spy gaps down within flag -- finance sector leads the

advertisement

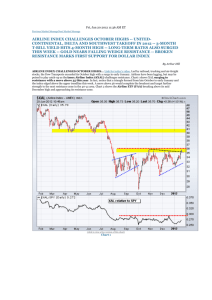

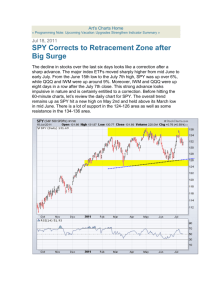

Mon, Sep 19 2011 3:37 PM ET Previous Market MessageNext Market Message SPY FORMS BEARISH CONTINUATION PATTERN ON WEEKLY CHART -- SPY GAPS DOWN WITHIN FLAG -FINANCE SECTOR LEADS THE MARKET LOWER AGAIN -- OIL LEADS COMMODITIES LOWER -INDUSTRIALS METALS ETF BREAKS AUGUST LOW -GOLD AND SILVER SUCCUMB TO SELLING PRESSURE By Arthur Hill SPY FORMS BEARISH CONTINUATION PATTERN ON WEEKLY CHART... Link for today’s video. There can be different trends in different timeframes. A three year weekly chart can show an emerging downtrend, but a three month daily chart can show an uptrend. Moreover, there can, and are, counter-trend rallies within bear markets. Chart 1 shows weekly candlesticks for the S&P 500 ETF (SPY) since 2009. The ETF clearly broke support around 125 and moved below the July 2009 trendline. The yellow areas mark support in the 125, 112, 100 and 93 areas. SPY broke the first support area and bounced off the second support. The current bounce looks like a rising flag, which is a bearish continuation pattern. “Rising” is the key word here. Uptrends rise and downtrends fall. This flag is, however, viewed as a smaller uptrend within a bigger downtrend. Should this long-term bearish prognosis play out, there would be a continuation lower that targets the next support zone. A 50% retracement of the entire bull run would extend to the 100 area. The 2010 lows confirm support in the low 100s. A 61.80% retracement would extend all the way to the low 90s. (click to view a live version of this chart) Chart 1 The indicator window shows StochRSI oscillating between zero and one. In general, a move above .80 shows strength until countered with a move below .20, which marks the bearish threshold. A move below .20 shows weakness until countered with a move back above .80, the bullish threshold. Something clearly changed in this momentum oscillator with the March decline. Notice how StochRSI moved below .20 in March and has yet to move back above .80. During the bull run, the oscillator did not remain down for long and quickly surged back above .80 to revive the bulls. The dips below .20 were especially short-lived in 2009. The 2010 dips lasted longer and the current dip is now over six months old. Six months without a surge back above .80 shows weakness in upside momentum. This further confirms the overall bearish bias in SPY. Chart 2 shows the Russell 2000 ETF (IWM) with a rising wedge after the August breakdown. A continuation lower targets a move to the 56-58 area (yellow). (click to view a live version of this chart) Chart 2 SPY GAPS DOWN WITHIN FLAG... The SPY bulls have shown some resilience with a zigzag advance since early August. With a higher trough in early August and higher peak in late August, the trend since the August low is up. This uptrend, however, is considered a bear market rally with resistance expected below the July highs. In particular, broken support and the 50-61.80% retracement zone mark the most likely resistance zone. This technique can be applied to any other chart with a sharp August decline. When will this shorter term uptrend end and the longer term downtrend resume? That, of course, is the million dollar question. With today’s gap down and decline, a lower peak could be taking shape. This is the first step towards a trend reversal. A move below the flag trendline and September lows would clearly reverse this uptrend. Once reversed, the targets put forth on the weekly chart would come into play. Why do bear market rallies occur? One possible reason is that the Fed, European Central Bank (ECB) and other government entities do everything they can to prevent extended declines. The ECB announced a big injection for European banks last week and this sent European stocks sharply higher at the end of the week. The Fed meets this week and is expected to announce some sort of QE3. The monetary spigots are on full blast and there is no telling how the market will react to the Fed policy statement. (click to view a live version of this chart) Chart 3 The indicator window shows the Commodity Channel Index (CCI). CCI broke the short green trendline, but recovered quickly and surged back into positive territory. I am drawing anothergreen trendline to mark the next support to watch. A second break of the trendline would turn momentum bearish and this would be another negative sign for SPY. Chart 4 shows IWM with similar characteristics. (click to view a live version of this chart) Chart 4 FINANCE SECTOR LEADS THE MARKET LOWER AGAIN... The Finance SPDR (XLF) continues to bear the brunt of selling pressure. Leading stocks in this sector include JP Morgan Chase, Wells Fargo, Citigroup, Bank of America and Goldman Sachs. These five make up over 30% of the ETF. Chart 5 shows XLF with a Diamond pattern taking shape since early August. This is basically a consolidation within a downtrend. Moreover, the right half of the pattern is a Symmetrical Triangle. Last week’s high and low mark resistance and support. Chartists can watch these levels for the next directional clue. An upside breakout would be quite positive and possible give the six week uptrend in SPY some legs. A support break would be negative and weigh on the broader market. Chart 6 shows the Regional Bank SPDR (KRE) with a Symmetrical Triangle this month. As with XLF, chartists can watch last week’s range for the next directional break. KRE also shows relative weakness as the Price Relative (KRE:SPY ratio) moved to new lows this month. (click to view a live version of this chart) Chart 5 (click to view a live version of this chart) Chart 6 OIL LEADS COMMODITIES LOWER... The combination of a strong Dollar and weak stock market pushed commodities lower on Monday. A rising Dollar makes Dollardenominated commodities like oil more expensive on the world market. A weak stock market signals weakness in the economy and this means less demand for commodities. Chart 7 shows the US Dollar Fund (UUP) with a Double Bottom breakout. The next resistance zone resides in the 23.4 area. Chart 8 shows the US Oil Fund (USO) failing at resistance in the 35 area. As noted last week, resistance here stems from broken support, the 50% retracement and the May trendline. The ETF broke below the wedge trendline with a sharp move lower on Monday. This signals a continuation of the bigger downtrend. (click to view a live version of this chart) Chart 7 (click to view a live version of this chart) Chart 8 INDUSTRIALS METALS ETF BREAKS AUGUST LOW... The Base Metals ETF (DBB)extended its downtrend with a move below the August lows. Industrial metals are closely tied to economic performance, global economic performance that is. Demand for copper, aluminum and zinc fluctuates right along with the economy. A new low in this ETF suggests that demand and the economy are weak. Chart 9 shows DBB breaking rising flag support in early September and plunging below 21.50 today. (click to view a live version of this chart) Chart 9 GOLD AND SILVER SUCCUMB TO SELLING PRESSURE... The Gold SPDR (GLD)started the day strong, but selling pressure kicked in and drove bullion sharply lower. Chart 10 shows GLD within a falling wedge pattern this month. Even though the September wedge may be a bullish consolidation, we need to see a move above 178 to break wedge resistance and signal a continuation of the late August surge. Barring a wedge breakout, the mid-late August lows and 38.2% retracement mark first support in the 166-167 area. Below this level, broken resistance and the late January trendline mark next support in the low 150s. Also note that a 50-61.80% retracement of the entire advance would extend to this area. (click to view a live version of this chart) Chart 10 Chart 11 shows the Silver Trust (SLV) breaking the lower trendline of a rising wedge. Also notice that the ETF retraced 61.80% of the prior decline and met resistance at 42 twice. The trendline break is negative and further weakness below the late August low would complete the trend reversal with a lower low. The indicator window shows Aroon (23). I set it at 23 because this is roughly one month of trading days. A new downtrend is signaled when Aroon Down (red) surges to 100. A new uptrend is signaled when Aroon Up (green) surges to 100. Well, Aroon Down surged to 100 today and this indicator signals the start of a new downtrend. Next support is at 32. (click to view a live version of th