple Blossom Cologne Company Working Trial Balance - Balance Sheet December 31, 2011 Code - WTB - BS Accounts 1 ASSETS: 2 101 Cash - Big City Nat'l Bank 3 103 Cash - Second Nat's Bank 4 104 Petty Cash 5 105 Accounts Receivable 6 106 Allowance for Bad Debts 7 107 Miscellaneous Receivables 8 109 Inventory 9 110 Prepaid Insurance 10 111 Prepaid Rent 11 112 Office Supplies Inventory 12 113 Small Tools Inventory 13 115 Marketable Securities 14 116 Allowance to NRV 15 210 Land 16 220 Buildings 17 221 Acc. Depr. - Buildings 18 230 Machineries & Equipments 19 231 Acc. Depr. - Mach. & Equip. 20 240 Automotive Equipment 21 241 Acc. Depr. - Auto. Equipment 22 250 Office Furnitures & Fixtures 23 251 Acc. Depr. Furn. & Fictures 24 Total Assets 25 W/P Per Audit Ref. 12/31/10 Per Books Adjustments 12/31/11 Debit Credit 375,090 5,265 420 124,021 (10,485) 272,765 46,315 500 238,850 (11,455) 777,152 31,438 5,000 6,125 4,750 426,140 596,701 54,612 1,250 7,432 4,129 664,220 80,250 276,263 (65,416) 540,845 (160,866) 99,425 (50,798) 106,433 (37,581) 2,533,471 82,250 276,263 (74,625) 735,445 (185,899) 113,925 (79,467) 113,233 (43,073) 2,813,371 Reclassification Debit Credit Per Audit 12/31/11 LIABILITIES 1 301 2 302 3 303 4 304 5 305 6 306 7 307 8 308 9 330 10 401 11 450 EQUITY 1 2 3 4 5 501 505 601 605 610 Accounts Payable Accrued Payroll Taxes Wages & Salaries Payable Accrued Property Taxes Accured Interest Dividends Payable Fed. Income Tax Payable Notes Payable - Short Term Lease Obligation - Short Term Notes Payable - Long Term Lease Obligation - Long Term Total Liabilities Common Stocks Other Contributed Capital Retained Earnings Dividends Current Net Income Total Equities Total Liabilities & Equity 223,161 66,860 43,194 13,463 10,625 15,725 4,402 125,000 203,780 53,056 19,399 10,000 18,500 25,000 200,000 502,430 529,735 925,000 553,027 409,164 (15,725) 159,575 2,031,041 2,533,471 925,000 553,027 553,014 (18,500) 271,095 2,283,636 2,813,371

![Job Description [DOCX - 56 KB]](http://s3.studylib.net/store/data/006627716_1-621224f86779d6d38405616da837d361-300x300.png)