Engineering Economics

advertisement

Energy Economics

Introduction

Most investments involve an initial payment in return for future income. This is especially true

of investments in energy efficiency and renewable energy systems, both of which typically

require an up-front investment in equipment in order to derive future savings or future income.

In order to evaluate these investments, it is necessary to understand how the value of money

changes over time. Energy Economics describes the methods used to evaluate investments

which contain cash flows at different times.

Engineers who can clearly and correctly communicate the financial impacts of energy saving

ideas have more influence in the decision-making process. Those who do not have these skills

are less able to judge the economic merit of an idea or to advocate for ideas they believe in.

Although economics is important, many important factors are difficult to translate into dollars.

For this reason, economic analysis should not be the only criteria in accepting or rejecting a

design or investment option.

Simple Payback and Rate of Return

The simplest index of economic feasibility, and one that is very widely used, is simple payback.

Simple payback, SP, is the time period required for an investment to create a positive cash flow.

Simple payback is:

SP =

InitialCost $

SavingsPerYear $/yr

[1]

Example:

Calculate the simple payback of a lighting retrofit that will cost

$1,000 to implement and will save $250 per year.

SP =

$1,000

= 4 years

$250/year

The rate of return, ROR, is the reciprocal of the simple payback. Rate of return represents the

annual return on the investment.

ROR = 1 / SP =

SavingsPerYear $/year

InitialCost $

[2]

Example:

Calculate the ROR of a lighting retrofit that will cost $1,000 to

implement and will save $250 per year.

Document1

1

Rate of Return =

$250/year

= 25% per year

$1,000

One of the strengths of the simple payback and rate of return methods for evaluating

investments is that the results are independent of assumptions about the time-value of money.

Over short time periods, the value of money does not change much with time. Thus, simple

payback and rate of return are appropriate methods to analyze investments with short

paybacks.

Time Value of Money

The notion of economic growth, of investing in capital to generate future profit is a central

concept in capitalism. Entrepreneurs and growing companies are interested in acquiring money

today to make a profit with it tomorrow. Thus, in the right hands $100 today is worth more

than $100 tomorrow; money has a time-value component.

Example:

Would you rather have $100 now or $100 next year?

In a growing economy, I’d rather have $100 now, because I

could put it in the bank at 5% interest and have $105 next year.

To compare investment options with cash flows that occur at different times, it is useful to

covert all cash flows to a common time. The most common way to do so is to covert all cash

flows into their “present value”, and then compare the present values to evaluate alternative

investments. Cash flows involving future amounts of money can be converted to their present

values using three important equations:

Present Value of a Future Amount

Present Value of a Series of Annuities

Present Value of an Escalating Series of Annuities

Present Value of a Future Amount

Consider the common situation of investing a present amount, P, in an account that pays a rate

of interest, i, over n compounding periods. The future amount, F, can be determined from the

following example. Start with a present amount, P = $100 at a rate of interest, i = 5% per year.

The future amount after n years, Fn, is:

F0 = 100

F1 = 100 + 100(.05) = P + Pi = P (1+i)

F2 = [100 + 100(.05)] + [100 + 100(.05)](.05) = P(1+i) + P(1+i)i = P(1+i) 2

Fn = P (1+i)n

Document1

2

Equation 3 is the fundamental equation of exponential growth and can be applied whenever

growth is a fixed percentage of the current quantity.

F = P (1+i)n

[3]

Equation 3 can be rearranged to show the present value of a future amount, as in Equation 4.

P = F (1+i)-n

[4]

The factor (1+i)-n is sometimes called the present worth factor, PWF(i,n). Thus,

P = F(1+i)-n = F PWF(i,n)

Example:

Someone promises to pay you $1,000 in 5 years. If the interest

rate is 10% per year, what amount would you take today that is

equivalent to $1,000 in 5 years (i.e. what is the present value of

$1,000 5 years from now?) ?

P = F(1+i)-n = $1,000 (1+.10)-5 = $621

Present Value of a Series of Annuities

An annuity is a regular payment of income made at the end of a fixed period. Consider

investing an annuity of amount, A, during each of n compounding periods with an interest rate i.

This situation can be shown graphically in a cash flow diagram. In cash flow diagrams, income is

shown as line extending upward and payments are shown as lines extending downward. The

cash flow diagram for a series of n investments of amount A is shown below.

A

0 1 2 3

n

The following derivation shows how to calculate the present value, P, of this series of payments.

Pn = present value of n payments of amount A

= present amount that is equal to a series of payments, A, for n years

P0= 0

P1 =

A

(1 i)

Document1

3

P2 =

A

A

2

(1 i)

(1 i)

1

A

1

Pn = A

...

n

n1

(1 i)

(1 i) (1 i)

To find closed-form solution, do a little algebra...

1)

Pn (1 i)n = A 1 (1 i) ... (1 i)n1

n1

n1

2)

Pn (1 i)

2-1)

Pn (1 i)n1 (1 i)n = A (1 i)n 1

Pn =

= A (1 i) ... (1 i)

(1 i)n

1 (1 i)n

A (1 i)n 1

A

i

(1 i)n (1 i) 1

Thus, the present value of a series of n payments of amount A is:

1 (1 i)n

Pn = A

i

[5]

1 (1 i)n

The factor

is sometimes called the series present worth factor, SPWF(i,n). The

i

reciprocal of the series present worth factor is sometimes called the capital recovery factor,

CRF(i,n). Thus,

1 (1 i)n

Pn = A

= A SPWF(i,n)

i

Document1

{SPWF(i,n) = 1 / CRF(i,n)}

4

Example:

A standard-efficiency furnace costs $100 and consumes $40 per

year in fuel over its 10 year lifetime. A high-efficiency furnace

costs $200 and consumes $20 per year in fuel over its 10 year

lifetime. If interest rates are 10% per year, which is the better

investment?

Standard efficiency

High-efficiency

$40

$20

$100

$200

1 (1 .10) 10

Pstd costs = $100 + $40

= $346

.10

10

1 (1 .10)

Phigh costs = $200 + $20

= $323

.10

and

Phigh savings = $346 - $323 = $23

Or you could solve directly for the present value of savings by

setting up your cash flow diagram to reflect ‘savings’ instead of

‘costs’.

$20

-$100

$100

1 (1 .10) 10

Phigh savings = -$100 + $20

= $23

.10

It is sometimes easier to understand “annualized savings” than the “present value” of savings”.

To find annual savings, find the present value of savings, and then annualize that amount by

solving P = A SPWF(i,n) for A.

Document1

5

Example:

Find the annualized savings from investing in the high efficiency

furnace over the standard efficiency furnace:

1 (1 .10) 10

Ahigh savings = P / SPWF(.10,10) = $23 /

.10

Ahigh savings = $4

Present Value of an Escalating Series of Annuities

Sometimes a recurring annuity, A, is expected to increase over time at some escalation rate e.

For example, as equipment gets older it often requires more and more maintenance. A cash

flow diagram of an escalating series is shown below.

A(1+e)n

A

0 1 2 3

n

Using a method similar to the previous derivation, the present value of an escalating series is:

A

n

1 1 e

1

if e i

(i e) 1 i

A

n

(1 e)

[6a]

P=

The factor

if e = i

[6b]

n

1 1 e

n

(depending on whether i = e) is called the escalating

1

or

(1 e)

(i e) 1 i

series present worth factor, ESPWF(i,e,n). Thus,

P = A ESPWF(i,e,n)

Note that when e = 0, escalating series present worth factor ESPWF(i,0,n) is identical to the

series present worth factor SPWF(i,n).

Document1

6

Example:

The maintenance director says that it will cost $50 this year to

maintain an aging piece of equipment and estimates that the

equipment will require 5% more maintenance every year for

the next 10 years. New replacement equipment would cost

$400 and would require only $10 of maintenance per year with

no expected escalation over the next 10 years. Which is a

better investment if interest rates are 5%?

Current Equipment:

0 1 2 3

10

$50(1+.05)10

Pcurrent equip costs

= A ESPWF(.05, .05,10)

n

10

= A

= $50

= $476

(1 e)

(1 .05)

New Equipment:

0 1 2 3

10

$10

$400

Pnew equip costs

= $400 + A SPWF(.05,10)

1 (1 .05) 10

= $400 + $10

= $477

.05

Hence, the two options are expected to cost about the same

amount.

Future Value of a Series of Payments

In addition, it is sometimes useful to calculate the future value of a series of annuities. Using a

derivation similar to that for the present value of a series of annuities, the future value, F, of a

series of equal annuities, A, that accrue interest at a rate, i, over n periods is:

Fn =

Document1

A (1 i)n 1

i

[7]

7

Example:

The future value of an annual investment of $2,000 per year for

20 years in an IRA that accrues interest at 5% per year is:

2,000 1 0.05 20 1

F=

$66,132

0.05

Compounding Periods

Typically, interest is paid or payments are due on fixed intervals rather than continuously.

These intervals are called compounding intervals. Interest rates are typically reported for an

annual compounding period. If interest is paid or payments are due at other compounding

intervals, simply divide the annual interest rate, i, in the time value of money equations by the

number of compounding periods per year, m, and multiply the number of years, n, by m.

Example:

Calculate the future value of $100 earning 8% annual interest

compounded quarterly for 10 years.

F = P(1 + i/m)nm = $100 (1 + .08/4)(10*4) = $220

Example:

Calculate the monthly house payment if $100,000 is borrowed

at 8% on a 30 year mortgage.

P = A SPWF(i,n)

A = P / SPWF(.08/12, 30*12) = $734 / month

Summary of Time Value of Money Equations

The figure below shows the four time value of money equations developed so far.

Document1

8

P = F (1+i)-n = F PWF(i,n)

1 (1 i)n

P = A

= A SPWF(i,n)

i

Fn =

A (1 i)n 1

i

A

n

1 1 e

1

if e i

(i e) 1 i

P=

= A ESPWF(i,e,n)

A

n

(1 e)

if e = i

The Discount Rate

So far, we have referred to the rate of growth i as the rate of interest. More formally, i is the

discount rate. The discount rate is the expected rate of return from an alternative investment.

The alternative investment could be interest from a bank, stock market appreciation or

expected profits from one’s own company. High discount rates reflect the belief that a large

profit can be made from an alternative investment; thus, money today is very valuable and

future money is less valuable. High discount rates have the effect of discounting future sums of

money or “discounting the future”. Hence the name “discount” rate. To get a feeling for how

the discount rate affects time value of money, reconsider a previous example, but compare

solutions with two discount rates.

Document1

9

Example:

A standard-efficiency furnace costs $100 and consumes $40 per

year in fuel over its 10 year lifetime. A high-efficiency furnace

costs $200 and consumes $20 per year in fuel over its 10 year

lifetime. If the discount rate is 10% per year, which is the

better investment? What if the discount rate is 30%?

Cash flow diagrams are:

Standard Efficiency

High Efficiency

$40

$20

$100

$200

Savings from high-efficiency furnace

$20

-$100

$100

1 2 3

10

If the discount rate is 10%, then:

1 (1 .10) 10

Phigh-eff savings = -$100 + $20

= $23

.10

The positive savings indicate that the high-efficiency furnace is

the best investment.

If the discount rate is 30%, then:

1 (1 .30) 10

Phigh-eff savings = -$100 + $20

= $-38

.30

The negative savings indicate that when the discount rate is

30%, the traditional furnace is the better investment.

In summary, a high discount rate reduces the value of future

cash flows, including savings from energy efficiency measures.

In general, renewable energy and energy conservation technologies have high first capital costs

and low future fuel costs. Thus, high discount rates (which value the present and ‘discount’ the

future) work against these technologies. Some people argue that a discount rate of zero ought

Document1

10

to be used in non-renewable resource decisions. A zero discount rate implies that the future is

equally as important as the present.

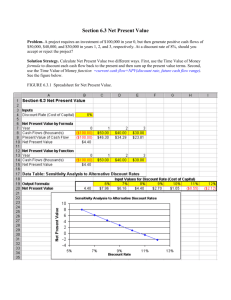

Lifecycle Cost and Net Present Value

The most comprehensive way to make investment decisions is to consider the total cost of a

system over its entire life. Because the costs or revenues during these phases occur at different

times, time-value of money equations can be used to calculate the present value of all costs and

revenues over the lifecycle of a product. The net present value is the sum of the present values

of the costs and revenues of a system over its lifetime. A positive net present value indicates

that an investment is more cost-effective than investing the money at the discount rate used in

the calculations. When the net present value is calculated for all costs and revenues over a

product’s lifetime, including manufacturing, operating and post-use phases, it is called the

lifecycle cost.

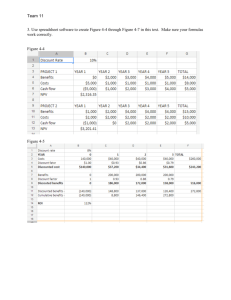

Example:

Determine the net present value (i.e. lifecycle cost) of a 2 kW

photovoltaic system that costs $8,000 per kW, generates 3,000

kWh per year that displaces electricity purchased from the

utility at $0.10 /kWh with a projected cost escalation of 2% per

year. The system lifetime is 20 years and the discount rate is 5%

per year. System recycle income or removal costs at the end of

the systems life are negligible.

A ESPWF(i=.05, e=.02, n=20)

-$16,000

$100=.

1 2 3

20

PV_IC = - 2 kW x $8,000 /kW = -$16,000

A = 3,000 kWh/yr x $0.10 /kWh = $300 /yr

NPV = PV_IC + A ESPWF(i=.05, e=.02, n=20)

NPV = -$16,000 + $300 14.665

NPV = -11,600

Thus, this is not a cost-effective investment compared to

alternative investments which return 5% per year.

Document1

11

Return on Investment

Because of the discount rate’s large influence on the results of time value of money

calculations, the discount rate is sometimes solved for, rather than input, in time value of

money calculations. The discount rate when the present value of an investment is zero

represents the return on an equivalent investment, and is called the return on investment, ROI.

To calculate ROI, set NPV = 0 and solve for i.

Example:

Reconsider the furnace example. Find the return on investment

for upgrading to a high-efficiency furnace if the enatural gas =

0.84%.

Savings with Real Fuel Price Escalation

$20 ESPWF(i, e=.0084, n=10)

-$100

$100

1 2 3

10

NPV = -$100 + $20 ESPWF(i,e=.0084,n=10)

1 .0084 10

1

0 = -$100 +$20

1

(i .0084) 1 i

1 .0084

1

$100/$20 = 5 =

1

(i .0084) 1 i

10

By iteration: i = ROI = 16%

In Microsoft Excel, return on investment (ROI) is called internal rate of return (IRR). The IRR is

calculated by an internal function: IRR(range), where the range is made up of all cash flows.

Document1

12

Example:

A high efficiency furnace costs $100 more than a low efficiency

furnace and saves $20 per year over a ten year period. Use

Microsoft Excel to calculate the return on investment.

A cash flow diagram of savings is shown below.

$20

-$100

$100

In Excel the cash flows below should be entered in separate

cells such as A1: A11.

-100, 20, 20, 20, 20, 20, 20, 20, 20, 20, 20.

Use the IRR function, “=IRR(A1:A11)” to calculate return on

investment.

Evaluating Energy Efficiency Options: The Problem with Simple Payback

In the industrial sector, the economic criterion used to evaluate energy saving opportunities is

frequently simple payback. Moreover, many companies demand very short simple paybacks on

the order of 2 years as the criteria for implementation. On the surface, this appears to be

unrational economic decision making, since a simple payback of 2 years is a rate-of-return of

50%. Thus, demanding a 2-year simple payback before a project will be funded appears to

indicate that a company has alternative investments that return 50% per year. Since this is

seldom the case, the wisdom of demanding very short simple paybacks appears to be

questionable.

However, the real problem is that simple payback, and hence rate-of-return, are poor metrics

for evaluating cost effectiveness because they do not take into account project lifetime.

Consider for example a project with a simple payback of 4 years, and hence a rate-of-return of

25% per year. This appears to be a highly profitable project. However, if the project lifetime is

3 years, then the initial investment will never be paid off. In this case, the 25% per year return is

completely misleading. If the project lifetime is 5 years, the investment is barely cost effective,

since it positive revenue is generated for only one year. If, however, the project lifetime is 20

years, then the project is highly cost effective since the project will generate positive revenue

for 16 years after it has paid back the initial investment. Thus, to properly evaluate energy

saving investments, the economic analysis must include project lifetime.

The economic criteria return on investment (ROI) includes project lifetime, and is thus a much

better measure of cost effectiveness. The return on investment, in contrast to rate of return,

can be directly compared to alternative investments in order to evaluate economic merit.

Document1

13

Example:

A project has a simple payback of 3 years. Calculate the rate of return, ROR,

and return on investment, ROI, if the project has a lifetime of 3, 6, 12, 15 and 18

years.

Rate of Return = Annual Savings / Initial Cost

Rate of Return = 1 / Simple Payback = 1 / 3 years = 33% /year

To evaluate return on investment for a project with a 33% rate of return, let the

initial cost be $1,000. If so the annual savings would be $333. The net present

value of the investment, assuming that the initial investment has no value at

the end of the project life, is:

1 (1 i)n

NPV = -$1,000 + $333 SPWF(i,n) = -$1,000 + $333

i

To solve for return on investment ROI, set NPV = 0 and solve for i. If the project

lifetime is 3 years, then:

1 (1 i)3

0 = -$1,000 +$333

By iteration: i = ROI 0%

i

If the project lifetime is 6 years, then:

1 (1 i)6

0 = -$1,000 +$333

By iteration: i = ROI 24.2%

i

Graphing the rate of return and return on investment as functions of project life

gives:

Document1

14

Note that ROI calculated in the preceding example is for the case in which the initial investment

has no value at the end of the project life. If the initial investment had value at the end of the

project life, then that value should be added to the NPV equation explicitly. However, once ROI

is calculated using this method, the ROI represents the value of an alternative investment with

both capital and interest accumulation. For example, if an alternative investment returned

24.2% per year for six years, the value of a $1,000 investment after six years would be:

F = P (1 + i)n = $1,000 (1 + .242)6 = $3,671

The ROI of this alternative investment would be calculated as:

NPV = 0 = -$1,000 + $3,671 / (1+i)6

and solving for i gives i = ROI = 24.2%.

Thus, ROI represents the value of an alternative investment with both capital and interest.

A comparison of rate-of-return and return-on-investment, shows that return-on- investment is:

negative when the project life is less than the simple payback

much less than rate-of-return for short project lifetimes

approaches rate-of-return as project life increases.

This shows the importance of project lifetime in determining project cost effectiveness. It may

also explain why some companies require very short simple paybacks to fund a project. In

these cases, the company may believe that the project lifetime is very short. In our view,

however, the use of return-on-investment makes these assumptions explicit and is therefore a

much more transparent metric of economic fitness than simple payback.

Inflation and the ‘Real’ Discount Rate

Inflation causes the price of goods and services to rise or, equivalently, the value of money to

decrease. A widely used metric of the overall rate of inflation in the United States is the

“Implicit Price Deflator”, IPD. Implicit Price Deflator is determined by the U.S. Department of

Commerce. IPDs using year 2000 as the base year, are shown in the table below (Annual Energy

Review 2007, Energy Information Agency, U.S. Department of Energy, Table D1).

Document1

15

IPD, 1949-2007, 2000 = 1.000

Year

1949

1950

1951

1952

1953

1954

1955

1956

1957

1958

1959

1960

1961

1962

1963

1964

1965

1966

1967

1968

1969

IPD

0.16352

0.16531

0.17718

0.18022

0.18243

0.18417

0.18743

0.19393

0.20038

0.20498

0.20751

0.21041

0.21278

0.21569

0.21798

0.22131

0.22535

0.23176

0.23893

0.24913

0.26149

Year

1970

1971

1972

1973

1974

1975

1976

1977

1978

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

IPD

0.27534

0.28911

0.30166

0.31849

0.34725

0.38002

0.40196

0.42752

0.45757

0.49548

0.54043

0.59119

0.62726

0.65207

0.67655

0.69713

0.71250

0.73196

0.75694

0.78556

0.81590

Year

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

IPD

0.84444

0.86385

0.88381

0.90259

0.92106

0.93852

0.95414

0.96472

0.97868

1.00000

1.02399

1.04187

1.06404

1.09462

1.13000

1.16567

1.19664

The annual rate of inflation, j, over any period of n years can be calculated by applying Equation

3.

Example:

Find the general rate of inflation, j, from 1996 to 2006 using

IPDs.

Solution:

F = P (1+j)n

1.16042 = 0.93852 (1 + j)10

j = 0.02145

General inflation rates for various periods are shown in the table below.

1967-2006

Input

n

39

P

0.23893

F

1.16042

Calculations

j

0.041354

Document1

1996-2006

Input

n

10

P

0.93852

F

1.16042

Calculations

j

0.02145

1996-2001

Input

n

5

P

1.02399

F

1.16042

Calculations

j

0.025331

16

The rate of inflation is important, since inflation erodes the value of money. For example, if an

investment appreciates at an interest rate of 3% per year and the rate of inflation is also 3% per

year, then the investment does not deliver ‘real’ value.

The discount rate with the effect of inflation removed is called the “real” discount rate and

indicates the “real” return from an investment. To calculate the real discount rate, i’, one needs

to explicitly remove the effect of inflation, j. To do so, consider the following derivation.

Interest Adds Value to Money

Inflation Devalues Money

P

F=

(1 j)n

F = P(1 i)n

If both are active:

P(1 i)n

(1 j)n

Find i’, the “effective” or “real” discount rate, such that:

F=

F = P(1 i')n =

i’ =

Document1

i j

1 j

P(1 i)n

(1 j)n

[8]

17

Example:

Returns from an S&P index fund indicate that a single share of

the fund was worth $14.90 in 1976 and $124.56 in 1994. What

is the market” rate of return from this investment?

Using F = P (1+i)n, we can solve for i, the average annual rate of

return. We assume that the investment began with a present

value P = $14.90 and ended with a future value F = $124.56

after 18 years.

i = market discount rate

i= e

1 F

ln

n P

1= e

1 124.56

ln

18 14.90

1 = 12.52 %

If the GDP implicit price deflator (an indication of general

inflation) was 52.3 in 1976 and 126.1 in 1994, what is the

annual rate of inflation over this period?

j = annual rate of inflation

j= e

1 F

ln

n P

1= e

1 126.1

ln

18 52.3

1 = 5.01%

What is the real annual rate of return (discount rate) over the

period?

i’ = real discount rate =

.1252 .0501

i j

=

= 7.15%

1 j

1 .0501

Energy Cost Escalation

In energy economics, many calculations include cost of energy, which frequently changes over

time. In most cases, the rate of escalation of energy prices is different than the general rate of

inflation. One way to estimate energy price escalation rates in the future is to consider past

rates of energy price escalation. The tables below show historical U.S. electricity and natural

gas prices (Annual Energy Review 2006, Energy Information Agency, U.S. Department of

Energy).

Document1

18

Table 8.10 Average Retail Prices of Electricity, 1960-2006

(Cents per Kilowatthour, Including Taxes)

Year

Residential

Commercial 1

Industrial 2

Nominal Real

Nominal Real

Nominal Real

1960

2.6

12.4

2.4

11.4

1.1

1961

2.6

12.2

2.4

11.3

1.1

1962

2.6

12.1

2.4

11.1

1.1

1963

2.5

11.5

2.3

10.6

1

1964

2.5

11.3

2.2

9.9

1

1965

2.4

10.7

2.2

9.8

1

1966

2.3

9.9

2.1

9.1

1

1967

2.3

9.6

2.1

8.8

1

1968

2.3

9.2

2.1

8.4

1

1969

2.2

8.4

2.1

8

1

1970

2.2

8

2.1

7.6

1

1971

2.3

8

2.2

7.6

1.1

1972

2.4

8

2.3

7.6

1.2

1973

2.5

7.9

2.4

7.5

1.3

1974

3.1

8.9

3

8.6

1.7

1975

3.5

9.2

3.5

9.2

2.1

1976

3.7

9.2

3.7

9.2

2.2

1977

4.1

9.6

4.1

9.6

2.5

1978

4.3

9.4

4.4

9.6

2.8

1979

4.6

9.3

4.7

9.5

3.1

1980

5.4

10

5.5

10.2

3.7

1981

6.2

10.5

6.3

10.7

4.3

1982

6.9

11

6.9

11

5

1983

7.2

11

7

10.7

5

1984

7.15

10.57

7.13

10.54

4.83

1985

7.39

10.6

7.27

10.43

4.97

1986

7.42

10.41

7.2

10.11

4.93

1987

7.45

10.18

7.08

9.67

4.77

1988

7.48

9.88

7.04

9.3

4.7

1989

7.65

9.74

7.2

9.17

4.72

1990

7.83

9.6

7.34

9

4.74

1991

8.04

9.52

7.53

8.92

4.83

1992

8.21

9.5

7.66

8.87

4.83

1993

8.32

9.41

7.74

8.76

4.85

1994

8.38

9.28

7.73

8.56

4.77

1995

8.4

9.12

7.69

8.35

4.66

1996

8.36

8.91

7.64

8.14

4.6

1997

8.43

8.84

7.59

7.95

4.53

1998

8.26

8.56

7.41

7.68

4.48

1999

8.16

8.34

7.26

7.42

4.43

2000

8.24

8.24

7.43

7.43

4.64

2001

8.58

8.38

7.92

7.73

5.05

2002

8.44

8.1

7.89

7.57

4.88

2003

8.72

8.2

8.03

7.55

5.11

2004

8.95

8.18

8.17

7.47

5.25

2005

9.45

8.38

8.67

7.69

5.73

2006

10.4

8.96

9.36

8.07

6.09

Document1

5.2

5.2

5.1

4.6

4.5

4.4

4.3

4.2

4

3.8

3.6

3.8

4

4.1

4.9

5.5

5.5

5.9

6.1

6.3

6.9

7.3

8

7.7

7.14

7.13

6.92

6.52

6.21

6.01

5.81

5.72

5.59

5.49

5.28

5.06

4.9

4.75

4.64

4.53

4.64

4.93

4.68

4.8

4.8

5.08

5.25

19

Table 6.8 Natural Gas Prices by Sector, 1967-2006

(Dollars per Thousand Cubic Feet)

Year

Residential Sector

Commercial Sector 1 Industrial Sector 2

Prices

Prices

Prices

1967

1968

1969

1970

1971

1972

1973

1974

1975

1976

1977

1978

1979

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

Nominal Real

Nominal Real

Nominal Real

1.04

4.35

0.74

3.10

0.34

1.42

1.04

4.17

0.73

2.93

0.34

1.36

1.05

4.02

0.74

2.83

0.35

1.34

1.09

3.96

0.77

2.80

0.37

1.34

1.15

3.98

0.82

2.84

0.41

1.42

1.21

4.01

0.88

2.92

0.45

1.49

1.29

4.05

0.94

2.95

0.50

1.57

1.43

4.12

1.07

3.08

0.67

1.93

1.71

4.50

1.35

3.55

0.96

2.53

1.98

4.93

1.64

4.08

1.24

3.08

2.35

5.50

2.04

4.77

1.50

3.51

2.56

5.59

2.23

4.87

1.70

3.72

2.98

6.01

2.73

5.51

1.99

4.02

3.68

6.81

3.39

6.27

2.56

4.74

4.29

7.26

4.00

6.77

3.14

5.31

5.17

8.24

4.82

7.68

3.87

6.17

6.06

9.29

5.59

8.57

4.18

6.41

6.12

9.05

5.55

8.20

4.22

6.24

6.12

8.78

5.50

7.89

3.95

5.67

5.83

8.18

5.08

7.13

3.23

4.53

5.54

7.57

4.77

6.52

2.94

4.02

5.47

7.23

4.63

6.12

2.95

3.90

5.64

7.18

4.74

6.03

2.96

3.77

5.80

7.11

4.83

5.92

2.93

3.59

5.82

6.89

4.81

5.70

2.69

3.19

5.89

6.82

4.88

5.65

2.84

3.29

6.16

6.97

5.22

5.91

3.07

3.47

6.41

7.10

5.44

6.03

3.05

3.38

6.06

6.58

5.05

5.48

2.71

2.94

6.34

6.76

5.40

5.75

3.42

3.64

6.94

7.27

5.80

6.08

3.59

3.76

6.82

7.07

5.48

5.68

3.14

3.25

6.69

6.84

5.33

5.45

3.12

3.19

7.76

7.76

6.59

6.59

4.45

4.45

9.63

9.40

8.43

8.23

5.24

5.12

7.89

7.57

6.63

6.36

4.02

3.86

9.63

9.05

8.40

7.89

5.89

5.54

10.75

9.82

9.43

8.62

6.53

5.97

12.84

11.39

11.59

10.28

8.56

7.59

13.76

11.86

11.97

10.32

7.89

6.80

Using this data, the energy price escalation rate, e, over any period can be calculated by

applying Equation 3.

Document1

20

Example:

Find the energy price escalation rate, e, for natural gas for the

residential sector from 1996 to 2006 using nominal cost data

from the Annual Energy Review.

Solution:

F = P (1+e)n

13.76 = 6.34 (1 + e)10

e = 0.081

Residential natural gas price escalation rates for various periods are shown in the table below.

Residential

Nominal

1967-2006

Input

n

P

F

39

1.04

13.76

Calculations

e

0.068461

Residential

Nominal

1996-2006

Input

N

P

F

10

6.34

13.76

Calculations

e

0.08057

Residential

Nominal

2001-2006

Input

n

P

F

5

9.63

13.76

Calculations

e

0.073986

Residential electricity price escalation rates for various periods are shown in the table below.

Residential

1967-2006

Input

n

39

P

2.3

F

10.4

Calculations

e

0.039448

Residential

1996-2006

Input

n

10

P

8.36

F

10.4

Calculations

e

0.022075

Residential

2001-2006

Input

n

5

P

8.58

F

10.4

Calculations

e

0.039224

The ‘real’ energy price escalation rate, e’, which represents the energy price escalation rate

with the effect of inflation removed, can be determined in two ways. The first is by removing

the effect of inflation, j, from the nominal energy escalation rate e using Equation 9. The

derivation for Equation 9 is analogous to the derivation for ‘real’ discount rate in Equation 8.

e’ =

ej

1 j

[9]

Example: Find the real energy price escalation rate, e, for

residential natural gas from 1996 to 2006.

Document1

21

Solution:

The nominal annual energy escalation rate, e, from 1996 to

2006 was e = 0.081. The annual rate of inflation over this

period was 0.021. The real annual energy escalation rate e’ is:

ej

e’ =

1 j

0.081 0.021

e’ =

= 0.058

1 0.021

Alternately, ‘real’ energy escalation rates, e’, could be determined by applying Equation 3 to

energy costs reported in “constant dollars”.

Example:

Find the real energy escalation rate, e’, for natural gas for the

residential sector from 1996 to 2006 using constant dollar cost

data from the Annual Energy Review.

Solution:

F = P (1+e)n

11.86 = 6.76 (1 + e)10

e = 0.058

Choice of Real or Nominal Discount and Escalation Rates

It is important to use either real rates or nominal rates in time-value of money calculations and

to avoid mixing real and nominal rates in the same calculation. For example, either use nominal

discount rate, i, and nominal energy price escalation rate, e, or use real discount rate, i’, and

real energy price escalation rates e’. When money is borrowed or invested at interest, the

interest is typically represents a nominal rate; thus, to avoid mixing nominal and real rates, it is

common practice to use nominal rates in time value of money calculations.

Tax Deductions for Fuel, Interest and Equipment Depreciation

Tax laws sometimes allow businesses to deduct fuel, interest and equipment depreciation

expenses for tax purposes. Because combined local, state and federal corporate income taxes

are often nearly 50% of profits, it is often necessary to consider these deductions when

evaluating investment options.

In many cases, taxes have the effect of equaling reducing both initial costs and operating

savings. Initial costs are reduced since the initial cost can depreciated over the lifetime of the

equipment and deducted from income. Similarly, annual savings are reduced by the tax rate

Document1

22

applied to profit. Hence, when considering taxes, the initial cost and annual savings are both

reduced by the tax rate, however the simple payback and ROI remain unchanged.

Example:

Find the NPV and annualized NPV for an energy investment which costs $1,000

and returns $500 per year for 10 years if the discount rate is 5% per year and

the energy cost escalation rate is 2% per year. Do so without considering taxes

and with considering taxes assuming the total tax rate is 40%.

Solution Without Taxes:

Input Data

AS ($/yr)

IC ($)

n (yrs)

i

e

Calculations

ESPWF = (1-((1+e)/(1+i))^n)/(i-e)

Ps ($)= AS x ESPWF

NPV ($) = Ps - IC

SPWF = (1-(1-i)^(-n))/i

A_NPV ($/yr) = NPV / SPWF

500

1,000

10

0.05

0.02

8.388106

4,194

3,194

7.721735

414

Solution With Taxes:

Input Data

AS ($/yr)

IC ($)

n (yrs)

i

e

tr

Calculations

ASAT ($/yr) = AS x (1-tr)

ICAT ($) = IC x (1-tr)

ESPWF = (1-((1+e)/(1+i))^n)/(i-e)

Ps ($) = ASAT x ESPWF

NPV ($) = Ps - ICAT

SPWF = (1-(1-i)^(-n))/i

A_NPV ($/yr) = NPV / SPWF

500

1000

10

0.05

0.02

0.5

250

500

8.388106

2,097

1,597

7.721735

207

Interest Expenses

If equipment is purchased with a mortgage, the interest is usually deductible. Because energy

saving equipment usually has a higher first cost than traditional equipment, interest deductions

Document1

23

usually enhance the cost effectiveness of energy saving investments. Following the fuel savings

example:

Tax Savings = Tax1 - Tax2 = TR(Interest2 - Interest1) = TR(I2 - I1)

The example below shows how to calculate the interest and principle components of a

mortgage payment.

Example:

Show the interest and principle components of loan payments for a $10

loan borrowed at an interest rate of 10% for 5 years.

P = A SPWF(.10,5)

A = P / SPWF(.10,5) = $10 / 3.79 = $2.64 per year

The components are shown in the table below.

At end

of year

1

2

3

4

5

Payment

amount

2.64

2.64

2.64

2.64

2.64

Interest part

of payment

.1(10) = 1.00

.1(8.36) = .84

.1(6.56) = .66

.1(4.58) = .46

.1(2.40) = .24

Principle part

of payment

2.64 - 1.00 = 1.64

2.64 - .84 = 1.80

2.64 - .66 = 1.98

2.64 - .46 = 2.18

2.64 - .24 = 2.40

Principle

remaining

10 - 1.64 = 8.36

8.36 - 1.80 = 6.56

6.56 - 1.98 = 4.58

4.58 - 2.18 = 2.40

2.40 - 2.40 = 0

Depreciation Expenses

Because equipment wears out over time, many tax laws allow businesses to deduct the cost of

equipment wear from income taxes. The annual amount of wear is called the depreciation, D.

Several methods are usually allowed by the tax laws to calculate the depreciation. Straight-line

depreciation calculates D as:

D = (Purchase Cost - Salvage Value) / Equipment Lifetime

As in the following examples,

Tax Savings = TR(D1 - D2)

The higher costs of energy conserving equipment usually increases the depreciation deduction

and make energy saving investments more attractive.

Document1

24

Uncertainty in Economic Analyses

Studies have shown that the results of economic analyses are most sensitive to i, e and n.

Because of this, it is recommended that one determine and report the sensitivity of the

economic analyses results using analytical or substitutional methods.

Example:

Determine the sensitivity of the present value of a future

amount of $100 in year 10 if the discount rate is 6% 2%.

By calculus...

P = F (1+i) -n

dP =

P

P

P

di

dn

dF

i

n

F

if F and n are known exactly, then dn = dF = 0 and

dP =

P

di

i

= F (-n) (1+i)-n-1 di = $100 (-10) (1+.06)-10-1 (.02)

=

Or by substitution...

P = F (1+i) -n at limits of i

Plow = $100 (1+.08)-10 = $46.3

Phigh = $100 (1+.04)-10 = $67.5

Corporations and Energy Investments

The Congressional Office of Technology Assessment concluded that the biggest factor affecting

industrial energy efficiency is the will to invest in new technology. In normal course of business,

worn out and obsolete technologies are replaced with better and usually more energy efficient

technologies.

Will to invest influenced by:

Maturity of industry: Young, high-growth industries tend to invest heavily, while

mature industries with price based competition and low profit margins have little

incentive.

Business climate: Growth and competition encourage investment.

Corporate climate: “If it ain’t broke don’t fix it” versus

“continual improvement”

Shortage of technical personnel, especially in “lean” companies.

Regulations (mainly environmental)

Energy’s fraction of production costs.

Many corporations demand a simple payback of 2 or 3 years for energy efficiency investments.

This extremely high investment hurdle causes the “efficiency gap”, which economists have

identified as “chronic underinvestment” in energy efficiency. Some corporations report that

Document1

25

the reason for the high economic hurdle is that energy efficiency projects must compete for inhouse capital and management time. Some analysts have observed that mandatory projects

(such as regulatory compliance, replacement of essential equipment, and maintenance of

product quality) and strategic projects (such as those which increase market share or new

product development) have higher corporate priority than discretionary (energy efficiency)

projects. Another commonly cited reason for high discount rates for energy efficiency projects

is the risk associated with those projects. Although risk means different things to different

organizations, when risk is measured in terms of volatility, the risk of energy efficiency

investments is about the same as U.S. T-bills, while the return on investment is greater than

that of small company stocks.

Source: Laitner, J., Ehrhardt-Martinez, K. and Prindle, W., 2007, “American Energy Efficiency

Investment Market”, Energy Efficiency Finance Forum, American Council or and Energy Efficient

Economy .

Some of these barriers can be lessened by energy service companies offering shared savings

and the linking of energy efficiency to pollution prevention and a good corporate image.

Some Good References

Bartlett, A.A., “Forgotten Fundamentals of the Energy Crisis", The American Journal of Physics,

Volume 46, September 1978, pages 876 to 888.)

Duffie, J. and Beckman, W., 1991. Solar Engineering of Thermal Processes, John Wiley and Sons,

Inc., New York, NY.

Stoecker, W., Design of Thermal Systems, 1989. Design of Thermal Systems, McGraw-Hill, Inc.,

New York, NY.

Document1

26

Thuesen, G. and Fabrycky, W., 1993. Engineering Economy, Prentice Hall, Englewood Cliffs, NJ.

U.S. Congress, Office of Technology Assessment, Industrial Energy Efficiency, OTA-E-560, 1993.

Document1

27