X-Ref - Matrimonial CaseLaw Corp.

advertisement

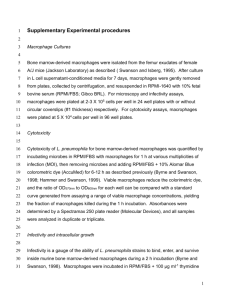

Matrimonial CaseLaw ENFORCEMENT OF CHILD SUPPORT ORDERS IN FEDERAL AND STATE COURTS by RUSSSELL I. MARNELL The United States Congress and state legislatures have enacted numerous provisions to combat the problem of noncustodial parents who are delinquent in their child support payments and simply refuse to pay. As a result, more stringent enforcement provisions have recently been added to deal with “deadbeat” parents who flagrantly refuse to support their children.i For example, in 1992 Congress passed the Child Support Recovery Act (“CSRA”), which allows the federal government to jail parents who have fallen behind in their child support payments.ii Additionally, many states have enacted statutes that require adverse action against delinquent obligor’s driver’s licenses, including occupational or professional licenses.iii Finally, two of the newest punitive enforcement techniques include posting “most wanted” lists consisting of delinquent obligors,iv prosecuting individuals who aid and abet nonpayment of child support obligationsv and booting the car’s of delinquent obligors.vi Many of these child support enforcement provisions are highly publicized and have caused considerable debate and litigation. Arguably, none has caused more debate and publicity then CSRA. These debates typically center on whether CSRA is constitutionally valid and/or the meaning of “willfully fails to pay,” a requirement found in the statute’s definition of the offense.vii When considering the first issue respectively, there is substantial authoritative weight that suggests that CSRA is a constitutional exercise of Congressional authority, pursuant to the Commerce Clause.viii However, there is a relatively strong argument that CSRA violates the Tenth Amendment and that Congress has impermissibly extended its authority under the Commerce Clause.ix Ultimately, CSRA should survive a constitutional attack due to its purpose, namely to prevent delinquent parents who have moved from the state in which their children reside and also have willfully failed to pay child support from getting away with it, and because of the existence of its extensive legislative history.x The second issue is the meaning of “willfully fails to pay.” Although CSRA does not define willfulness, “criminalization of the willful failure to pay is not new to the criminal code; it appears frequently in the tax statutes.”xi Congress specifically stated, “[the] language has been borrowed from the tax statutes that makes willful failure to collect or pay taxes a Federal crime.” xii The willfulness element in the tax felony statutes requires proof of an intentional violation of a known legal duty, and thus describes a specific intent crime. Accordingly, CSRA’s legislative history directs that its willful failure standard should be interpreted in the same manner that the Federal courts have interpreted these felony tax provisions.xiii In United States v. Mattice,xiv the United States Court of Appeals for the Second Circuit affirmed a judgment of the United States District Court for the Western District of New York convicting defendantappellant of willfully failing to pay a past due child support obligation in violation of CSRA, and ordering him, as part of his sentence, to pay full restitution. The defendant-appellant, relying on the Supreme Court’s decision in Bryan v. United States,xv contended that in order to satisfy the knowledge component of CSRA’s willfulness standard, he must have known that his conduct violated the Act. Moreover, the defendantappellant, argued that since CSRA was supposed to be interpreted in the same manner as the willfulness standard in the federal tax statutes, the government must prove that he was aware of the specific federal criminal statute under which he was charged.xvi The court, however, rejected the defendant-appellant’s argument and held that unlike the tax statutes, CSRA does not itself prescribe the legal duty to pay child support because the legal duty to pay child support arises from a relevant state court or administrative order imposing the support obligation rather than CSRA.xvii Thus, it is the defendant’s awareness of the order rather than the statute that is critical to the willfulness inquiry.xviii In many cases, unfortunately, proving intent is a lesser burden to carry than enforcing the child support payments. Typically, when a noncustodial parent ignores a court order to pay child support, the name immediately goes into a state computer. Usually, wages are garnished, bank accounts are seized and tax refunds are withheld. Additionally, many states have enacted laws that suspend the driver’s licenses of obligors who are not in substantial compliance with a child support order.xix The underlying goal of license revocation or denial is hit the “deadbeat parent” where it hurts by taking away the drivers or occupation license essential for earning a livelihood. However, these statutes will undoubtedly be subject to future constitutional challenges. These challenges will likely include the following: 1) a substantive due process argument that the state’s interest in collecting child support is not sufficiently compelling to overcome the individual’s interest in supporting a family by procuring or maintaining an occupational or professional license; 2) a procedural due process argument that the statute deprives individuals of their licenses without providing Copyright 1985-1999 Articles of Current Interest constitutionally adequate procedures under the Due Process clause of the Fourteenth Amendment; and 3) an argument that the inclusion of certain types of occupational licenses and the exclusion of others violates the Equal Protection clause of the Fourteenth Amendment.xx Even if these statutes survive a constitutional attack, they prove ineffective against parents who declare no income and don’t hold bank accounts in their own name. In recognizing the existence this situation, Fairfax, Virginia became the first county in the United States to boot the cars of “deadbeat” parents. The program has been so successful that it went into effect state wide in December. Any parent in Virginia who owes more than $1,000 in child support is at risk of having his or her car booted with a pink or baby blue boot. The sheriffs who put on the boot also attach a large sign on the care that says, “This vehicle has been seized by the sheriff for unpaid child support.” xxi In New York, Suffolk county legislators are proposing a similar approach to get deadbeat parents to pay.xxii However, this law seems to be open to the same kinds of constitutional attack as the laws that authorize the revocation, denial or suspension of a driver’s license. Currently, in New York the petitioner is entitled to an array of remedies, regardless what relief petitioner requests.xxiii Hearing examiners decide enforcement/violation petitions. A judge hears objections.xxiv Only a judge may incarcerate. The first remedy is income deduction to garnish wages.xxv Employers could retain garnished money or forward it. This is an effective, inexpensive remedy. Although no court order is needed,xxvi the court may issue one.xxvii Another remedy is the suspension of the respondent’s drivers, business or professional licenses if four months of support are owed.xxviii If respondent receives public assistance or the income is below the federal self-support reserve, no license may be suspended.xxix Finally, imposing incarceration, rehabilitation or probation requires a finding of willfulness.xxx If seeking willfulness, petitioner moves for contempt.xxxi Other remedies require only nonpayment. Contempt proceedings for child support are civil because they are remedial, not punitive.xxxii Incarceration for civil contempt is conditioned on paying support.xxxiii Criminal sanctions have four main advantages over the numerous civil remedies available for enforcing child support orders: 1) criminal enforcement may act as a deterrent, reducing recidivism for a particular defendant and reducing the tendency of the rest of the population to commit the crime; 2) the threat of extradition in interstate cases may encourage compliance with court orders; and 4) the criminalization of the nonpayment of child support demonstrates state and federal legislatures’ realization that it is a serious threat not only to the children who suffer, but to society as a whole. However, punishing a delinquent obligor with revocation or denial of his or her license will merely prevent the obligor form working to meet his or her obligations, thus frustrating the goal of recovery of support.xxxiv One way to reconcile this problem is to enforce license restrictions and to utilize “most wanted” lists in situations where they are reluctant to impose jail sentences. The rationale behind this technique is to publicly shame these “deadbeat parents” into paying up. For example, Mississippi’s statute authorizing the creation of such list allows its child support enforcement agency to release to the public the name, photo, last known address, arrearage amount and other necessary information of a parent who has a judgment against him for child support and is currently in arrears in the payment of this support.xxxv These lists are generally published in newspapers within the state and turned into posters that are then posed in public buildings.xxxvi Many are also posted on sites on the World Wide Web.xxxvii However, the use of “most wanted” might be in violation of an obligor’s right to privacy.xxxviii Thus, licensee restrictions and “most wanted” lists have advantages over the criminal statutes. Although these alternative provisions punish criminal conduct, they provide penalties that are much less harsh than loss of liberty. For this reason, judges and prosecutors might be more inclined to enforce license restrictions and to utilize “most wanted” lists in situations where they are now reluctant to impose jail sentences. This would enable them to reserve prosecution under the criminal provisions as a last resort. The egregious cases are more suitable candidates for criminal penalties than the average delinquent obligor. i. See Pamela Forrestall Roper, Note: Hitting Deadbeat Parents Where it Hurts: “Punitive” Mechanisms in Child Support Enforcement, 14 ALASKA L. REV. 41, 42 (1997). ii. See Child Support Recovery Act of 1992, 18 U.S.C.§ 228 (1994). CSRA, passed in October 1992, created a federal criminal offense for any willful failure to pay past child support obligations to a child who resides in a different state than parent. However, parent must owe more than $5000 or, alternatively, owe less than $5000 which has remained unpaid for more than a year. A parent’s first offense will result in a jail sentence of not more than six months or, alternatively, a fine. However, parent can be both fined and Matrimonial CaseLaw Corp. - Articles of Current Interest - Page # 1 Matrimonial CaseLaw imprisoned. For subsequent offenses, offender can be jailed for up to two years, fined, or both. Once convicted, court must order restitution in an amount equal to past due support obligation as it exists at time of sentencing. iii. See Roper, supra note 1, at 64. iv. See id. at 71 (noting that a typical “most wanted” list might include state’s top ten most egregious offenders’ profiles and pictures). v. See id. at 43. vi. See Oscar Corral, Virginia Deadbeats Get A Boot to Auto, New York Newsday, February 12, 2000, at A22. vii. 18 U.S.C.§ 228(a). bill was amended to include willful language. See 138 CONG. REC. S17139 (daily ed. Oct. 7, 1992) (statement of Sen. Kohl) (noting that element of willfulness was added to protect those parents who cannot pay child support and “because it tells real deadbeats, pay up or go to jail”). viii. See United States v. Hampshire, 95 F.3d 999 (10th Cir. 1996); United States v. Mussari, 95 F.3d 787 (9th Cir. 1996); United States v. Sage, 92 F.3d (2d Cir. 1996). ix. See , e.g., Robyn Shields, Comment: Can Feds Put Deadbeat Parents In Jail?: A Look At Constitutionality Of Child Support Recovery Act, 60 ALB. L. REV. 1409 (1997) (an extensive compilation of constitutional extent of federal power under Commerce Clause). x. See generally id. xi. United States v. Mattice, 186 F..3d 219, 224 (2d Cir. 1999) (quoting United States v. Williams, 121 F.3d 615, 620 (11th Cir. 1997), cert. denied, 523 U.S. 1065 (1998). xii. H.R. REP. NO. 102-771, at 6 (1992). To establish “willfulness” using this standard government must establish, beyond a reasonable doubt, that at time payment was due taxpayer possessed sufficient funds to enable him to meet his obligation or that lack of sufficient funds on such date was created by (or was result of) a voluntary and intentional act without justification in view of all financial circumstances of taxpayer. xiii. See Mattice, 186 F.3d at 225. xiv. See id. xv. See Bryan v. United States, 524 U.S. 184 (1998) (holding that knowledge that the conduct was unlawful was required to establish that a defendant willfully violated prohibition on dealing in firearms without a federal license. Court specifically distinguished cases involving willful violation of tax laws, in which jury must find that defendant was aware of specific provision of tax code that he was charged with violating). xvi. Mattice, 186 F.3d at 226. xvii. See generally Bryan, 524 U.S. at 1947 (stating that tax cases involved highly technical statutes that presented danger of ensnaring individuals engaged in apparently innocent conduct, however, by contrast, parameters of legal duty to pay child support are clear form face of state court or administrative order imposing support obligation). xviii. Id. xix. See, e.g., COLO. REV. STAT. 26-13-123 (1996); KY. REV. STATE. ANN. 186.570 (Banks-Baldwin Supp. 1996); VT. STATE. ANN. tit. 15, 795 (Supp. 1996); N.C. GEN. STATE. 110-142.1, 110-142.2 (1995). xx. For a good analysis of se and or constitutional issues raised by an Arizona licensure suspension statute, see Susan Nicholas, Note: A Constitutional Analysis of An Arizona Enforcement Mechanism, 34 ARIZ. L. REV. 163 (1992). xxi. See Corral, supra note 6, at A22. xxii. See Steven Kreytak, A Boot for Deadbeats?, New York Newsday, February 12, 2000, at A4. xxiii. FCA § 454(1). xxiv. FCA § 439(a),(e). xxv. FCA § 448, 454; CPLR 5241, 5242(b). xxvi. FCA § 448 xxvii. FCA § 454. xxviii. FCA §§ 454(2)(f), 458-a, 458-b; DRL § 244-b; SSL § 111(b)(12); VTL §§ 510, 511(7), 535-a. xxix. FCA § 458-a, 4. xxx. FCA § 454(3). xxxi. FCA § 454(1); Jud. Law § 753(A)(3), (8). xxxii. Hicks o/b/o Feiock v. Feiock, 485 US 624, 645-47 (1988). xxxiii. Id. at 633; Matter of Russo v. Goldbaum, 627 NYS2d 966, 967 (2d Dept. 1995). xxxiv. See Roper, supra note 1, at 45. Copyright 1985-1999 Articles of Current Interest xxxv. See MISS. CODE ANN. 43-19-45 (1993). See Roper, supra note 1, at 72. xxxvii. See Matw Bowers, Virginia Will Jump Onto Internet to Try to Locate Deadbeat Parents, Virginian-Pilot and Ledger Star, February 12, 2000, at BI. address for Massachusetts’ child support Web site is <http://www.mst.oa.net/ten.html>. xxxviii. For a good analysis of se and or constitutional issues, See Roper, supra,, at 73. xxxvi. Matrimonial CaseLaw Corp. - Articles of Current Interest - Page # 2