mid term exam answers

advertisement

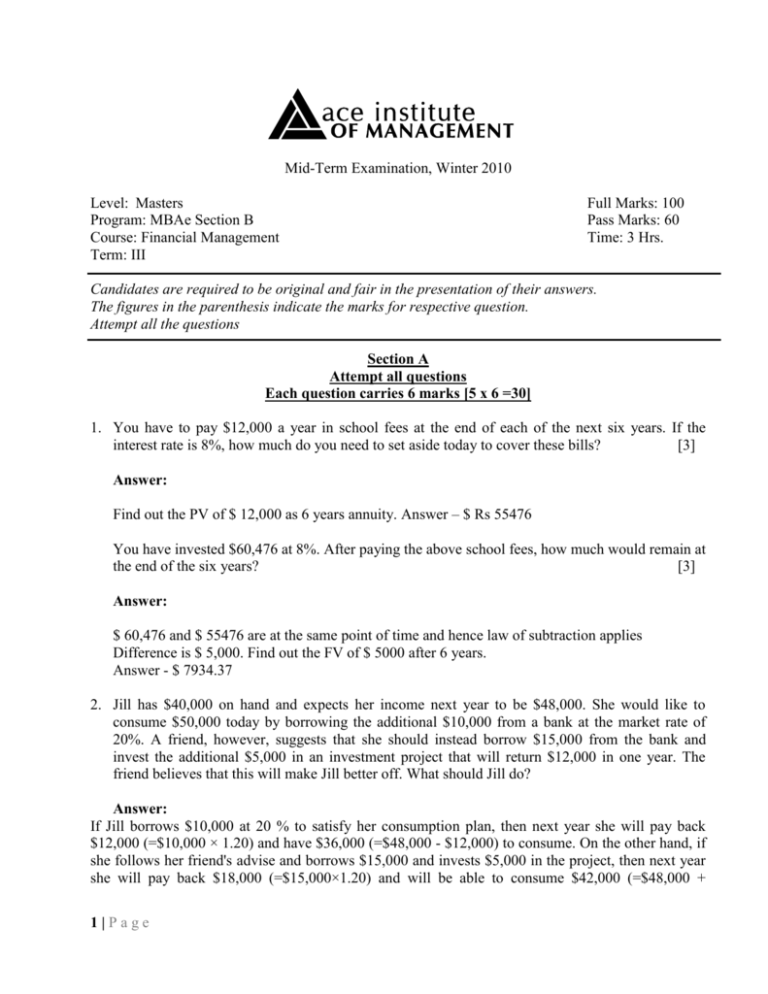

Mid-Term Examination, Winter 2010 Level: Masters Program: MBAe Section B Course: Financial Management Term: III Full Marks: 100 Pass Marks: 60 Time: 3 Hrs. Candidates are required to be original and fair in the presentation of their answers. The figures in the parenthesis indicate the marks for respective question. Attempt all the questions Section A Attempt all questions Each question carries 6 marks [5 x 6 =30] 1. You have to pay $12,000 a year in school fees at the end of each of the next six years. If the interest rate is 8%, how much do you need to set aside today to cover these bills? [3] Answer: Find out the PV of $ 12,000 as 6 years annuity. Answer – $ Rs 55476 You have invested $60,476 at 8%. After paying the above school fees, how much would remain at the end of the six years? [3] Answer: $ 60,476 and $ 55476 are at the same point of time and hence law of subtraction applies Difference is $ 5,000. Find out the FV of $ 5000 after 6 years. Answer - $ 7934.37 2. Jill has $40,000 on hand and expects her income next year to be $48,000. She would like to consume $50,000 today by borrowing the additional $10,000 from a bank at the market rate of 20%. A friend, however, suggests that she should instead borrow $15,000 from the bank and invest the additional $5,000 in an investment project that will return $12,000 in one year. The friend believes that this will make Jill better off. What should Jill do? Answer: If Jill borrows $10,000 at 20 % to satisfy her consumption plan, then next year she will pay back $12,000 (=$10,000 × 1.20) and have $36,000 (=$48,000 - $12,000) to consume. On the other hand, if she follows her friend's advise and borrows $15,000 and invests $5,000 in the project, then next year she will pay back $18,000 (=$15,000×1.20) and will be able to consume $42,000 (=$48,000 + 1|Page $12,000 - $18,000). Thus, by investing in the project Jill can consume the same today and an additional $6,000 next year. 3. A 10 year, 12 % semiannual coupon bond, with a par value of Rs 1,000 may be called in 4 years at a call price of Rs 1,060. The bond sells for Rs 1,100 (Assume that the bond has just been issued) a) What is the bond’s approx YTM ? [2] b) What is the bond’s current yield? [1] c) What is the bond’s capital gain or loss yield? [1] d) What is the bond’s approx yield to call? [2] Answer: M-P C n a) Approx YTM to get AYTM = 10.31% M 2P 3 b) Current Yield = C / P = 120/1100 = 10.91%. Or find out semiannual current yield by using C = 60 and later multiplying the rate by 2 to make it annual. c) Capital Gain/Loss Yield = YTM – Current Yield = 10.31% - 10.91% = (0.79%) Loss. Capital gain or loss yield should also be always reported on annual form. d) Call Price - P C n = 10.12% Approx YTC Call price 2P 3 Alternatively, you can find YTM by using semiannual data, C = 60, n = 20 and then report the answer in annual form by multiplying the semiannual YTM by 2. Same can be done in case of YTC using C= 60, n = 8 and them multiplying the rate by 2 to make it annual percentage rate. 4. Phoenix Company borrows Rs 500,000 at an interest rate of 14 %. The loan is to be repaid in 4 equal installments payable at the end of each of the next 4 years. Prepare a loan amortization schedule. Answer: Equated annual installment = 500000 / PVIFA(14%,4) = 500000 / 2.914 = Rs.171,585 Loan Amortisation Schedule Beginning 2|Page Annual Principal Remaining Year 1 2 3 4 amount 500000 398415 282608 150588 installment 171585 171585 171585 171585 Interest repaid 70000 55778 39565 21082 balance 101585 115807 132020 150503 398415 282608 150588 85* (*) rounding off error 5. Parnelli Product’s stock is currently selling for Rs 45 a share. The firm is earning Rs 5 per share and is expected to pay a year-end dividend of Rs 1.80. a) If investors require a 12% return, what rate of growth must be expected for Parnelli ? [3] Answer: Price = 45, D1 = 1.80, Ke = 0.12. Use constant growth model of stock valuation. Answer – 8% b) If Parnelli reinvests retained earnings to yield the expected rate of return, what will be the next year’s EPS ? [3] Answer: Dividend Payout Ratio being constant, EPS growth rate will be equal to dividend growth rate. Next year’s EPS = 8% more than Rs 5. Answer = Rs 5.4 Alternative way, EPS 1 = EPS 0 + Retained earning per share x Rate of return EPS 1 = Rs 5 + 3.2 x 0.12 = Rs 5.4 Section B Attempt any three questions Each question carries 15 marks [3 x 15 = 45] 6. The Tanner Company’s cost of equity is 18%. Tanner’s before tax cost of debt is 12%, and its tax rate is 40%. Using the following balance sheet, calculate Tanner’s after tax weighted average cost of capital. (Assume that this accounting balance sheet also represents Tanner’s target capital structure) – All figures are in Ten thousands. Assets Amount Liabilities Amount 3|Page Cash Accounts Receivables Inventories Plant and Equipment, net Total Assets Rs 100 200 300 1800 Rs 2400 Accounts Payable Accrued taxes due Long term debt Equity Total Liabilities Rs 200 200 400 1600 Rs 2400 Answer: While computing D/E ratio or D/V and E/V ratio, we always use only long term capital (debt, pref stock, equity). So D = 400 and E = 1600 in this case and V = sum of both = 2000 Thus, we get Wd = 0.2 and We = 0.8. This will be used in all of the three problems, since its not changing with question. Kdat = 7.2 %, Ke = 18%. Hence we get WACC = 15.84% Find out the average cost of capital of Tanner if it has Rs 2 million requirement of capital and 20% of the equity is coming from retained earnings. Assume that the cost of retained earnings is 18% and cost of new equity is 20% more than the cost of retained earnings. Take all other things same as above. Answer: Here equity has two parts, retained earnings and new equity. Cost of retained earnings is 18% and cost of new equity is 1.2 x 18% = 21.6 %. Part of retained earnings in equity is 20% and part of new equity is 80%. Hence average cost of equity will be 20.88%. Now use Wd = 0.2 and We = 0.8 , Kdat = 7.2 %, Ke average = 21.6 % To get the WACC = 18.144% Find out the average cost of capital of Tanner if it has Rs 2 million requirement of capital and Rs 0.3 million of the equity is coming from retained earnings. Assume that the cost of retained earnings is 18% and cost of new equity is 20% more than the cost of retained earnings. Take all other things same as above. Answer: Here also equity has two parts, retained earnings and new equity. Cost of retained earnings is 18% and cost of new equity is 1.2 x 18% = 21.6 %. Part of retained earnings in equity is 0.3/1.6 and part of 4|Page new equity is 1.3/1.6 while 1.6 million is the part of equity. Hence average cost of equity will be 20.925%. Now use Wd = 0.2 and We = 0.8 , Kdat = 7.2 %, Ke average = 20.925 % To get the WACC = 18.18% 7. Microtech Corporation is expanding rapidly, and it currently needs to retain all of its earnings. Hence, it does not pay any dividends. However, investors expect Microtech to begin paying dividend, with the first dividend of Rs 1.00 coming 3 years from today. The dividend should grow rapidly at a rate of 50% per year during years 4 and 5. After year 5, the company should grow at a constant rate of 8% per year. If the required return on the stock is 15%, what is the value of the stock today? Answer: Here, D3 = 1, D4 = 1.5, D5 = 2.25 and D6 = 2.43. Using D6, find P5 (constant growth model with g = 8% and r = 15%) = Rs 34.71. Discount D3, D4, D5 and P5 with relevant PVIF (15%, n) to get P0 = Rs 19.89 [Note n =3, 4, 5 and 5, while discounting D3, D4, D5 and P5] What is the value of the stock if first dividend next year is Rs 1.00 and it grows at 50% per year for first two years, after two years, the company should grow at a constant rate of 8% per year, and the required rate of return on the stock is 15%. Answer: Here, D1 = 1, D2 = 1.5 and D3 = 1.62. Using D3, find P2 = Rs 23.14. Discount D1, D2 and P2 with relevant PVIF (15%, n) to get P0 = Rs 19.50 What is the value of the stock if the dividend paid two years ago was Rs 1.00 and it has been growing at 50% rate since last five years, which will continue till next two years. After two years, the company should grow at a constant rate of 8% per year, and the required rate of return on the stock is 15%. Answer, Here, D-2 = 1, D-1 = 1.5, D0 = 2.25, D1 = 3.375, D2 = 5.0625, D3 = 5.4675. Using D3, find P2 = Rs 78.107 Discount D1, D2 and P2 with relevant PVIF (15%, n) to get P0 = Rs 65.82 [Remember, the price of stock or any security means price at point 0 and its found out by only discounting the future cash flows. Past cash flows has nothing to do with the present price. Past cash flows can only serve as guide as in 2nd question, to find out the future cash flow pattern] 8. You are provided with the information below: 5|Page Sales Less: Variable costs Less: Fixed Costs EBIT Less: Interest EBT Less: Tax Net Income After Tax EPS Rs 430,000 107,500 150,000 172,500 11,000 161,500 64,600 96,900 9.69 Required: a. Calculate Degree of Operating Leverage, Financial Leverage and Combined Leverage [6] Answer, Use the normal formulae of DOL, DFL and DCL to find out the values of each as 1.869, 1.068 and 1.996 (lets say 2). Remember DCL = DOL x DFL b. By how much the Sales should be increased, if EPS is to be doubled? [2] Measure of leverage that links EPS with Sales is DCL. DCL is 2 in this case. EPS to be doubled means increase in EPS required is 100%. DCL = 2 means, 1% change in Sales brings 2% change in EPS. Hence, to bring 100% increase in EPS, sales need to increase by 50% i.e. by Rs 215,000. c. By how much the Sales should be increased, if EBIT is to be trippled ? [2] Measure of leverage that links EBIT with Sales is DOL. DOL is 1.869 in this case. EBIT to be trippled means increase in EBIT required is 200%. DCL = 1.869 means, 1% change in Sales brings 1.869 % change in EPS. Hence, to bring 200% increase in EPS, sales need to increase by 107% i.e. by Rs 890100. d. What would be the impact of increasing fixed cost proportion in cost structure of the firm on the operating leverage ? Show demonstration. And also show what would be the percentage increased required in sales to double the EPS. [2+3] Answer: Fixed cost proportion in cost structure is linked with operating leverage. Higher the fixed cost proportion in cost structure, higher will be the operating leverage. Show one example of it. 9. Answer the followings: a) What are the factors to be taken into consideration by Finance Manager in order to maximize the wealth of shareholders ? Explain with examples. b) What is agency problem and agency cost ? What can be the ways to prevent agency costs in a profit making company ? 6|Page Section C The question carries 25 marks. 10. As an investment advisor, you have been approached by a client called Peter for advice on his investment plan. He is 30 years old and has Rs.300,000 in his bank. He plans to work for 20 years and retire at the age of 50, so that he can pursue his hobbies and travel widely in his postretirement period. His present salary is Rs.600,000 per year. He expects his salary to increase at the rate of 12 percent per year until his retirement. Peter has decided to invest his bank balance and future savings in a balanced mutual fund scheme which he believes will provide a return of 10 percent per year. You concur with his assessment. Peter seeks your help in answering several questions given below. In answering these questions, ignore the tax factor. (i) Once he retires at the age of 50, he would like to withdraw Rs. 1,000,000 per year for his consumption needs for the following 30 years (His life expectancy is 80 years). Each annual withdrawal will be made at the beginning of the year. How much should be the value of his investments be when he turns 50, to meet his retirement need? [5] (ii) How much should Peter save each year for the next 20 years to be able to withdraw Rs.1,000, 000 per year from the beginning of the 21st year for a period of 30 years? Assume that the savings will occur at the end of each year. Remember that he already has some bank balance. ( Approximate it to the nearest ‘000) [10] Peter needs 10,369,700 when he reaches the age of 50. His bank balance of Rs 300,000 will grow to: 300,000 (1.10)20 = 2,018,400 7|Page (iii) Suppose Peter wants to donate Rs.800,000 per year in the last 10 years of his life to a charitable cause. Each donation would be made at the beginning of the year. Further, he wants to bequeath Rs. 3,000,000 to his son at the end of his life. How much should he have in his investment account when he reaches the age of 50 to meet this need for donation and bequeathing? (Approximate it to the nearest ‘000.) [10] One more question: Peter wants to find out the present value of his lifetime salary income. For the sake of simplicity, assume that his current salary of Rs 600,000 will be paid exactly a year from now, and his salary is paid annually. What is the present value of his lifetime salary income, if the discount rate applicable to the same is 8 percent? Remember that Peter expects his salary to increase at the rate of 12 percent per year until retirement. [This is the case of Growing Annuity – Finite Time. The formula and example of such case can be seen in the lecture slide of time value of money] 8|Page Best of Luck 9|Page