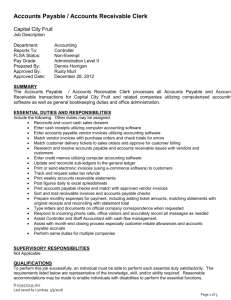

Job Description [DOCX - 56 KB]

advertisement

![Job Description [DOCX - 56 KB]](http://s3.studylib.net/store/data/006627716_1-621224f86779d6d38405616da837d361-768x994.png)

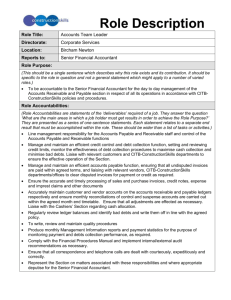

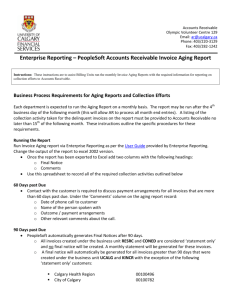

COUNTY OF GRANDE PRAIRIE JOB DESCRIPTION JOB TITLE: Accounts Clerk I CURRENT CLASSIFICATION/GRID AD Grid Level 4(b) NOC CODE: 1431 STANDARD HOURS: 35 hours/week (non-management) JOB TITLE OF IMMEDIATE SUPERVISOR SUPERVISOR’S CLASS/GRID Accounting Supervisor AD Grid Level 6(k) DIVISION Corporate Services DEPARTMENT Financial Services POSITION # #3 POSITION # #320 LOCATION Main Administration Building PROGRAM FUNCTION: The Corporate Services division is responsible for financial, legislative, assessment, information systems, procurement and risk management/insurance functions and support for the organization. The Financial Services department provides financial stewardship and management services for the County, including financial support to all departments in the areas of budgeting and financial. Services provided include: centralized accounting services, including accounts payable, accounts receivable, utilities, collections, interim financial reporting, payroll and benefits and property taxation. administrative customer service including cash receipting and reception technical services for financial systems including online web services, database management and integration, upgrades, support and training on systems and equipment, and disaster recovery financial services including financial analysis, cost recovery calculations, management of cash and investment portfolios, annual and interim financial reporting, capital asset accounting and reporting, operating and capital budgets, long range financial planning, reserves and debt management, financial policy, grant application and reporting, and other financial management, information and advice liaison with the public and property owners regarding taxation, water and sewer accounts, accounts receivable and payable, local improvements, budget and financial information, and other services Reviewed Date: July 2015 PURPOSE OF JOB: Responsible for processing computerized accounts payable and/or accounts receivable and related records maintenance; analyzing and reconciling accounts, and performing a variety of supporting accounting duties. Job Duties and Tasks: Accounts Payable: 1. Oversee audit stamping, distributing and appropriate approvals of invoices and statements received on a daily basis. 2. Assist departments with Purchase Orders and periodic review of outstanding with various departments. 3. Verify accuracy of computations and approval; vendor numbers; batch for posting; balancing of batches in preparation for computer processing. Ensure all payables are supported by adequate back-up documents and copies of invoices are distributed as required (ie. Insurance, capital fixed assets, rebilling). Recognize and investigate irregularities and discrepancies on invoices. 4. Verify accuracy of GL expense and project, equipment, inventory and work order costing codes. 5. Receive cheques, EFT reports, and vouchers from computer processing, prepare payments for distribution and oversee filing of all permanent records. 6. Obtain Workers Compensation Board supplier clearance letters as required and maintain register of non-covered suppliers. 7. Reconcile vendors regarding their invoices and reconcile any discrepancies in their statements. 8. Reconcile GL accounts payable accounts monthly. 9. Keep accounts payable manuals current and relay changes to departments. Accounts Receivable: 10. Upload, reconcile & invoice safety codes permits via CityView and process cash receipt batches for online safety code permit applications 11. General Accounts Receivable invoicing and Fire rescue invoicing 12. Take payments over the phone; Provide backup coverage for all online payments 13. Liaise with the landfill/customers over tickets 14. Assist Planning Clerks & other departments on queries 15. Upload, reconcile and invoice Clairmont Landfill billing from Paradigm 16. Process and distribute the Regional Landfill bills 17. Monthly billing of Animal Control, Assessment Services & Special Constable Services to neighbouring municipalities 18. Monthly upload and reconciliation of all Home Care billing 19. Prepare the salary invoice for the Grande Prairie Ag society 20. Collections & monthly ageing report 21. Monthly reconciliation of Accounts Receivable from CityView 22. Monthly reconciliation of safety codes fees submitted to safety codes council 23. Balance and invoice water & sewer bills on a bi-monthly basis 24. Calculation and administration of Penalties on all Utility accounts 25. Work order processing and balancing 26. Process the bank files for customers on the autopay program Reviewed Date: July 2015 27. Transfer unpaid Utility bills to the tax roll on an annual basis or when a tax certificate is pulled 28. Calculate and distribute invoices for Oil well Drilling in the County of Grande Prairie 29. Complete mobile home tax collection General Duties: 30. Support as required for front office and accounting staff for telephone and front counter inquiries and cash receipting. 31. Other accounting support and/or finance projects duties as assigned. Reviewed Date: July 2015 JOB DESCRIPTION CERTIFICATION: I have read this job description: ___________________________ Incumbent’s Signature ________________________ Name (print) ____________ Date This job description is an accurate statement of the position’s assigned duties, responsibilities, and reporting relationships, as indicated in the preceding organization chart, effective _______. ___________________________ Supervisor’s Signature ___________________________ Name (print) __________ Date This Job Description is in the appropriate format and contains sufficient data for its evaluation in the County Job Evaluation Plan: ___________________________ HR Manager’s Signature Attachment: Organization Chart Reviewed Date: July 2015 ____________________________ ___________ Name (print) Date QUALIFICATIONS STATEMENT Education and Experience: Business or Accounting Diploma and two years related experience, or an equivalent combination of education and experience. Skills and Abilities: Ability to ensure all work related information is kept confidential as per policy and in accordance with Freedom of Information and Protection of Privacy Act. Ability to comply with records management practices as stated in the Records Management Policy. Ability to communicate tactfully, clearly, and effectively; and exercise mature judgement to deal effectively with staff. Knowledge of accepted accounting rules, practices, tax laws, and reporting requirements Customer focused Quality Orientation Problem-solving abilities Computer literate, including effective working skills of MS Word, Excel and e-mail Ability to adapt to and learn new software Able to work efficiently as a part of a team as well as independently High level of critical and logical thinking, analysis, and/or reasoning to identify underlying principles, reasons, or facts Able to work well under pressure and meet set deadlines Good organizational, time management and prioritizing skills Ability to interpret and implement company policies and procedures Attention to detail in all areas of work High level of personal integrity and a strong work ethic Self starter Manual dexterity required to use desktop computer and peripherals Ability to work some overtime as required Ability to lift or move up to 10lbs Training Matrix: Preferred: Defensive Driving First Aid including AED Leadership for Safety Excellence (4 modules- Supervisor’s Role, Hazard Assessment Inspections, Investigations). Required: Hazard Identification, Assessment & Control Musculoskeletal Injury Prevention: Office Environment Workplace Violence Prevention Reviewed Date: July 2015