Prestats2013 - The Prehistoric Society

advertisement

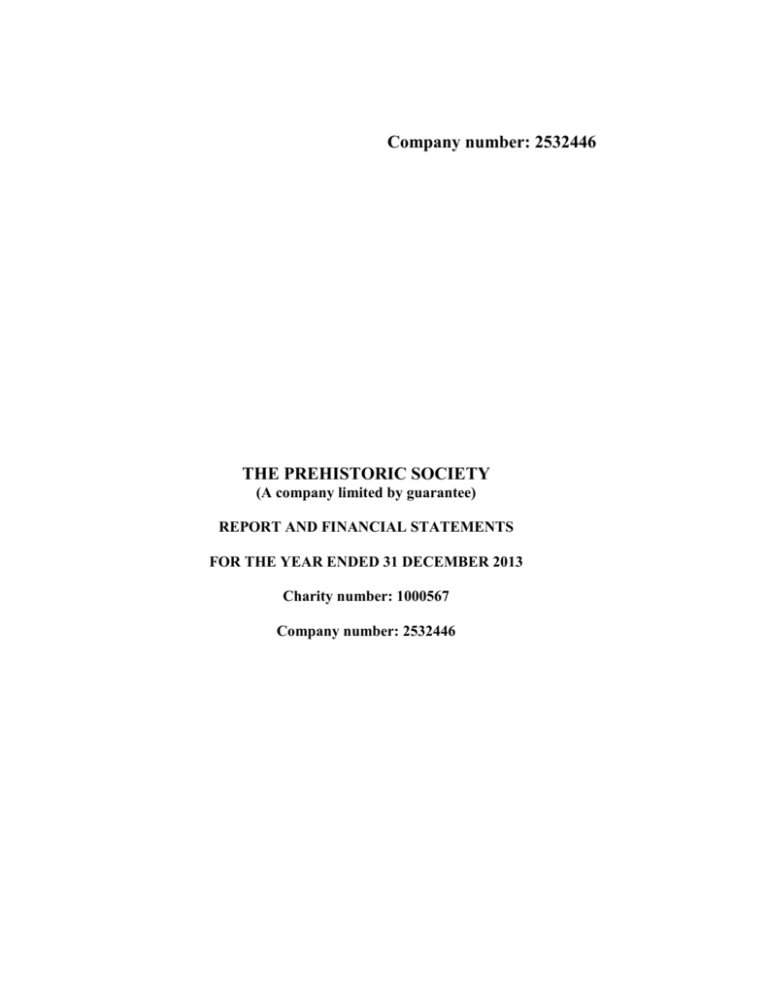

Company number: 2532446 THE PREHISTORIC SOCIETY (A company limited by guarantee) REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2013 Charity number: 1000567 Company number: 2532446 THE PREHISTORIC SOCIETY STATEMENT OF FINANCIAL ACTIVITIES FOR THE YEAR ENDED 31 DECEMBER 2013 Note Unrestricted funds £ Restricted funds £ Total £ Total 2012 £ Incoming resources Incoming resources from generated funds: Voluntary income Investment income 2 3 32,422 3,399 35,821 4,883 4,883 32,422 8,282 40,704 48,165 8,881 57,046 Incoming resources from charitable activities 4 24,823 5,490 30,313 20,963 60,644 10,373 71,017 78,009 6,947 38,626 5,669 9,768 - 6,947 48,394 5,669 8,698 62,752 5,969 51,242 9,768 61,010 77,419 9,402 605 10,007 590 (4,665) (281) (4,946) 2,154 4737 324 5,061 2,744 Total funds at 1 January 60,581 101,076 161,657 158,913 Total funds at 31 December 65,318 101,400 166,718 161,657 Total incoming resources Resources expended Costs of generating funds: Costs of generating voluntary income Charitable activities Governance costs 7 8 9 Total resources expended Net incoming resources (Loss)/gain on revaluation of investments Net movement in funds 10 The statement of financial activities includes all gains and losses recognised in the year. All incoming resources and resources expended derive from continuing activities. The notes on pages 4 to 9 form part of these financial statements. THE PREHISTORIC SOCIETY BALANCE SHEET AS AT 31 DECEMBER 2013 Notes FIXED ASSETS Tangible assets Investments 13 14 31 December 2013 £ £ 31 December 2012 £ 166,288 293 171,234 171,527 166,288 CURRENT ASSETS Debtors Cash at bank CURRENT LIABILITIES Creditors: Amounts falling due within one year 15 19,049 19,049 8,745 21,552 30,297 16 (18,619) (40,167) NET CURRENT ASSET/(LIABILITIES) NET ASSETS Restricted funds Unrestricted funds TOTAL FUNDS 18 18 £ 430 (9,870) 166,718 161,657 101,400 65,318 166,718 101,076 60,581 161,657 The directors consider that the charitable company is entitled to exemption from the requirement to have an audit under the provisions of section 477 of the Companies Act 2006 ("the Act") and members have not required the charitable company to obtain an audit for the year in question in accordance with section 476 of the Act. The directors acknowledge their responsibilities for ensuring that the charitable company keeps accounting records which comply with section 386 of the Act and for preparing financial statements which give a true and fair view of the state of affairs of the charitable company as at 31 December 2013 and of its incoming resources and application of resources for the year then ended in accordance with the requirements of sections 394 and 395 of the Act and which otherwise comply with the requirements of the Companies Act 2006 relating to the financial statements so far as applicable to the charitable company. The financial statements have been prepared in accordance with the special provisions relating to companies subject to the small companies regime within Part 15 of the Companies Act 2006 and in accordance with the Financial Reporting Standard for Smaller Entities (effective April 2008). Approved by the Council on 28 May 2014 and signed on its behalf by: Dr J A Sheridan President The notes on pages 4 to 9 form part of these financial statements. THE PREHISTORIC SOCIETY NOTES TO THE FINANCIAL STATEMENTS 31 DECEMBER 2013 1. Accounting policies Basis of accounting The financial statements have been prepared under the historical cost convention, as modified by the inclusion of fixed asset investments at market value, and in accordance with the Financial Reporting Standard for Smaller Entities (effective April 2008) and Accounting and Reporting by Charities: Statement of Recommended Practice (SORP 2005). Incoming resources All incoming resources are included in the Statement of Financial Activities when the charitable company is entitled to the income and the amount can be quantified with reasonable accuracy. Voluntary income is included when receivable except for membership subscriptions received for the following year, which are included in ‘Accruals and deferred income’ in the Balance Sheet. Investment income is included when receivable. Incoming resources from charitable activities are included when earned. Resources expended Resources expended are recognised in the year in which they are incurred and include attributable VAT that cannot be recovered. Resources expended include those costs that can be allocated directly to each activity and support costs relating to the activity. Costs of generating funds comprise the costs associated with attracting voluntary income. Charitable activities include those costs incurred by the charitable company in the delivery of its charitable activities. Governance costs include those costs associated with meeting the constitutional and statutory requirements of the charitable company. Support costs are allocated between expenditure categories on a basis designed to reflect the use of the resource. Tangible assets Tangible assets are stated at cost less accumulated depreciation. Depreciation is provided at rates calculated to write off the cost of each asset over its expected useful life, which in all cases is estimated at four years. Items of equipment are capitalised when the purchase price exceeds £500. Investments Investments held as fixed assets are revalued at mid-market value at the balance sheet date and the gain or loss taken to the Statement of Financial Activities. Fund accounting Unrestricted funds are available for use at the discretion of the trustees in furtherance of the general objectives of the charitable company. Restricted funds are subject to restrictions on their expenditure imposed by the donors. Cash flow statement The charitable company has taken advantage of the exemption not to prepare a cash flow statement on the grounds that it is a small reporting entity. NOTES TO THE FINANCIAL STATEMENTS (continued) 31 DECEMBER 2013 THE PREHISTORIC SOCIETY Unrestricted funds £ Restricted funds £ Total £ Restated Total 2012 £ 31,702 720 32,422 - 31,702 720 32,422 42,948 1,194 4,023 48,165 2. Voluntary income Subscriptions Donations and other income Gift Aid ‘Donations and other income’ includes standing order receipts from subscribers for which the Society no longer has a current address. There is a risk that some of these standing order receipts might be repayable in future years but, based on the lack of claims in previous years, the trustees consider that the risk is not significant and therefore no applicable provision has been made. 3. Investment income Unrestricted funds £ Restricted funds £ Total £ Total 2012 £ 3,375 24 3,399 4,875 8 4,883 8,250 32 8,282 8,834 47 8,881 4. Incoming resources from charitable activities Unrestricted funds £ Restricted funds £ Total £ Total 2012 £ 5,490 5,490 4,361 3,006 14,096 579 8,271 30,313 10,506 2,052 524 1,795 5,290 777 19 20,963 Dividends Bank interest Publication grants Copyright fees Publications Back numbers of Proceedings Conferences Study tours Other 4,361 3,006 14,096 579 2,781 24,823 THE PREHISTORIC SOCIETY NOTES TO THE FINANCIAL STATEMENTS (continued) 31 DECEMBER 2013 5. Support costs Administration fee Website Insurance Stationery and postage Bank charges Exchange difference Depreciation Disposal of asset £ 2012 £ 11,254 490 816 226 800 16 293 13,895 11,008 435 801 408 640 39 234 13,565 Support costs are general administration costs incurred by the charitable company that cannot be specifically allocated to activities. 6. Allocation of support costs £ 2012 £ Costs of generating voluntary income 6,947 6,782 Resources expended on charitable activities: Grants Lectures Proceedings PAST Back numbers of Proceedings Conferences Study tours 834 139 278 417 1,390 2,223 - 407 136 271 407 1,357 2,170 407 1,667 13,895 1,628 13,565 Governance costs Support costs are allocated on a basis consistent with the use of resources. THE PREHISTORIC SOCIETY NOTES TO THE FINANCIAL STATEMENTS (continued) 31 DECEMBER 2013 7. Costs of generating voluntary income Printing and postage Support costs Unrestricted funds £ Restricted funds £ Total £ Total 2012 £ 6,947 6,947 - 6,947 6,947 1,916 6,782 8,698 Unrestricted funds £ Restricted funds £ Total £ Total 2012 £ 3,600 280 22,095 4,146 2,863 1,250 4,392 38,626 500 1,212 8,056 9,768 4,100 280 23,307 4,146 2,863 1,250 12,448 48,394 4,825 1,719 34,001 10,436 1,755 9,609 407 62,752 Unrestricted funds £ Restricted funds £ Total £ Total 2012 £ 2,244 1,647 111 1,667 5,669 - 2,244 1,647 111 1,667 5,669 1,722 2,508 0 111 1,628 5,969 8. Resources expended on charitable activities Grants Lectures Proceedings PAST Back numbers of Proceedings Research Papers Conferences Study tours 9. Governance costs Hire of meeting rooms Travel expenses Annual General Meeting Statutory fees Support costs 10. Net incoming resources Net incoming resources for the year are stated after charging depreciation of £NIL (2012: £234). 11. Trustee remuneration and related party transactions No members of the Council received any remuneration during the year. Travel costs amounting to £1,647 (2012: £2,508) were reimbursed to 19 (2012: 19) members of Council. THE PREHISTORIC SOCIETY NOTES TO THE FINANCIAL STATEMENTS (continued) 31 DECEMBER 2012 12. Taxation The charitable company is exempt from tax on income and gains falling within section 505 of the Taxes Act 1988 or s256 of the Taxation of Chargeable Gains Act 1992 to the extent that these are applied to its charitable activities. 13. Tangible fixed assets Office equipment £ Cost At 31 December 2012 At 31 December 2013 703 703 Depreciation At 31 December 2012 Provided during the year At 31 December 2013 410 293 703 Net book value At 31 December 2013 At 31 December 2012 293 14. Fixed asset investments £ 2012 £ Quoted investments: At 1 January Unrealised (losses)/gains At 31 December 171,234 (4,946) 166,288 169,080 2,154 171,234 Historical cost 172,926 172,926 £ 2012 £ - 8,745 15. Debtors Prepayments and accrued income THE PREHISTORIC SOCIETY NOTES TO THE FINANCIAL STATEMENTS (continued) 31 DECEMBER 2013 16. Creditors: Amounts falling due within one year £ 2012 £ 8,250 10,369 18,619 24,573 15,594 40,167 Unrestricted funds £ Restricted funds £ Total £ 66,849 17,088 (18,619) 65,318 99,439 1,961 101,400 166,288 19,049 (18,619) 166,718 Trade creditors Accruals and deferred income 17. Analysis of net assets between funds Tangible fixed assets Investments Current assets Current liabilities Net assets at 31 December 2013 18. Movement in funds 31 December 2012 Restricted funds: Europa Fund John and Bryony Coles Fund Total restricted funds Unrestricted funds Total funds Incoming Resources resources expended Revaluation of investments 31 December 2013 £ £ £ £ £ 87,850 13,226 101,076 9,769 604 10,373 (9,768) (9,768) (964) 683 (281) 86,887 14,513 101,400 60,581 60,644 (51,242) (4,665) 65,318 161,657 71,017 (61,010) (4,946) 166,718 Purposes of the restricted funds The Europa Fund was set up following a donation from Professor Grahame Clark and provides income to promote the study of prehistory by European scholars. The John and Bryony Coles Fund was set up following a donation from Professors John and Bryony Coles and provides income to allow students to work abroad at prehistory projects.