Balance Sheet as at 31 March 2014

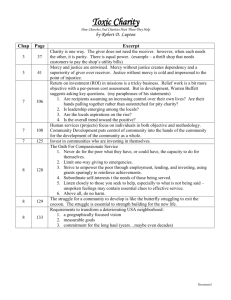

advertisement

Association for Citizenship Teaching (A registered charity in England and Wales) Un-audited financial statements for the Year Ended 31 March 2014 Charity Number: 1100180 1 Prepared by ExcluServ Ltd r ended 31 March 2014 Association for Citizenship Teaching Statement of Financial Activities for the year ended 31 March 2014 Notes Unrestricted Funds 2014 Restricted Funds 2014 Total Funds 2014 Total Funds 2013 £ £ £ £ Incoming Resources Incoming resources from generated funds: Investment income 2 205 - 205 418 23,555 104,003 127,558 138,951 6,887 - 6,887 9,672 11,741 - 11,741 20,596 42,388 104,003 146,391 169,637 Incoming resources from charitable activities Citizenship Project Income Conferences Membership Subscriptions Total Incoming Resources Resources Expended Cost of generating funds 3 44,618 - 44,618 49,034 Charitable activities 3 47,775 106,018 153,793 180,625 Governance costs 3 4,586 - 4,586 3,237 96,979 106,018 202,997 232,896 (54,591) (2,015) (56,606) (63,259) - - - - (54,591) (2,015) (56,606) (63,259) 120,393 17,781 138,174 201,433 65,802 15,766 81,568 138,174 Total Resources Expended Net Expenditure for the year Transfer of funds Net movement of funds Reconciliation of funds Total funds brought forward Total funds carried forward The statement of financial activities includes all gains and losses in the year. All incoming resources and resources expended derive from continuing activities. 2 Prepared by ExcluServ Ltd Balance Sheet as at 31 March 2014 Association for Citizenship Teaching Balance Sheet as at 31 March 2014 (Charity number 1100180) 2014 Notes £ 2013 £ £ Fixed Assets Tangible assets 8 263 468 Current Assets Debtors Cash at bank and in hand Creditors: Amounts falling due within one year 9 20,355 1,395 10 75,742 150,790 96,097 152,185 14,792 14,479 11 Net Current Assets 81,305 Net Assets 81,305 137,706 81,568 138,174 Unrestricted Funds 12 65,802 120,393 Restricted Funds 12 15,766 17,781 81,568 138,174 Total Funds Approved by the Board of Trustees on ………………………… and signed on their behalf by: Michael Raftery Chairman 3 Gordon Mattocks Treasurer Prepared by ExcluServ Ltd Notes forming part of the Financial Statements for the Year ended 31 March 2014 1) Accounting Policies The financial statements have been prepared under the historical cost convention, and in accordance with applicable accounting standards and the Statement of Recommended Practice, “Accounting and Reporting by Charities”, issued in March 2005, the Charities Act 2011 and in accordance with the Financial Reporting Standard for Smaller Entities (effective April 2008). SORP 2005 provides a number of concessions for smaller charities that are not subject to a statutory audit. Association for Citizenship Teaching falls within this category and has taken advantage of these concessions (as set out in SORP 2005, Appendix 5.3). The following are the accounting policies which have applied in dealing with material items. Incoming resources Grants are recognised in the accounts when receivable and allocated to restricted or unrestricted funds as specified by the donor. Income from conference fees is included as income from activities in furtherance of the charity's objectives. Where a conference has not taken place by the year end, the related income is deferred to the period in which it is held. Subscription income is recognised upon receipt from the member, whereupon the invoice for the fee is raised. Subscription to the charity's magazine includes membership of ACT. Resources expended Expenditure is recognised on an accruals basis when a liability occurs. Expenditure includes VAT which cannot be recovered and is reported as part of the expenditure to which it relates. Charitable expenditure comprises those costs incurred by the charity in the delivery of its activities. It includes both costs that can be allocated directly to these activities and indirect costs which are necessary to support them. Governance costs include those costs associated with meeting the constitutional and statutory requirements of the charity and include independent examiner's fees and costs linked to the strategic management of the charity. Taxation The company is a charitable institution with exemption from UK taxation. 4 Prepared by ExcluServ Ltd Fixed Assets Tangible fixed assets are stated at cost less depreciation. Assets with a cost of £250 or more are capitalised. Depreciation is provided at rates calculated to write off the cost less estimated residual value of each asset over its expected useful life, as follows: Information Technology Office Equipment 33.33% on cost 20% on cost Pensions The charity pays into defined contribution personal pension schemes on behalf of its employees. The charity has no further responsibility to its employees regarding pensions. Funds Restricted funds are used for the specific purpose laid down by the donor. Expenditure which meets these conditions is charged to the fund. Unrestricted funds are other incoming resources receivable or generated for the objectives of the charity without further specified purpose and are available as general funds. 2) Investment Income Unrestricted Restricted £ Interest receivable 5 £ 2014 Total 2013 Total £ £ 205 - 205 418 205 - 205 418 Prepared by ExcluServ Ltd £ £ Governance Membership & Journal Projects £ Conferences Direct Costs Cost of Generating Funds Basis of Allocation 3) Total Resources Expended £ £ 2014 Totals 2013 Totals £ £ Publishing Costs Direct - 240 3,800 - - 4,040 7,433 Consultancy Fees Direct 18,788 27,758 500 - - 47,046 31,113 Event Costs Direct - 15,900 - 4,188 - 20,088 2,049 Independent Examiner's Fees Direct - - - - 3,660 3,660 2,340 18,788 43,898 4,300 4,188 3,660 74,834 42,935 Total Direct Costs Support Costs Staff Costs Staff Time - 47,965 14,819 3,039 - 65,823 57,083 Contract Labour Staff Time 20,115 288 454 52 - 20,909 56,438 Premises Staff Time 2,063 2,562 854 854 - 6,333 10,000 Communications Staff Time 576 44 1,549 1 - 2,170 2,596 General Office Staff Time (263) 3,491 4,597 875 - 8,700 11,397 Travel Staff Time 1,403 17,804 699 1,444 926 22,276 41,193 Website Costs Staff Time 1,857 - - - - 1,856 11,161 Other Finance Costs Staff Time 11 - - - - 11 22 Bank Charges Staff Time 68 9 6 2 - 85 71 Total Support Costs 25,830 72,163 22,978 6,267 926 128,163 189,961 Total Resources Expended 44,618 116,061 27,278 10,455 4,586 202,997 232,896 Allocations are based on time spent by employees. 6 Prepared by ExcluServ Ltd 4) Act ivities undertaken directly Unrestricted £ Depreciation Restricted £ Total 2014 £ Total 2013 £ 205 - 205 147 Travel & Subsistence 3,982 17,366 21,348 40,293 Venue Hire 2,414 15,870 18,284 - Catering Cost Event Costs 1,774 - 30 - 1,804 - 2,049 Wages & Salaries 10,587 48,480 59,067 50,504 Employer's Pension 1,545 - 1,545 1,545 Employer's NI 5,211 - 5,211 5,034 Contract Labour 20,745 163 20,908 56,438 Consultancy Fees 26,875 20,170 47,045 31,113 567 - 567 601 4,625 1,708 6,333 10,000 Telephone & Facsimile 247 - 247 250 Email & Internet 275 - 275 Website Costs 1,857 - 1,857 11,161 Postage & Delivery 1,603 45 1,648 2,347 Promotions and Print 5,855 262 6,117 4,991 Publishing Costs 3,800 240 4,040 7,433 Insurance (314) 1,658 1,344 1,450 76 9 85 71 11 453 92,393 17 106,018 11 470 198,411 22 4,210 229,659 Subscriptions Rent & Service Bank Charges Other Finance Costs General Office Costs 7 Prepared by ExcluServ Ltd 5) Em ployee Remuneration Payroll Details: 2014 2013 £ £ Wages and Salaries 59,067 50,504 Social Security Costs 5,211 5,034 Other Pension Costs 1,545 1,545 65,823 57,083 No employee received emoluments of more than £60,000 (2013: None) The average number of employees during the year, calculated on the basis of full time equivalents, was as follows: 2014 2013 Number Number Project workers 2 2 Admin and Support - - Total 2 2 6) Trustee Remuneration None of the trustees (or any person connected with them) received any remuneration or expense reimbursements during the year. ACT had taken out indemnity insurance at an annual cost of £320 to cover all trustees (2012: £286). 7) Taxation As a charity, Association for Citizenship Teaching is exempt from tax on income and gains falling within section 505 of the Taxes Act 1988 or s256 of the Taxation of Chargeable Gains Act 1992 to the extent that these are applied to its charitable objects. No tax charges have arisen in the Charity. 8 Prepared by ExcluServ Ltd 8) Tangible Fixed Assets Information Technology Office Equipment Total £ £ £ Cost: At 1 April 2013 8,672 409 9,081 Additions At 31 March 2014 8,672 409 9,081 8,203 409 8,612 205 - 205 8,409 409 8,818 At 31 March 2014 263 - 263 At 31 March 2013 468 - 468 Accumulated Depreciation At 1 April 2013 Charge for the year At 31 March 2014 Net book value 9) Debtors 2014 2013 £ Trade debtors £ 980 598 Prepayments and accrued income 19,375 797 Total 20,355 1,395 10) Cash at bank and in hand 2014 £ 2013 £ Unity Trust Bank Accounts 75,742 150,790 Total 75,742 150,790 9 Prepared by ExcluServ Ltd 11) Creditors: Amounts Falling Due within One Year 2014 2013 £ £ Trade Creditors 9,231 8,569 Accruals and deferred income 3,000 2,340 PAYE NI payable 1,337 3,223 Other Creditors 1,224 347 14,792 14,479 Total No income was deferred at the end of the year (2013: Nil). 12) Movement in Funds At 1 April 2013 Incoming Resources Outgoing Resources Transfers At 31 March 2014 £ £ £ £ £ Restricted Funds Five Nations Network 9,000 81,929 75,507 - 15,422 CEdAR Project (Lebanon) 8,781 22,074 30,511 - 344 17,781 104,003 106,018 - 15,766 120,393 42,388 96,979 - 65,802 Unrestricted Funds *Five Nations Network – ACT is the coordinating body of the Five Nations Network, a unique forum sharing practice in education for citizenship and values in England, Ireland, Northern Ireland, Scotland and Wales. *CEdAR Project (Lebanon) – is a 30 month education development project to evaluate the Citizenship in Lebanon. The project is funded by the EU and undertaken in partnership with the Institute of Education in London. 10 Prepared by ExcluServ Ltd 13) Analysis of net assets between funds Fund balances at 31 March 2014 are represented by: Tangible fixed assets Current assets Creditors: amounts falling due within one year Unrestricted funds £ Restricted funds £ Total 263 80,331 (14,792) 65,802 15,766 15,766 263 96,097 (14,792) 81,568 £ 14) Related Party Transactions There were no related party transactions recorded in the period. 11 Prepared by ExcluServ Ltd