Structural Change

advertisement

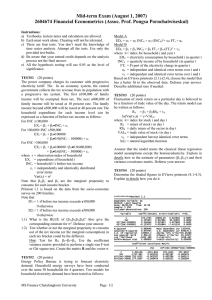

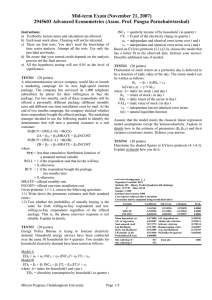

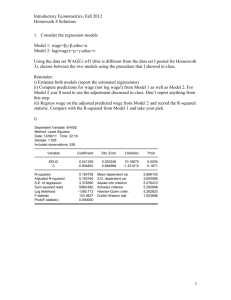

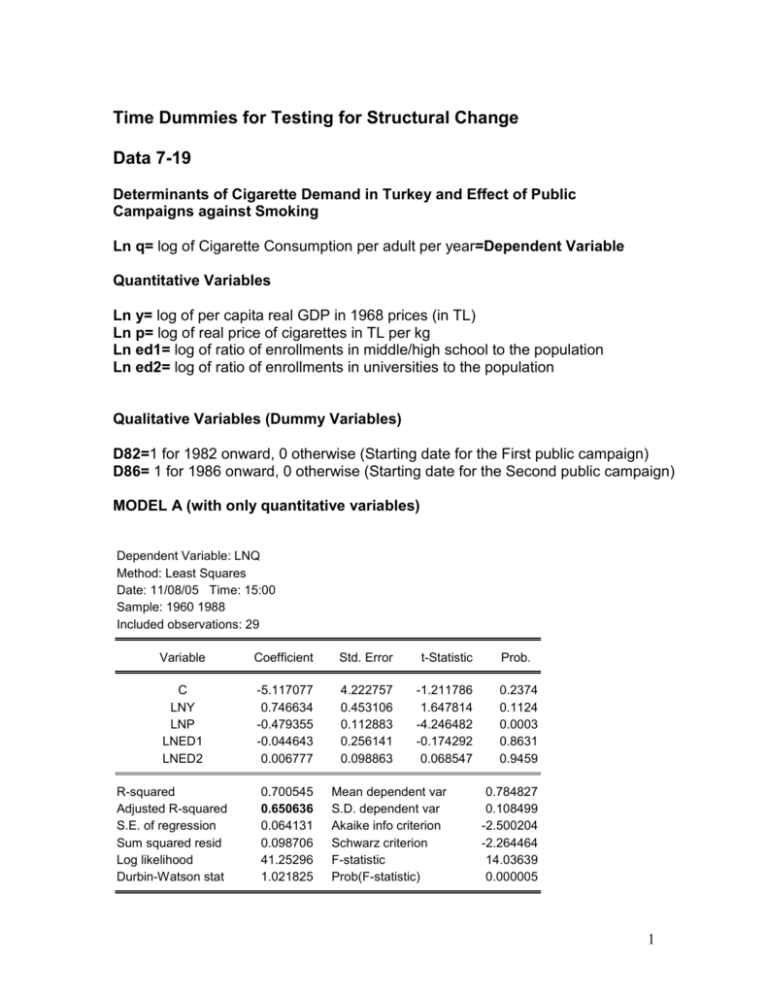

Time Dummies for Testing for Structural Change Data 7-19 Determinants of Cigarette Demand in Turkey and Effect of Public Campaigns against Smoking Ln q= log of Cigarette Consumption per adult per year=Dependent Variable Quantitative Variables Ln y= log of per capita real GDP in 1968 prices (in TL) Ln p= log of real price of cigarettes in TL per kg Ln ed1= log of ratio of enrollments in middle/high school to the population Ln ed2= log of ratio of enrollments in universities to the population Qualitative Variables (Dummy Variables) D82=1 for 1982 onward, 0 otherwise (Starting date for the First public campaign) D86= 1 for 1986 onward, 0 otherwise (Starting date for the Second public campaign) MODEL A (with only quantitative variables) Dependent Variable: LNQ Method: Least Squares Date: 11/08/05 Time: 15:00 Sample: 1960 1988 Included observations: 29 Variable Coefficient Std. Error t-Statistic Prob. C LNY LNP LNED1 LNED2 -5.117077 0.746634 -0.479355 -0.044643 0.006777 4.222757 0.453106 0.112883 0.256141 0.098863 -1.211786 1.647814 -4.246482 -0.174292 0.068547 0.2374 0.1124 0.0003 0.8631 0.9459 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.700545 0.650636 0.064131 0.098706 41.25296 1.021825 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 0.784827 0.108499 -2.500204 -2.264464 14.03639 0.000005 1 MODEL B (with quantitative and intercept time dummies) Dependent Variable: LNQ Method: Least Squares Date: 11/08/05 Time: 15:09 Sample: 1960 1988 Included observations: 29 Variable Coefficient Std. Error t-Statistic Prob. C LNY LNP LNED1 LNED2 D82 D86 -9.509262 1.171375 -0.140956 -0.226339 -0.141883 -0.126167 -0.105592 2.652959 0.282972 0.089356 0.164159 0.068069 0.028011 0.036964 -3.584398 4.139551 -1.577466 -1.378774 -2.084413 -4.504173 -2.856628 0.0017 0.0004 0.1290 0.1818 0.0489 0.0002 0.0092 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.898862 0.871278 0.038927 0.033337 56.99234 1.692424 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 0.784827 0.108499 -3.447748 -3.117711 32.58727 0.000000 We see here positive income elasticity, negative price elasticity and relative unpopularity of cigarettes among the educated people. Moreover, intercept dummies D82 and D86 have negative coefficients implying that these public campaigns indeed significantly reduced cigarette consumption in Turkey after 1982 and then further after 1986. LM Test Step 1: Regress lnq on the above variables as well as some additional interactive dummies and interactive terms and save the residuals (uhat). Then regress the uhat on all the original variables (Model A) and intercept and interactive dummies/terms. This is called the auxiliary regression. New Variables created using the “generate” command in Stata: D82lny, D86lnp, D82lned2, Lnylnp, Lnylned1, Lnylned2, Lnplned1, Lnplned2, Lned1lned2 and other possibilities 2 Auxiliary Regression for LM test Dependent Variable: uhat Method: Least Squares Date: 11/08/05 Time: 15:25 Sample: 1960 1988 Included observations: 29 Variable Coefficient Std. Error t-Statistic Prob. C LNY LNP LNED1 LNED2 D82 D86 D82LNED2 D86LNP LNYLNP LNYLNED1 LNYLNED2 LNPLNED1 LNPLNED2 LNED1LNED2 78.88732 -8.444417 -62.42377 10.15174 12.18011 -0.933135 -0.112997 -0.297774 0.030253 6.712299 -0.553646 -1.207149 -3.250171 -0.930393 1.212970 128.8360 14.00025 64.16996 15.70892 29.16306 0.444921 0.244640 0.163616 0.248495 6.917964 1.173282 3.143089 3.593546 1.165807 2.121436 0.612308 -0.603162 -0.972788 0.646240 0.417656 -2.097302 -0.461890 -1.819956 0.121745 0.970271 -0.471878 -0.384065 -0.904447 -0.798068 0.571768 0.5502 0.5560 0.3472 0.5286 0.6825 0.0546 0.6513 0.0902 0.9048 0.3484 0.6443 0.7067 0.3811 0.4382 0.5765 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.834180 0.668359 0.034192 0.016367 67.30729 2.265701 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) -2.86E-16 0.059373 -3.607399 -2.900177 5.030622 0.002326 Test statistic=29*0.834180=24.186 exceeds the critical value of the chi-square, so some of the new variables added are significant and based on the p-value test, these are d82, d82lned2 lnylnp lnplned1 lnplned2 (Also keep the original lnp, lny, lned1, lned2) 3 FINAL MODEL (after eliminating insignificant ones) Dependent Variable: LNQ Method: Least Squares Date: 11/08/05 Time: 15:32 Sample: 1960 1988 Included observations: 29 Variable Coefficient Std. Error t-Statistic Prob. C LNY LNP D82 D82LNED2 LNYLNP -2.504783 0.416469 -3.653049 -1.413943 -0.475105 0.416570 0.643911 0.079784 1.185994 0.213406 0.078118 0.141064 -3.889955 5.219984 -3.080159 -6.625593 -6.081882 2.953058 0.0007 0.0000 0.0053 0.0000 0.0000 0.0071 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.935344 0.921288 0.030440 0.021312 63.47975 2.471386 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 0.784827 0.108499 -3.964121 -3.681232 66.54564 0.000000 Note that Adj Rsq is the highest among all other tries and all variables are significant! Moreover, d82lned2 has a negative and signicant coefficient which means that not only 1982 campaign was successful in reducing cigarette consumption (sign of D82 is negative) but also it was even more effective among the university students! (sign of D82lned2 is negative and significant) In other words, university education began to have a negative influence on cigarette consumption especially after the year 1982. Another point is worth pursuing: the interactive term lnylnp is significant and positive. This means that both the income elasticity of demand (coefficient of lny) and the price elasticity of demand (coefficient of lnp) depend on the level of price and level of income respectively. Differentiating lnq with respect to lnp, we get –3.65+0.4165lny. This means that price elasticity is smaller (less negative, more inelastic) as per capita income grows. In addition, differentiating lnq with respect to lny, we get +0.416+0.4165lnp. This means that higher the price, greater is the income elasticity of demand (more sensitive to income demand gets at higher prices) 4