EELNÕU

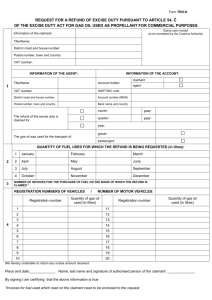

advertisement

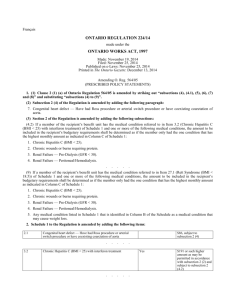

1. ------IND- 2009 0302 EE- EN- ------ 20090616 --- --- PROJET DRAFT 20.05.2009 ALCOHOL, TOBACCO, FUEL AND ELECTRICITY EXCISE DUTY ACT AMENDMENT ACT § 1. The Alcohol, Tobacco, Fuel and Electricity Excise Duty Act is amended as follows: 1) subsection 491 (2) is amended and worded as follows: “(2) Alcohol with an ethanol content exceeding 22 per cent by volume in sales packagings of a net content of 0.05 litres or more shall be revenue stamped.”; 2) clause 6 is added to subsection 491 (4) worded as follows: “6) alcohol is considered to be a medicinal product as defined in the Medicinal Products Act.”; 3) subsection 56 (1) is amended and worded as follows: “(1) The rate of excise duty on cigarettes consists of a fixed rate per one thousand cigarettes and a proportional rate calculated on the basis of the maximum retail price of the cigarettes. The fixed rate is 500 kroons and the proportional rate is 31 per cent of the maximum retail price of the cigarettes. As of 1 January 2010, the fixed rate shall be 525 kroons and the proportional rate shall be 33 per cent of the maximum retail price of the cigarettes.”; 4) subsection 57 (1) is amended and worded as follows: “(1) Upon first arrival in Estonia from outside the EC territory within one day, a traveller of at least 18 years of age is permitted to bring into Estonia for noncommercial purposes inside the baggage with which he or she is travelling, without paying excise duty up to: 1) 40 cigarettes; 2) 100 cigarillos; 3) 50 cigars; 4) 50 grams of smoking tobacco or 5) 50 grams of chewing tobacco.”; 5) subsection 66 (1) is amended and worded as follows: “(1) The rate of excise duty on unleaded petrol is 5901 kroons per one thousand litres of unleaded petrol.”; 6) subsection 66 (6) is amended and worded as follows: “(6) The rate of excise duty on diesel fuel is 5423 kroons per one thousand litres of diesel fuel.”; 7) subsection 66 (7) is amended and worded as follows: “(7) The rate of excise duty on diesel fuel for specific purposes and on light heating oil is 1008 kroons per one thousand litres of diesel fuel for specific purposes or light heating oil.”; 8) subsection 66 (13) is amended and worded as follows: “(13) The rate of excise duty on fuel for which the first four digits, first six digits or first eight digits of the CN code are 2707 10, 2707 20, 2707 30, 2707 50, 2710 11 11 – 2710 11 25, 2710 11 90, ex 2901 (substances which are not gaseous at atmospheric pressure and a temperature of 15°C), 2902 20 00, 2902 30 00, 2902 41 00, 2902 42 00, 2902 43 00 or 2902 44 00, is 5901 kroons per one thousand litres of fuel.”; 9) subsection 66 (16) is amended and worded as follows: “(16) The rate of excise duty on fuel for which the first eight digits of the CN code are 2710 19 31 or 2710 19 35, is 5423 kroons per one thousand litres of fuel.”; 10) section 855 is added to the Act worded as follows: “§ 855. Application of Act to alcohol without revenue stamps Alcohol without revenue stamps specified in subsection 491 (2) of this Act which is released for consumption before 1 January 2010 may be sold until 31 January 2010.”. § 2. Entry into force of Act This Act enters into force on 1 July 2009 and clauses 1), 2) and 10) enter into force on 1 January 2010. President of the Riigikogu Ene Ergma Tallinn,..............................2009 Initiated by the Government of the Republic .............................2009 No.